Cablevision 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(66)

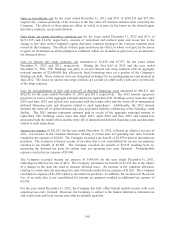

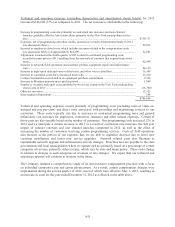

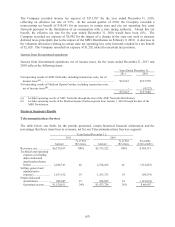

Adjusted operating cash flow increased $171,115 (8%) for the year ended December 31, 2011 as

compared to the same period in 2010. The net increase is attributable to the following:

Increase in AOCF of the Telecommunications Services segment ......................................................... $164,275

Increase in AOCF of the Other segment ................................................................................................ 6,840

$171,115

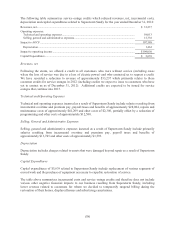

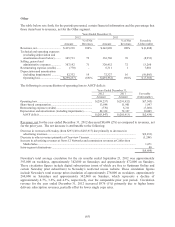

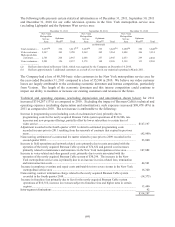

Interest expense, net increased $34,955 (5%) for 2011 as compared to 2010. The net increase is

attributable to the following:

Net increase due to change in average debt balances ........................................................................... $ 36,391

Increase due to higher average interest rates on our indebtedness ........................................................ 9,887

Higher interest income ........................................................................................................................... (339)

Other net decrease (term loan extension fees of $11,034 were included in 2010) ................................ (10,984)

$ 34,955

See "Liquidity and Capital Resources" discussion below for a detail of our borrower groups.

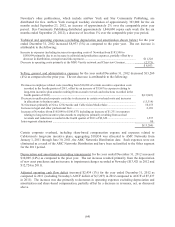

Gain on sale of affiliate interests of $683 and $2,051 for the years ended December 31, 2011 and 2010,

respectively, relate to the installment sale of our ownership interest in PVI.

Gain on investments, net for the years ended December 31, 2011 and 2010 of $37,384 and $109,813,

respectively, consists primarily of the increase in the fair value of Comcast common stock owned by the

Company. The effects of these gains are partially offset by the losses on the related equity derivative

contracts, net described below.

Gain (loss) on equity derivative contracts, net for the years ended December 31, 2011 and 2010 of $1,454

and $(72,044), respectively, consists of unrealized and realized gains and losses due to the change in fair

value of the Company's equity derivative contracts relating to the Comcast common stock owned by the

Company. The effects of these gains and losses are partially offset by the losses or gains on investment

securities pledged as collateral, which are included in gain (loss) on investments, net discussed above.

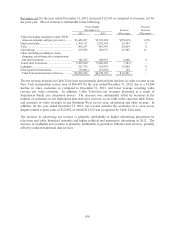

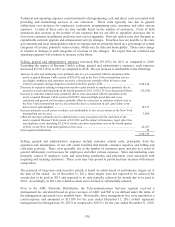

Loss on interest rate swap contracts, net amounted to $7,973 and $85,013 for the years ended

December 31, 2011 and 2010, respectively. These interest rate swap contracts effectively fix the

borrowing rates on a portion of the Company's floating rate debt to limit the exposure against the risk of

rising rates. The losses on interest rate swap contracts are a result of a shift in the yield curve over the life

of the swap contracts.

Loss on extinguishment of debt and write-off of deferred financing costs amounted to $92,692 and

$110,049 for the years ended December 31, 2011 and 2010, respectively. The 2011 amount represents

amounts paid in excess of the aggregate principal amount to repurchase CSC Holdings senior notes due

April 2012, April 2014 and June 2015 and related fees associated with the tender offers and the write-off

of unamortized deferred financing costs and discounts related to such repurchases. The 2010 amount

represents premiums paid to repurchase a portion of Cablevision senior notes due April 2012 and related

fees associated with the tender offer and the write-off of unamortized deferred financing costs related to

such repurchases.

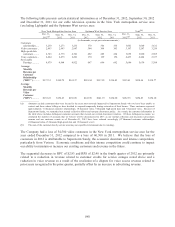

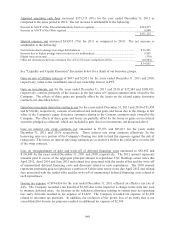

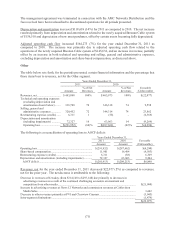

Income tax expense of $184,436 for the year ended December 31, 2011 reflected an effective tax rate of

44%. The Company recorded a tax benefit of $1,015 due to the impact of a change in the state rate used

to measure deferred taxes. An increase in the valuation allowance relating to certain state net operating

loss carry forwards resulted in tax expense of $1,822. The Company recorded tax expense of $1,699

related to uncertain tax positions. In addition, the exclusion of the pretax loss of an entity that is not

consolidated for income tax purposes resulted in additional tax expense of $2,509.