Cablevision 2012 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-70

The aggregate intrinsic value is calculated as the difference between the exercise price of the underlying

awards and the quoted price of Cablevision's common stock for the 15,579,344 options outstanding that

were in-the-money (which includes 3,623,044 exercisable options) at December 31, 2012. For the year

ended December 31, 2012, the aggregate intrinsic value of options exercised under Cablevision's stock

option plans was $22,265 determined as of the date of option exercise, as applicable. When an option is

exercised, Cablevision issues new shares of stock.

Cablevision stock options held by AMC Networks and Madison Square Garden employees are not

expensed by the Company, however such stock options do have a dilutive effect on net income per share

attributable to Cablevision stockholders.

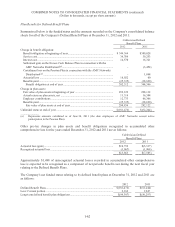

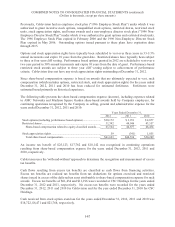

The following table summarizes activity relating to Company employees who held Cablevision restricted

shares for the year ended December 31, 2012:

Number of

Restricted

Shares

Number of

Performance

Restricted

Shares

Weighted

Average Fair

Value Per

Share at Date of

Grant

Unvested award balance, December 31, 2011 .................

.

4,768,482 540,700 $13.89

Granted .........................................................................

.

2,344,530 756,400 14.49(a)

Vested .........................................................................

.

(2,598,817) - 6.28

Awards forfeited ..........................................................

.

(503,520) - 18.17

Unvested award balance, December 31, 2012 .................

.

4,010,675 1,297,100 $18.06(a)

________________

(a) Does not include the fair value per share of the performance based restricted shares granted in 2012 as the performance

criteria had not yet been established as of December 31, 2012.

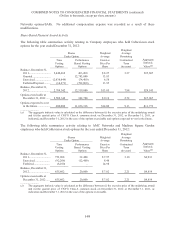

The following table summarizes activity relating to AMC Networks and Madison Square Garden

employees who held Cablevision restricted shares for the year ended December 31, 2012:

Number of

Restricted

Shares

Number of

Performance

Restricted

Shares

Weighted

Average Fair

Value Per

Share at Date of

Grant

Unvested award balance, December 31, 2011 .................

.

2,086,450 - $ 9.37

Vested ..........................................................................

.

(1,529,590) - 6.33

Awards forfeited ..........................................................

.

(37,710) - 17.71

Unvested award balance, December 31, 2012 .................

.

519,150 - $17.70

Cablevision restricted shares held by AMC Networks and Madison Square Garden employees are not

expensed by the Company, however such restricted shares do have a dilutive effect on net income per

share attributable to Cablevision stockholders.

For the years ended December 31, 2012, 2011 and 2010, the amount of cash used by the Company to

settle the aggregate intrinsic value of stock appreciation rights exercised under Cablevision's stock plans

was $602, $879 and $6,443, respectively, determined as of the date of exercise. The aggregate intrinsic

value, which was settled in cash, is calculated as the difference between (i) the exercise price of the

underlying awards and (ii) the quoted price of the CNYG Class A common stock as of the date of

exercise, plus dividends, as applicable.