Cablevision 2012 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-56

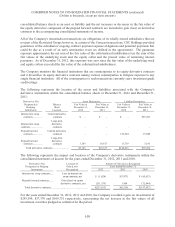

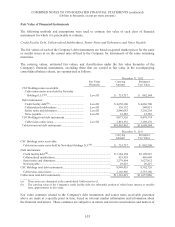

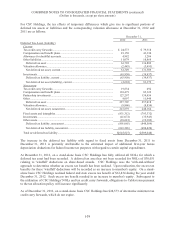

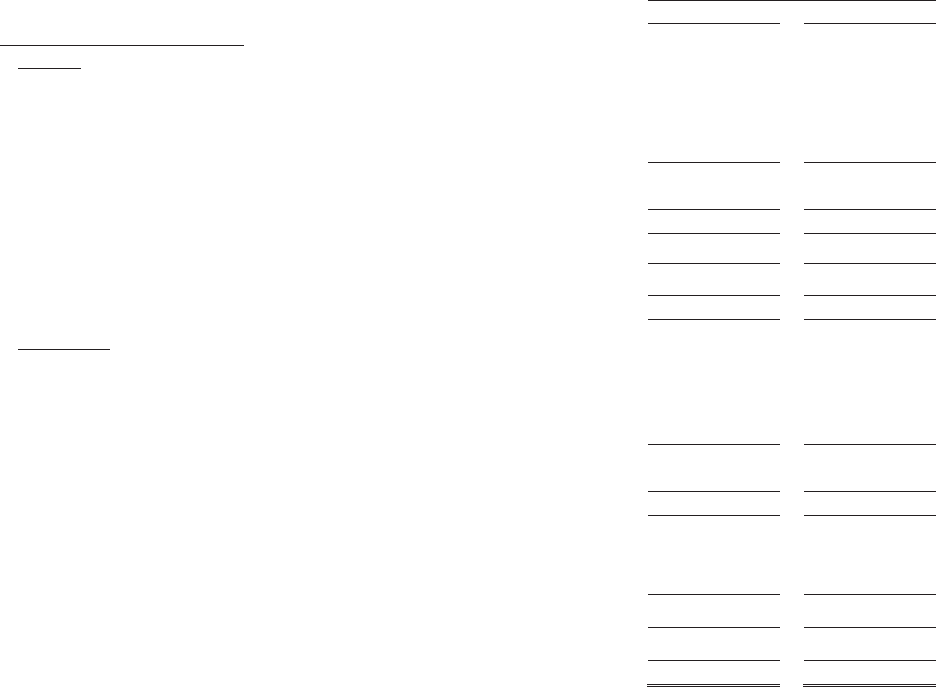

For Cablevision, the tax effects of temporary differences which give rise to significant portions of

deferred tax assets or liabilities and the corresponding valuation allowance at December 31, 2012 and

2011 are as follows:

December 31,

2012 2011

Deferred Tax Asset (Liability)

Current

NOLs and tax credit carry forwards .................................................................... $ 170,407 $ 69,689

Compensation and benefit plans ......................................................................... 23,158 41,330

Allowance for doubtful accounts ........................................................................ 4,982 5,286

Other liabilities .................................................................................................... 11,079 10,868

Deferred tax asset ............................................................................................ 209,626 127,173

Valuation allowance ............................................................................................ (4,194) (2,311)

Net deferred tax asset, current ......................................................................... 205,432 124,862

Investments ......................................................................................................... (63,950) (39,937)

Deferred tax liability, current .......................................................................... (63,950) (39,937)

Net deferred tax asset, current ......................................................................... 141,482 84,925

Noncurrent

NOLs and tax credit carry forwards .................................................................... 389,851 523,548

Compensation and benefit plans ......................................................................... 101,479 85,122

Partnership investments ...................................................................................... 127,297 159,456

Other ................................................................................................................... 9,097 11,948

Deferred tax asset ............................................................................................ 627,724 780,074

Valuation allowance ............................................................................................ (12,559) (12,036)

Net deferred tax asset, noncurrent ................................................................... 615,165 768,038

Fixed assets and intangibles ................................................................................ (831,312) (793,332)

Investments ......................................................................................................... (41,072) (35,943)

Other assets ......................................................................................................... (18,686) (19,309)

Deferred tax liability, noncurrent .................................................................... (891,070) (848,584)

Net deferred tax liability, noncurrent............................................................... (275,905) (80,546)

Total net deferred tax asset (liability) ................................................................. $(134,423) $ 4,379

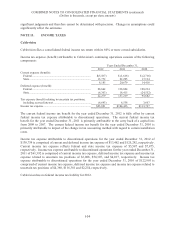

The increase in the deferred tax liability with regard to fixed assets from December 31, 2011 to

December 31, 2012 is primarily attributable to the estimated impact of additional first-year bonus

depreciation deductions for federal income tax purposes for certain capital expenditures.

At December 31, 2012, Cablevision had consolidated federal NOLs of $1,641,269 expiring on various

dates from 2021 through 2031. Cablevision has recorded a deferred tax asset related to $1,286,840 of

such NOLs. A deferred tax asset has not been recorded for the remaining NOL of $354,429 as this

portion relates to excess tax benefits that have not yet been realized, including 'windfall' deductions on

share-based awards. Cablevision uses the 'with-and-without' approach to determine whether an excess tax

benefit has been realized. Upon realization, such excess tax benefits will be recorded as an increase to

paid-in capital.

As of December 31, 2012, Cablevision has $21,273 of federal alternative minimum tax credit carry

forwards, which do not expire.

Subsequent to the utilization of Cablevision's NOLs and tax credit carry forwards, payments for income

taxes are expected to increase significantly.