Cablevision 2012 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-49

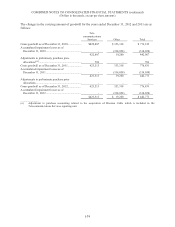

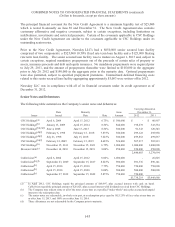

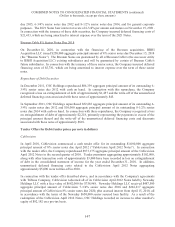

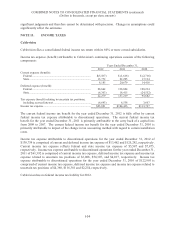

Summary of Debt Maturities

Total amounts payable by the Company under its various debt obligations outstanding as of December 31,

2012, including notes payable, collateralized indebtedness (see Note 11), and capital leases, during the

next five years and thereafter, are as follows:

Years Ending December 31, Cablevision(a) CSC Holdings

2013(b) ............................................................................................................. $ 502,431 $ 502,431

2014 ................................................................................................................. 763,780 763,780

2015 ................................................................................................................. 291,014 291,014

2016 ................................................................................................................. 3,309,096 3,309,096

2017 ................................................................................................................. 1,619,166 719,166

Thereafter ........................................................................................................ 4,576,000 2,576,000

________________

(a) Excludes the Cablevision 7.75% senior notes due 2018 and Cablevision 8.00% senior notes due 2020 held by

Newsday.

(b) In January 2013, the Company settled collateralized indebtedness relating to 2,668,875 shares of Comcast

Corporation by delivering cash equal to the collateralized loan value obtained from the proceeds of a new

monetization contract covering an equivalent number of Comcast Corporation shares. Accordingly, the

consolidated balance sheets of Cablevision and CSC Holdings as of December 31, 2012 reflect the reclassification

of $99,763 of investment securities pledged as collateral from a current asset to a long-term asset and $59,003 of

collateralized indebtedness from a current liability to a long-term liability.

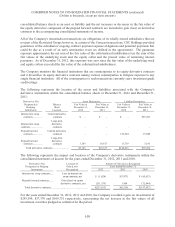

NOTE 11. DERIVATIVE CONTRACTS AND COLLATERALIZED INDEBTEDNESS

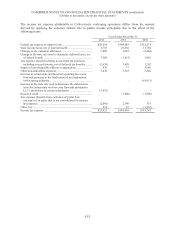

To manage interest rate risk, the Company has historically entered into interest rate swap contracts to

adjust the proportion of total debt that is subject to variable interest rates. Such contracts effectively fix

the borrowing rates on floating rate debt to limit the exposure against the risk of rising rates. The

Company does not enter into interest rate swap contracts for speculative or trading purposes.

As of December 31, 2011 and through their maturity date in June 2012, CSC Holdings was party to

several interest rate swap contracts with an aggregate notional amount of $2,600,000 that effectively fixed

borrowing rates on a portion of the Company's floating rate debt. As a result of these transactions, the

interest rate paid on approximately 81% of the Company's outstanding debt (excluding capital leases and

collateralized indebtedness) was effectively fixed at December 31, 2011 (56% being fixed rate obligations

and 25% effectively fixed through the utilization of these contracts). These contracts were not designated

as hedges for accounting purposes.

The Company has also entered into various transactions to limit the exposure against equity price risk on

its shares of Comcast Corporation ("Comcast") common stock. The Company has monetized all of its

stock holdings in Comcast Corporation through the execution of prepaid forward contracts, collateralized

by an equivalent amount of the respective underlying stock. At maturity, the contracts provide for the

option to deliver cash or shares of Comcast stock with a value determined by reference to the applicable

stock price at maturity. These contracts, at maturity, are expected to offset declines in the fair value of

these securities below the hedge price per share while allowing the Company to retain upside appreciation

from the hedge price per share to the relevant cap price.

The Company received cash proceeds upon execution of the prepaid forward contracts discussed above

which has been reflected as collateralized indebtedness in the accompanying consolidated balance sheets.

In addition, the Company separately accounts for the equity derivative component of the prepaid forward

contracts. These equity derivatives have not been designated as hedges for accounting purposes.

Therefore, the net fair values of the equity derivatives have been reflected in the accompanying