Cablevision 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(71)

The management agreement was terminated in connection with the AMC Networks Distribution and the

fees received have been reclassified to discontinued operations for all periods presented.

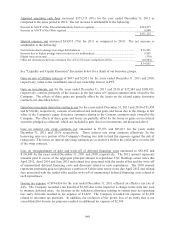

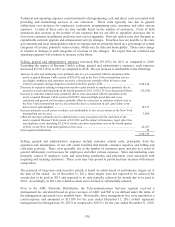

Depreciation and amortization increased $118,618 (14%) for 2011 as compared to 2010. The net increase

resulted primarily from depreciation and amortization related to the newly acquired Bresnan Cable system

of $156,510 and depreciation of new asset purchases, offset by certain assets becoming fully depreciated.

Adjusted operating cash flow increased $164,275 (7%) for the year ended December 31, 2011 as

compared to 2010. The increase was primarily due to adjusted operating cash flow related to the

operations of the newly acquired Bresnan Cable system of $145,632, and an increase in revenue, partially

offset by an increase in both technical and operating and selling, general and administrative expenses,

excluding depreciation and amortization and share-based compensation, as discussed above.

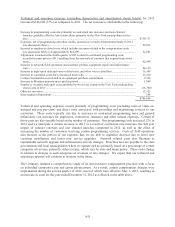

Other

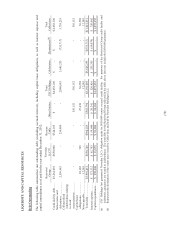

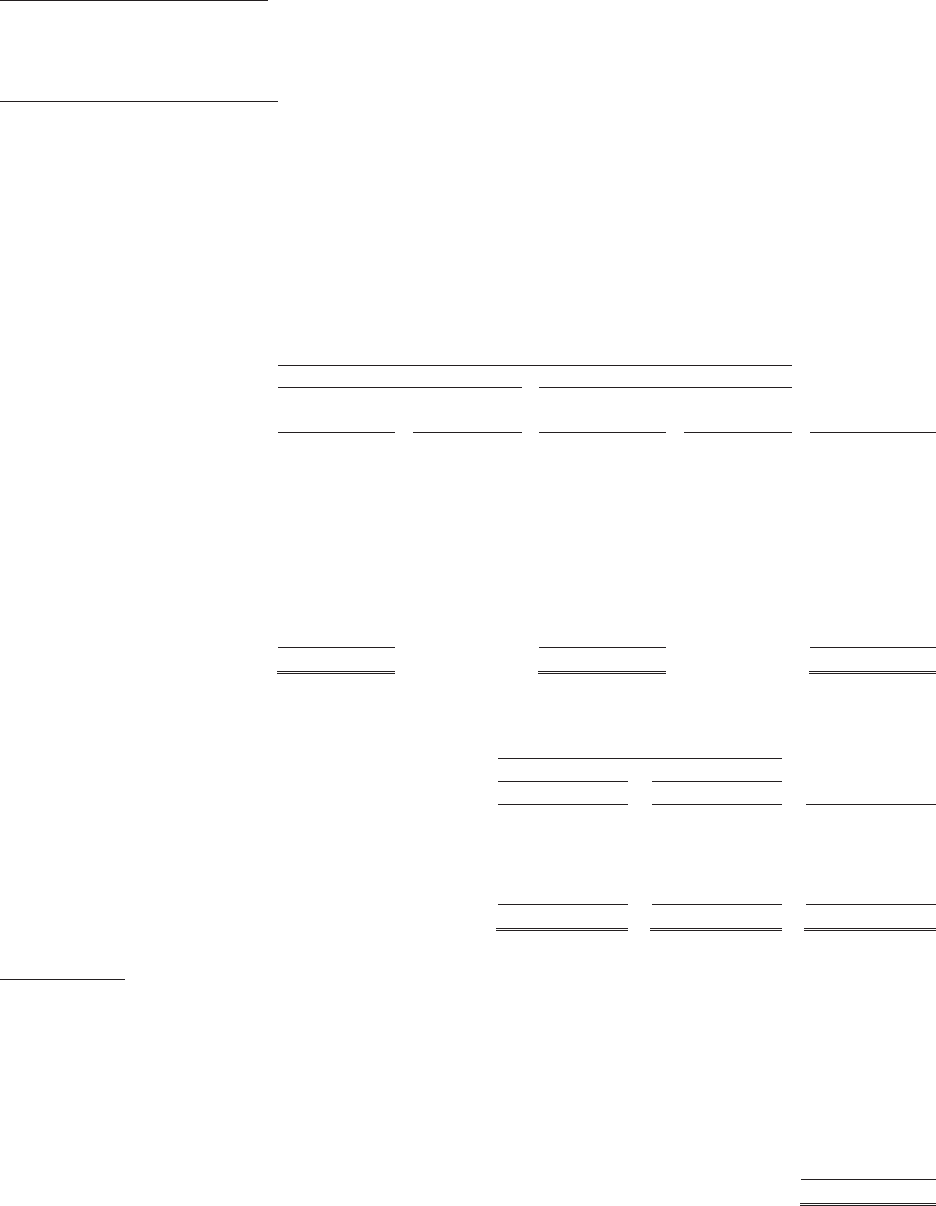

The table below sets forth, for the periods presented, certain financial information and the percentage that

those items bear to revenues, net for the Other segment.

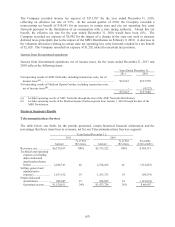

Years Ended December 31,

2011 2010

Amount

% of Net

Revenues Amount

% of Net

Revenues

Favorable

(Unfavorable)

Revenues, net ................................. $ 443,898 100% $ 465,975 100% $(22,077)

Technical and operating expenses

(excluding depreciation and

amortization shown below) ........ 336,760 76 346,318 74 9,558

Selling, general and

administrative expenses ............. 320,452 72 344,314 74 23,862

Restructuring expense (credits) ..... 6,311 1 (58) - (6,369)

Depreciation and amortization

(including impairments) ............ 72,327 16 63,063 14 (9,264)

Operating loss ............................ $(291,952) (66)% $(287,662) (62)% $(4,290)

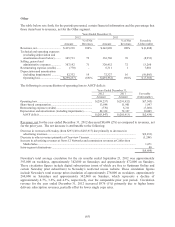

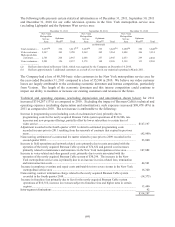

The following is a reconciliation of operating loss to AOCF deficit:

Years Ended December 31,

2011 2010 Favorable

Amount Amount (Unfavorable)

Operating loss ...........................................................................

.

$(291,952) $(287,662) $(4,290)

Share-based compensation ........................................................

.

11,901 16,404 (4,503)

Restructuring expense (credits) .................................................

.

6,311 (58) 6,369

Depreciation and amortization (including impairments) ...........

.

72,327 63,063 9,264

AOCF deficit .........................................................................

.

$(201,413) $(208,253) $6,840

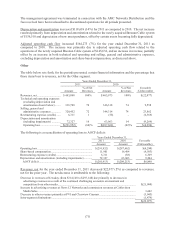

Revenues, net for the year ended December 31, 2011 decreased $22,077 (5%) as compared to revenues,

net for the prior year. The net decrease is attributable to the following:

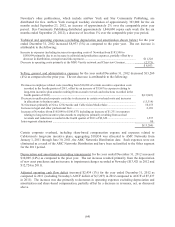

Decrease in revenues at Newsday (from $314,148 to $293,148) due primarily to decreases in

advertising revenues as a result of the continued challenging economic environment and

competition from other media ...........................................................................................................

.

$(21,000)

Increase in advertising revenues at News 12 Networks and commission revenues at Cablevision

Media Sales .......................................................................................................................................

.

3,442

Decrease in other revenues primarily at PVI and Clearview Cinemas .................................................

.

(3,045)

Intra-segment eliminations ...................................................................................................................

.

(1,474)

$(22,077)