Cablevision 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(53)

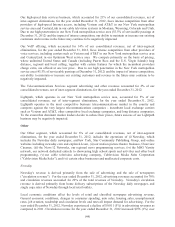

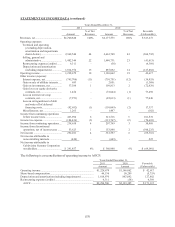

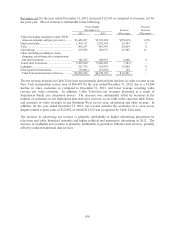

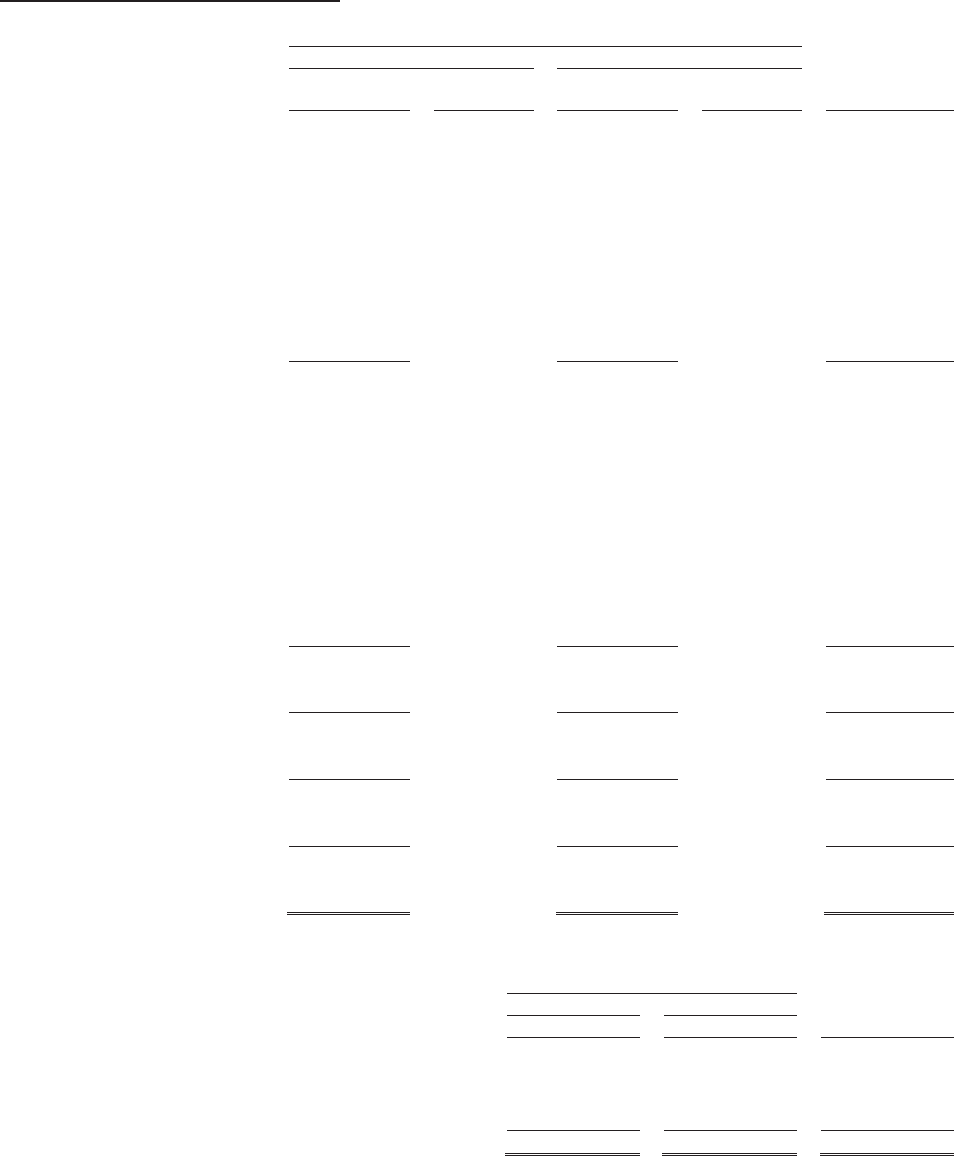

STATEMENT OF INCOME DATA (continued)

Years Ended December 31,

2011 2010

% of Net % of Net Favorable

Amount Revenues Amount Revenues (Unfavorable)

Revenues, net ...................................... $6,700,848 100% $6,177,575 100% $ 523,273

Operating expenses:

Technical and operating

(excluding depreciation,

amortization and impairments

shown below) .............................. 2,968,540 44 2,663,748 43 (304,792)

Selling, general and

administrative .............................. 1,482,344 22 1,440,731 23 (41,613)

Restructuring expense (credits) ....... 6,311 - (58) - (6,369)

Depreciation and amortization

(including impairments) .............. 1,014,974 15 887,092 14 (127,882)

Operating income ................................ 1,228,679 18 1,186,062 19 42,617

Other income (expense):

Interest expense, net ........................ (745,706) (11) (710,751) (12) (34,955)

Gain on sale of affiliate interests ..... 683 - 2,051 - (1,368)

Gain on investments, net ................. 37,384 1 109,813 2 (72,429)

Gain (loss) on equity derivative

contracts, net................................ 1,454 - (72,044) (1) 73,498

Loss on interest rate swap

contracts, net................................ (7,973) - (85,013) (1) 77,040

Loss on extinguishment of debt

and write-off of deferred

financing costs ............................. (92,692) (1) (110,049) (2) 17,357

Miscellaneous, net ........................... 1,265 - 1,447 - (182)

Income from continuing operations

before income taxes ........................ 423,094 6 321,516 5 101,578

Income tax expense ............................ (184,436) (3) (113,767) (2) (70,669)

Income from continuing operations .... 238,658 4 207,749 3 30,909

Income from discontinued

operations, net of income taxes ...... 53,623 1 153,848 2 (100,225)

Net income ......................................... 292,281 4 361,597 6 (69,316)

Net income attributable to

noncontrolling interests .................. (424) - (649) - 225

Net income attributable to

Cablevision Systems Corporation

stockholders .................................... $ 291,857 4% $ 360,948 6% $ (69,091)

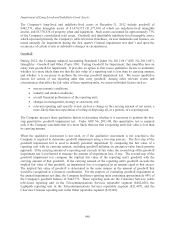

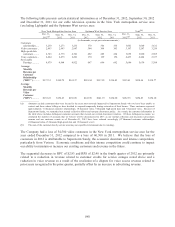

The following is a reconciliation of operating income to AOCF:

Years Ended December 31,

2011 2010 Favorable

Amount Amount (Unfavorable)

Operating income ............................................................................

.

$1,228,679 $1,186,062 $ 42,617

Share-based compensation ..............................................................

.

44,536 50,289 (5,753)

Depreciation and amortization (including impairments) .................

.

1,014,974 887,092 127,882

Restructuring expense (credits) .......................................................

.

6,311 (58) 6,369

AOCF ..........................................................................................

.

$2,294,500 $2,123,385 $ 171,115