Cablevision 2012 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-60

The Company

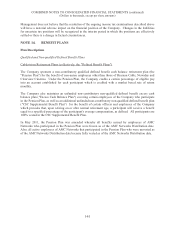

Deferred tax assets have resulted primarily from the Company's future deductible temporary differences

and NOLs. In assessing the realizability of deferred tax assets, management considers whether it is more

likely than not that some portion or all of the deferred tax asset will not be realized. The Company's

ability to realize its deferred tax assets depends upon the generation of sufficient future taxable income

and tax planning strategies to allow for the utilization of its NOLs and deductible temporary differences.

If such estimates and related assumptions change in the future, the Company may be required to record

additional valuation allowances against its deferred tax assets, resulting in additional income tax expense

in the Company's consolidated statements of income. Management evaluates the realizability of the

deferred tax assets and the need for additional valuation allowances quarterly. At this time, based on

current facts and circumstances, management believes that it is more likely than not that the Company

will realize benefit for its gross deferred tax assets, except those deferred tax assets against which a

valuation allowance has been recorded which relate to certain state NOLs.

In the normal course of business, the Company engages in transactions in which the income tax

consequences may be uncertain. The Company's income tax returns are filed based on interpretation of

tax laws and regulations. Such income tax returns are subject to examination by taxing authorities. For

financial statement purposes, the Company only recognizes tax positions that it believes are more likely

than not of being sustained. There is considerable judgment involved in determining whether positions

taken or expected to be taken on the tax return are more likely than not of being sustained.

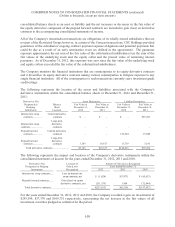

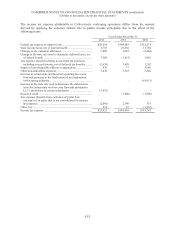

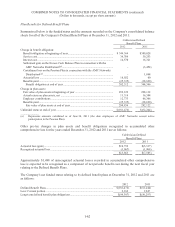

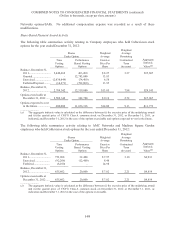

A reconciliation of the beginning and ending amount of unrecognized tax benefits associated with

uncertain tax positions, excluding associated deferred tax benefits and accrued interest, is as follows:

Balance at December 31, 2011 ..............................................................................................................

.

$64,621

Increases related to prior year tax positions ........................................................................................

.

853

Decreases related to prior year tax positions ......................................................................................

.

(6,864)

Settlements .........................................................................................................................................

.

(847)

Balance at December 31, 2012 ..............................................................................................................

.

$57,763

As of December 31, 2012, if all uncertain tax positions were sustained at the amounts reported or

expected to be reported in the Company's tax returns, the elimination of the Company's unrecognized tax

benefits, net of the deferred tax impact, would decrease income tax expense by $56,037.

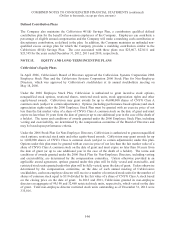

Interest expense related to uncertain tax positions is included in income tax expense, consistent with the

Company's historical policy. After considering the associated deferred tax benefit, interest expense

(income) of $(377), $1,179 and $1,210 has been included in income tax expense attributable to continuing

operations in the consolidated statements of operations for 2012, 2011 and 2010, respectively. At

December 31, 2012, accrued interest on uncertain tax positions of $118 and $2,461 was included in

accrued liabilities and other noncurrent liabilities, respectively, in the consolidated balance sheet.

The IRS is presently examining the Company's consolidated federal income tax returns for years 2009

and 2010. As such, it is reasonably possible that the liabilities for uncertain tax positions as of

December 31, 2012 may change by a significant amount within twelve months of December 31, 2012.

An estimate of the change in the liabilities, while potentially significant, cannot be made. The most

significant jurisdictions in which the Company is required to file income tax returns include the states of

New York, New Jersey and Connecticut and the city of New York. The State of New York is presently

auditing income tax returns for years 2006 through 2008.