Cablevision 2012 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-34

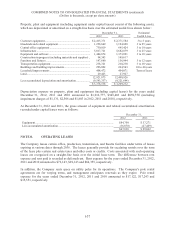

rate, determination of appropriate market comparables, average annual revenue per customer, number of

homes passed, operating margin, market penetration as a percentage of homes passed, and determination

of whether a premium or discount should be applied to comparables.

The estimates of expected useful lives take into consideration the effects of contractual relationships,

customer attrition, eventual development of new technologies and market competition.

Revenues and loss from continuing operations before income taxes attributable to Bresnan Cable for the

period from December 14, 2010 through December 31, 2010 amounted to approximately $22,135 and

($20,610), respectively, which are included in the accompanying consolidated statement of income for the

year ended December 31, 2010.

Approximately $167,300 of goodwill recorded in connection with the Bresnan Cable acquisition is

deductible for tax purposes.

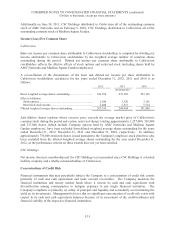

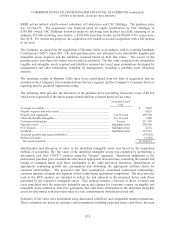

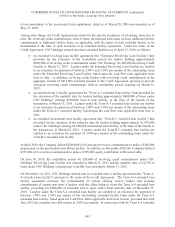

The unaudited pro forma revenues, income from continuing operations, net income, income per share

from continuing operations and net income per share for the year ended December 31, 2010, as if the

Bresnan acquisition had occurred on January 1, 2009, is as follows:

Cablevision CSC Holdings

Revenues........................................................................................................ $6,599,504 $6,599,504

Income from continuing operations ............................................................... $ 202,927 $ 416,256

Net income ..................................................................................................... $ 356,775 $ 570,104

Basic income per share from continuing operations ...................................... $0.69

Basic net income per share ............................................................................ $1.22

Diluted income per share from continuing operations ................................... $0.67

Diluted net income per share ......................................................................... $1.18

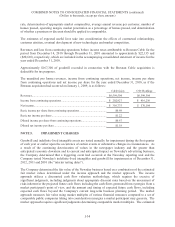

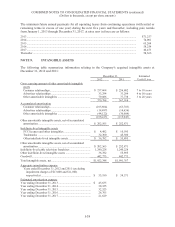

NOTE 5. IMPAIRMENT CHARGES

Goodwill and indefinite-lived intangible assets are tested annually for impairment during the first quarter

of each year or earlier upon the occurrence of certain events or substantive changes in circumstances. As

a result of the continuing deterioration of values in the newspaper industry and the greater than

anticipated economic downturn and its current and anticipated impact on Newsday's advertising business,

the Company determined that a triggering event had occurred at the Newsday reporting unit and the

Company tested Newsday's indefinite-lived intangibles and goodwill for impairment as of December 31,

2012, 2011 and 2010 (the "interim testing dates").

The Company determined the fair value of the Newsday business based on a combination of the estimated

fair market values determined under the income approach and the market approach. The income

approach utilizes a discounted cash flow valuation methodology, which requires the exercise of

significant judgments, including judgments about appropriate discount rates based on the assessment of

risks inherent in the projected future cash flows including the cash flows generated from synergies from a

market participant's point of view, and the amount and timing of expected future cash flows, including

expected cash flows beyond the Company's current long-term business planning period. The market

approach measures fair value using market multiples of various financial measures compared to a set of

comparable public companies taking into consideration synergies a market participant may generate. The

market approach requires significant judgments determining comparable market multiples. The estimated