Cablevision 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(81)

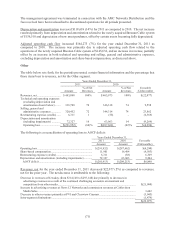

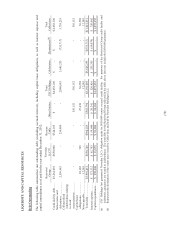

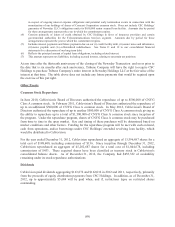

Payment Obligations Related to Debt

Total amounts payable by us in connection with our outstanding obligations during the five years

subsequent to December 31, 2012 and thereafter, including related interest, as well as capital lease

obligations and the value deliverable at maturity under monetization contracts as of December 31, 2012

are as follows:

Cablevision

Restricted

Group

Bresnan

Cable Newsday

Other

Entities Total

2013 ............... $ 218,344 $ 465,837 $ 61,724 $ 44,541 $335,619 (a)(c) $ 1,126,065

2014 ............... 219,812 772,627 61,374 43,741 260,252 (a) 1,357,806

2015 ............... 219,812 504,680 61,025 42,963 25,506 853,986

2016 ............... 219,812 2,914,495 60,767 607,360 - 3,802,434

2017 ............... 1,119,812 174,617 770,261 68 - 2,064,758

Thereafter ...... 2,349,375 2,713,989 270,000 - - 5,333,364

(

b)

Total .............. $4,346,967 $7,546,245 $1,285,151 $738,673 $621,377 $14,538,413

________________

(a) Cablevision has the option, at maturity, to deliver the shares of common stock underlying the monetization contracts along with

proceeds from the related derivative contracts in full satisfaction of the maturing collateralized indebtedness or obtain the

required cash equivalent of the common stock through new monetization and derivative contracts. The amount included in the

table is $307,763 in 2013 and $248,389 in 2014.

(b) Excludes the $487,500 principal amount of Cablevision 7.75% senior notes due 2018 and $266,217 principal amount of

Cablevision 8.00% senior notes due 2020 held by Newsday Holdings LLC, which are pledged to the lenders under its credit

facility.

(c) In January 2013, the Company settled collateralized indebtedness relating to 2,668,875 shares of Comcast Corporation by

delivering cash equal to the collateralized loan value obtained from the proceeds of a new monetization contract covering an

equivalent number of Comcast Corporation shares. Accordingly, the consolidated balance sheets of Cablevision and CSC

Holdings as of December 31, 2012 reflect the reclassification of $99,763 of investment securities pledged as collateral from a

current asset to a long-term asset and $59,003 of collateralized indebtedness from a current liability to a long-term liability.

Restricted Group

As of December 31, 2012, CSC Holdings and those of its subsidiaries which conduct our cable television

video operations, high-speed data service, and our VoIP services operations in the New York

metropolitan service area, as well as Lightpath, our commercial data and voice service business, comprise

the "Restricted Group" as they are subject to the covenants and restrictions of the credit facility and

indentures governing the notes and debentures issued by CSC Holdings. In addition, the Restricted

Group is also subject to the covenants of the debt issued by Cablevision.

Sources of cash for the Restricted Group include primarily cash flow from the operations of the

businesses in the Restricted Group, borrowings under its credit facility and issuance of securities in the

capital markets and, from time to time, distributions or loans from its subsidiaries. The Restricted

Group's principal uses of cash include: capital spending, in particular, the capital requirements associated

with the upgrade of its digital video, high-speed data and voice services (including enhancements to its

service offerings such as a broadband wireless network (WiFi)); debt service, including distributions

made to Cablevision to service interest expense and principal repayments on its debt securities;

distributions to Cablevision to fund dividends paid to stockholders of CNYG Class A and CNYG Class B

common stock; distributions to Cablevision to fund share repurchases; other corporate expenses and

changes in working capital; and investments that it may fund from time to time. We currently expect that

the net funding and investment requirements of the Restricted Group for the next 12 months will be met

with one or more of the following: cash on hand, cash generated by operating activities and available

borrowings under the Restricted Group's credit facility.