Cablevision 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(3)

Telecommunications Services Segment, and approximately $2.5 million for our Other Segment. In

addition to these costs, we experienced other negative financial impacts including lower revenue related

to customers for whom we decided to temporarily suspend billing during the restoration of their homes,

displaced homes and advertising cancelations. We expect insurance recoveries related to storm damage

and business interruption to be minimal.

For several weeks after the storm, our workforce was dedicated to restoring services to our customers as

quickly as possible. During this period we reduced our marketing and sales activities which resulted in

lower sales and lower new customer connections. We also suspended our normal non-pay collection

procedures and disconnect policy to focus our customer service representatives and field service

technicians on service restoration. As a result, our customer statistics include delinquent customer

accounts that exceed our normal disconnect date. Of these delinquent accounts, we estimated the number

of accounts that we believe will be disconnected in 2013 as our normal collection and disconnect

procedures resume and our customer counts as of December 31, 2012 have been reduced accordingly.

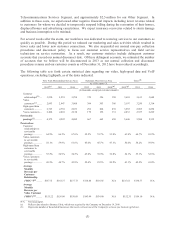

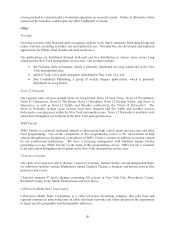

The following table sets forth certain statistical data regarding our video, high-speed data and VoIP

operations, excluding Lightpath, as of the dates indicated:

New York Metropolitan Service Area Optimum West Service Area Total (f)

As of December 31,

2012(g) 2011 2010 2012 2011 2010(a) 2012(g) 2011 2010

(in thousands, except per customer amounts)

Customer

relationships(b) .... 3,230 3,255 3,298 370 356 350 3,601 3,611 3,648

Video

customers(c) ........ 2,893 2,947 3,008 304 303 306 3,197 3,250 3,314

High-speed data

customers ............ 2,763 2,701 2,653 292 264 239 3,055 2,965 2,892

Voice customers .... 2,264 2,201 2,138 170 156 131 2,433 2,357 2,269

Serviceable

passings(d) ............ 4,979 4,922 4,882 667 662 650 5,646 5,584 5,532

Penetration:

Customer

relationships to

serviceable

passings ............... 64.9% 66.1% 67.6% 55.5% 53.7% 53.8% 63.8% 64.7% 65.9%

Video customers

to serviceable

passings ............... 58.1% 59.9% 61.6% 45.6% 45.7% 47.1% 56.6% 58.2% 59.9%

High-speed data

customers to

serviceable

passings ............... 55.5% 54.9% 54.3% 43.8% 39.9% 36.8% 54.1% 53.1% 52.3%

Voice customers

to serviceable

passings ............... 45.5% 44.7% 43.8% 25.4% 23.5% 20.2% 43.1% 42.2% 41.0%

Average

Monthly

Revenue per

Customer

Relationship

("RPC")(e) ......... $137.51 $141.37 $137.73 $118.84 $114.85 N/A $135.61 $138.77 N/A

Average

Monthly

Revenue per

Video Customer

("RPS")(e) .......... $153.22 $156.09 $150.68 $143.99 $134.60 N/A $152.35 $154.10 N/A

________________

N/A Not meaningful.

(a) Reflects data related to Bresnan Cable, which was acquired by the Company on December 14, 2010.

(b) Represents number of households/businesses that receive at least one of the Company's services (see footnote (g) below).