Cablevision 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(68)

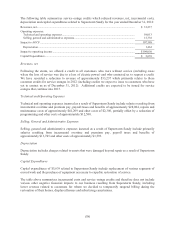

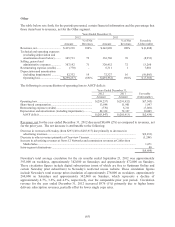

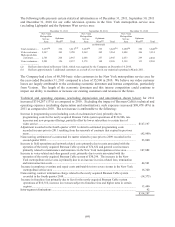

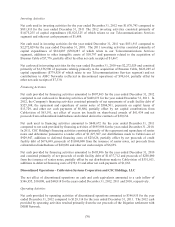

The following is a reconciliation of operating income to AOCF:

Years Ended December 31,

2011 2010 Favorable

Amount Amount (Unfavorable)

Operating income ....................................................................

.

$1,520,631 $1,473,724 $ 46,907

Share-based compensation .......................................................

.

32,635 33,885 (1,250)

Depreciation and amortization .................................................

.

942,647 824,029 118,618

AOCF ...............................................................................

.

$2,495,913 $2,331,638 $164,275

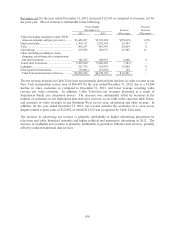

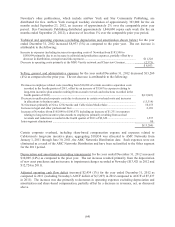

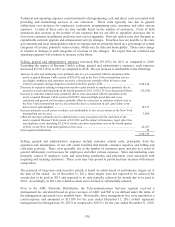

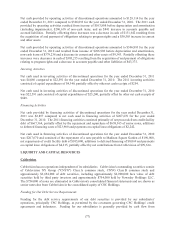

Revenues, net for the year ended December 31, 2011 increased $544,131 (9%) as compared to revenues,

net for the prior year. The net increase is attributable to the following:

Years Ended

December 31, Increase

Percent

Increase

Increase

due to

Bresnan

Percent

Increase

(Decrease),

Net of

Bresnan Cable

2011 2010 (Decrease) (Decrease) Cable Impact

Video (including

equipment rental, DVR,

video-on-demand, and

pay-per-view) .................. $3,521,882 $3,237,793 $284,089 9% $248,629 1%

High-speed data................. 1,329,354 1,193,624 135,730 11 119,493 1

Voice ................................. 885,343 808,374 76,969 10 62,868 2

Advertising ........................ 150,671 135,890 14,781 11 11,578 2

Other (including

installation, advertising

sales commissions,

home shopping, and

other products) ................ 100,953 94,907 6,046 6 6,952 (1)

Total Cable Television ...... 5,988,203 5,470,588 517,615 9 449,520 1

Lightpath ........................... 310,976 284,034 26,942 9 - 9

Intra-segment

eliminations ..................... (19,526) (19,100) (426) (2) - (2)

Total

Telecommunications

Services ......................... $6,279,653 $5,735,522 $544,131 9% $449,520 2%

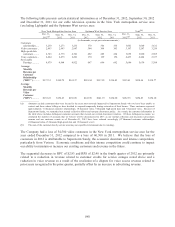

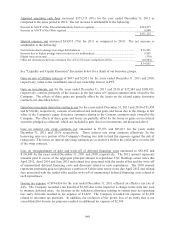

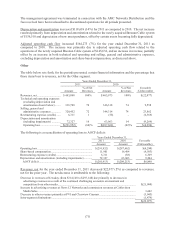

Revenue increases reflected above are primarily due to the acquisition of our Bresnan Cable system on

December 14, 2010. Revenue increases are also primarily derived from higher rates (primarily due to an

increase in video rates of 2.9% on average for our New York metropolitan service area subscribers, which

was implemented beginning in December 2010), increases in the number of subscribers to our high-speed

data and voice services as set forth in the table below, additional services sold to our existing video

subscribers, and other revenue increases. These increases are partially offset by a decline in video

customers primarily in our New York metropolitan service area, promotional offer pricing discounts and

other rate changes, and declines in other revenue. Our average monthly revenue per video customer for

our New York metropolitan service area for the three months ended December 31, 2011 was $156.09 as

compared to $153.97 and $150.68 for the three months ended September 30, 2011 and December 31,

2010, respectively.

The increase in advertising revenue is primarily due to the acquisition of our Bresnan Cable system as

well as a general improvement in the cable television advertising market in 2011. The increase in

Lightpath net revenues is primarily attributable to growth in Ethernet data services, partially offset by

reduced traditional data services.