Cablevision 2012 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-71

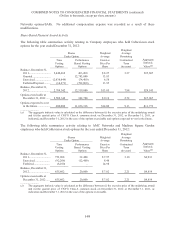

As of December 31, 2012, there was $53,448 of total unrecognized compensation cost related to

Cablevision's unvested options and restricted shares granted under Cablevision's stock plans. The

unrecognized compensation cost is expected to be recognized over a weighted-average period of

approximately 1 year.

During the year ended December 31, 2012 and 2011, 4,128,407 and 2,616,030 Cablevision restricted

shares, respectively, issued to employees of the Company, AMC Networks and Madison Square Garden

vested. To fulfill the employees' statutory minimum tax withholding obligations for the applicable

income and other employment taxes, 1,387,811 and 1,071,017 of these shares, with an aggregate value of

$19,831 and $35,555, respectively, were surrendered to the Company. These acquired shares have been

classified as treasury stock.

Long-Term Incentive Plans

In April 2006, Cablevision's Board of Directors approved the Cablevision Systems Corporation 2006 Cash

Incentive Plan, which was approved by Cablevision's stockholders at its annual stockholders meeting in

May 2006.

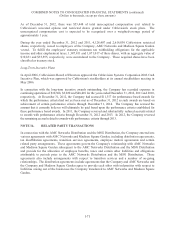

In connection with the long-term incentive awards outstanding, the Company has recorded expenses in

continuing operations of $10,308, $2,920 and $48,410 for the years ended December 31, 2012, 2011 and 2010,

respectively. At December 31, 2012, the Company had accrued $11,357 for performance based awards for

which the performance criteria had not yet been met as of December 31, 2012 as such awards are based on

achievement of certain performance criteria through December 31, 2014. The Company has accrued the

amount that it currently believes will ultimately be paid based upon the performance criteria established for

these performance based awards. In 2011, the Company reversed and substantially reduced accruals related

to awards with performance criteria through December 31, 2012 and 2013. In 2012, the Company reversed

the remaining accrual related to awards with performance criteria through 2013.

NOTE 16. RELATED PARTY TRANSACTIONS

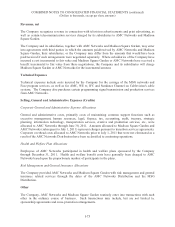

In connection with the AMC Networks Distribution and the MSG Distribution, the Company entered into

various agreements with AMC Networks and Madison Square Garden, including distribution agreements,

tax disaffiliation agreements, transition services agreements, employee matters agreements and certain

related party arrangements. These agreements govern the Company's relationship with AMC Networks

and Madison Square Garden subsequent to the AMC Networks Distribution and the MSG Distribution

and provide for the allocation of employee benefits, taxes and certain other liabilities and obligations

attributable to periods prior to the AMC Networks Distribution and the MSG Distribution. These

agreements also include arrangements with respect to transition services and a number of on-going

relationships. The distribution agreements include agreements that the Company and AMC Networks and

the Company and Madison Square Garden agree to provide each other with indemnities with respect to

liabilities arising out of the businesses the Company transferred to AMC Networks and Madison Square

Garden.