Cablevision 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(78)

operations, cash on hand, and borrowings under credit facilities made available to the Restricted Group

(as later defined) and Bresnan Cable, and the proceeds from the issuance of securities in the capital

markets. Our decision as to the use of cash generated from operating activities, cash on hand and

borrowings under credit facilities of the Restricted Group and Bresnan Cable will be based upon an

ongoing review of the funding needs of the business, the optimal allocation of cash resources, the timing

of cash flow generation and the cost of borrowing under each respective credit agreement. Moreover, we

will monitor the credit markets and may seek opportunities to issue debt, the proceeds of which could be

used to meet our future cash funding requirements. We have accessed the debt markets for significant

amounts of capital in the past and expect to do so in the future.

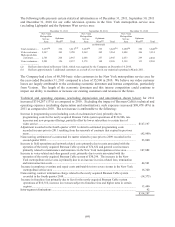

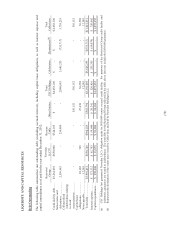

We have assessed our ability to repay our scheduled debt maturities over the next 12 months and we

currently believe that a combination of cash on hand, cash generated from operating activities and

availability under our revolving credit facilities should provide us with sufficient liquidity to repay such

scheduled current debt maturities in the next 12 months totaling approximately $183,660 under our credit

facilities, senior notes and notes payable as of December 31, 2012. However, market disruptions or a

deterioration in economic conditions could lead to lower demand for our products, such as cable

television services, as well as lower levels of television and newspaper advertising, and increased

incidence of customers' inability to pay for the services we provide. These events would adversely impact

our results of operations, cash flows and financial position. Although we currently believe that amounts

available under our CSC Holdings and Bresnan Cable revolving credit facilities will be available when,

and if needed, we can provide no assurance that access to such funds will not be impacted by adverse

conditions in the financial markets or other conditions. The obligations of the financial institutions under

our revolving credit facilities are several and not joint and, as a result, a funding default by one or more

institutions does not need to be made up by the others.

In the longer term, we do not expect to be able to generate sufficient cash from operations to fund

anticipated capital expenditures, meet all existing future contractual payment obligations and repay our

debt at maturity. As a result, we will be dependent upon our ability to access the capital and credit

markets. We will need to raise significant amounts of funding over the next several years to fund capital

expenditures, repay existing obligations and meet other obligations, and the failure to do so successfully

could adversely affect our business. If we are unable to do so, we will need to take other actions

including deferring capital expenditures, selling assets, seeking strategic investments from third parties or

reducing or eliminating dividend payments and stock repurchases or other discretionary uses of cash.

Issuance of Debt Securities

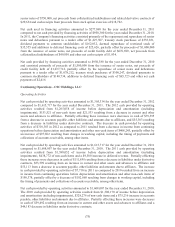

Cablevision 5-7/8% Senior Notes Due 2022

In September 2012, Cablevision issued $750,000 aggregate principal amount of 5-7/8% senior notes due

September 15, 2022 (the "2022 Notes") in a registered public offering. The 2022 Notes are senior

unsecured obligations and rank equally in right of payment with all of Cablevision's other existing and

future unsecured and unsubordinated indebtedness. Cablevision may redeem all or a portion of the 2022

Notes at any time at a price equal to 100% of the principal amount of the 2022 Notes redeemed plus

accrued and unpaid interest to the redemption date plus a "make whole" premium. In September 2012,

Cablevision contributed the net proceeds of approximately $735,000 from the issuance of the 2022 Notes

to CSC Holdings, and CSC Holdings used those proceeds to (i) repurchase a portion of 8-1/2% CSC

Holdings Senior Notes Due June 2015 ("June 2015 Notes") and a portion of the 8-1/2% CSC Holdings

Senior Notes Due April 2014 ("April 2014 Notes") in the tender offers commenced in September 2012

discussed below, (ii) make a $150,000 prepayment on the CSC Holdings Term B-2 extended loan facility,

and (iii) for general corporate purposes. In connection with the issuance of the 2022 Notes, Cablevision

incurred deferred financing costs of approximately $16,195, which are being amortized to interest

expense over the term of the 2022 Notes.