Cablevision 2012 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

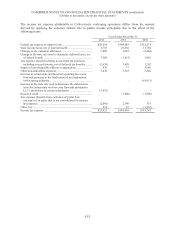

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-46

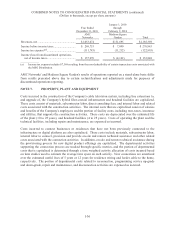

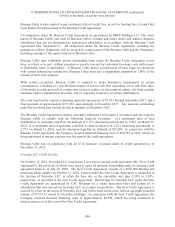

(e) At any time prior to December 15, 2013, the Company may redeem some or all of the notes at a specified "make-whole"

price plus accrued and unpaid interest to the redemption date. Beginning on or after December 15, 2013, the Company

may redeem some or all of the notes at a redemption price equal to 106% declining annually to 100% beginning on

December 15, 2016.

(f) The carrying amount of the senior note is net of the unamortized original issue discount.

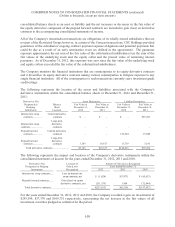

The table above excludes the $487,500 principal amount of Cablevision 7.75% senior notes due 2018 and

$266,217 principal amount of Cablevision 8.00% senior notes due 2020 held by Newsday at

December 31, 2012 and 2011, which are eliminated in the consolidated balance sheets of Cablevision.

The indentures under which the senior notes and debentures were issued contain various covenants, which

are generally less restrictive than those contained in the credit agreement of the issuer. The Company

was in compliance with all of its financial covenants under these indentures as of December 31,

2012.

Issuance of Debt Securities

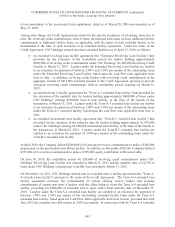

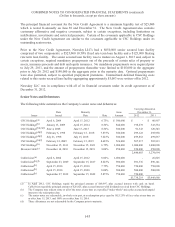

Cablevision 5-7/8% Senior Notes Due 2022

In September 2012, Cablevision issued $750,000 aggregate principal amount of 5-7/8% senior notes due

September 15, 2022 (the "2022 Notes") in a registered public offering. The 2022 Notes are senior

unsecured obligations and rank equally in right of payment with all of Cablevision's other existing and

future unsecured and unsubordinated indebtedness. Cablevision may redeem all or a portion of the 2022

Notes at any time at a price equal to 100% of the principal amount of the 2022 Notes redeemed plus

accrued and unpaid interest to the redemption date plus a "make whole" premium. In September 2012,

Cablevision contributed the net proceeds of approximately $735,000 from the issuance of the 2022 Notes

to CSC Holdings, and CSC Holdings used those proceeds to (i) repurchase a portion of 8-1/2% CSC

Holdings Senior Notes Due June 2015 ("June 2015 Notes") and a portion of the 8-1/2% CSC Holdings

Senior Notes Due April 2014 ("April 2014 Notes") in the tender offers commenced in September 2012

discussed below, (ii) make a $150,000 prepayment on the CSC Holdings Term B-2 extended loan facility,

and (iii) for general corporate purposes. In connection with the issuance of the 2022 Notes, the Company

incurred deferred financing costs of approximately $16,195, which are being amortized to interest

expense over the term of the 2022 Notes.

Cablevision 7-3/4% Senior Notes Due 2018 and 8% Senior Notes Due 2020

On April 15, 2010, Cablevision issued $750,000 aggregate principal amount of 7-3/4% senior notes due

April 15, 2018 and $500,000 aggregate principal amount of 8% senior notes due April 15, 2020 in a

registered public offering. These senior notes are Cablevision's senior unsecured obligations and rank

equally in right of payment with all of Cablevision's other existing and future unsecured and

unsubordinated indebtedness. The Company used the net proceeds of the offering to repurchase the April

2012 Notes (as defined below) in the tender offer Cablevision commenced in April 2010 discussed below

and for general corporate purposes. In connection with the issuance of these senior notes, the Company

incurred deferred financing costs of $26,481, which are being amortized to interest expense over the term

of these senior notes.

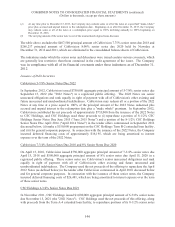

CSC Holdings 6-3/4% Senior Notes Due 2021

In November 2011, CSC Holdings issued $1,000,000 aggregate principal amount of 6-3/4% senior notes

due November 15, 2021 (the "2021 Notes"). CSC Holdings used the net proceeds of this offering, along

with proceeds from the Term A-4 extended loan facility, to repurchase portions of its 8-1/2% senior notes