Cablevision 2012 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-45

The principal financial covenant for the New Credit Agreement is a minimum liquidity test of $25,000

which is tested bi-annually on June 30 and December 31. The New Credit Agreement also contains

customary affirmative and negative covenants, subject to certain exceptions, including limitations on

indebtedness, investments and restricted payments. Certain of the covenants applicable to CSC Holdings

under the New Credit Agreement are similar to the covenants applicable to CSC Holdings under its

outstanding senior notes.

Prior to the New Credit Agreement, Newsday LLC's had a $650,000 senior secured loan facility

comprised of two components: a $525,000 10.50% fixed rate term loan facility and a $125,000 floating

rate term loan facility. The senior secured loan facility was to mature on August 1, 2013 and, subject to

certain exceptions, required mandatory prepayments out of the proceeds of certain sales of property or

assets, insurance proceeds and debt and equity issuances. No mandatory prepayments were required prior

to July 29, 2011, and the amount of prepayments thereafter were limited to $105,000 in the aggregate

prior to July 29, 2012 and $140,000 in the aggregate prior to the maturity date. Optional prepayments

were also permitted, subject to specified prepayment premiums. Unamortized deferred financing costs

related to this senior secured loan facility aggregating approximately $5,083 were written-off in 2012.

Newsday LLC was in compliance with all of its financial covenants under its credit agreement as of

December 31, 2012.

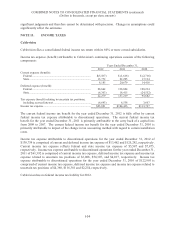

Senior Notes and Debentures

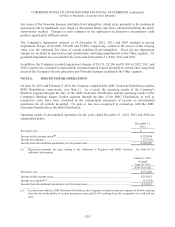

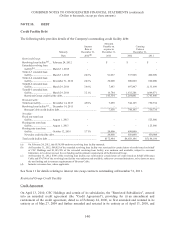

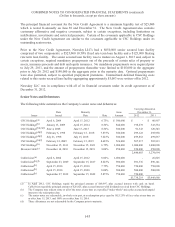

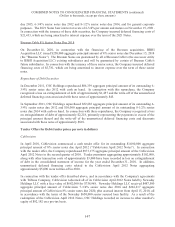

The following table summarizes the Company's senior notes and debentures:

Carrying Amount at

Date Maturity Issue December 31,

Issuer Issued Date Rate Amount 2012 2011

CSC Holdings(a) April 6, 2004 April 15, 2012 6.75% $ 500,000 $ - $ 60,997

CSC Holdings(b) January 13, 2009 April 15, 2014 8.50% 844,000 198,239 543,554

CSC Holdings(b)(c)(f) June 4, 2008 June 15, 2015 8.50% 500,000 91,543 120,543

CSC Holdings(d)(f) February 6, 1998 February 15, 2018 7.875% 300,000 299,122 298,950

CSC Holdings(d)(f) July 21, 1998 July 15, 2018 7.625% 500,000 499,862 499,837

CSC Holdings(b)(f) February 12, 2009 February 15, 2019 8.625% 526,000 507,917 505,813

CSC Holdings(b) November 15, 2011 November 15, 2021 6.75% 1,000,000 1,000,000 1,000,000

Bresnan Cable(e) December 14, 2010 December 15, 2018 8.00% 250,000 250,000 250,000

2,846,683 3,279,694

Cablevision(a) April 6, 2004 April 15, 2012 8.00% 1,000,000 - 26,825

Cablevision(b)(f) September 23, 2009 September 15, 2017 8.625% 900,000 891,536 890,141

Cablevision(b) April 15, 2010 April 15, 2018 7.75% 750,000 750,000 750,000

Cablevision(b) April 15, 2010 April 15, 2020 8.00% 500,000 500,000 500,000

Cablevision(b) September 27, 2012 September 15, 2022 5.875% 750,000 750,000 -

$5,738,219 $5,446,660

________________

(a) In April 2012, CSC Holdings repaid the principal amount of $60,997, plus accrued interest with cash on hand.

Cablevision repaid the principal amount of $26,825, plus accrued interest with dividends received from CSC Holdings.

(b) The Company may redeem some or all of the notes at any time at a specified "make-whole" price plus accrued and unpaid

interest to the redemption date.

(c) The senior notes are redeemable, in whole or in part, at a redemption price equal to 102.125% of face value at any time on

or after June 15, 2013, and 100% on or after June 15, 2014.

(d) These debentures are not redeemable by the Company prior to maturity.