Cablevision 2012 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

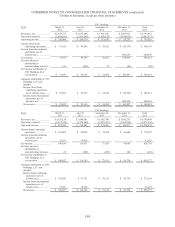

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-75

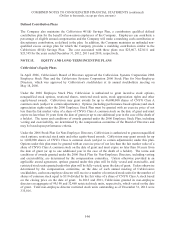

Holdings' guarantee of Newsday LLC's obligations under its $650,000 senior secured loan facility. Amounts due

by period for these arrangements represent the year in which the commitment expires.

(c) Consists primarily of letters of credit obtained by CSC Holdings in favor of insurance providers and certain

governmental authorities for the Telecommunications Services segment. Amounts due by period for these

arrangements represent the year in which the commitment expires.

At any time after the thirteenth anniversary of the closing of the Newsday acquisition and on or prior to

the date that is six months after such anniversary, Tribune Company will have the right to require CSC

Holdings to purchase Tribune Company's entire interest in Newsday Holdings LLC at the fair value of the

interest at that time. The table above does not include any future payments that would be required upon

the exercise of this put right.

Many of the Company's franchise agreements and utility pole leases require the Company to remove its

cable wires and other equipment upon termination of the respective agreements. The Company has

concluded that the fair value of these asset retirement obligations cannot be reasonably estimated since

the range of potential settlement dates is not determinable.

Legal Matters

Cable Operations Litigation

Brantley, et al. v. NBC Universal, Inc., et al.: On September 20, 2007, individual cable and satellite

subscribers, purportedly on behalf of a nationwide class of cable and satellite subscribers, filed an

antitrust lawsuit in the U.S. District Court for the Central District of California against Cablevision and

several other defendants, including other cable and satellite providers and programming content

providers. The complaint, as amended, alleged that the defendants violated Section 1 of the Sherman

Antitrust Act by agreeing to the sale and licensing of programming on a "bundled" basis and by offering

programming in packaged tiers rather than on an "à la carte" basis. Plaintiffs sought unspecified treble

monetary damages and injunctive relief. On June 12, 2009, the defendants filed motions to dismiss the

third amended complaint. On October 15, 2009, the District Court granted the defendants' motions and

dismissed the third amended complaint with prejudice for failure to plead foreclosure of any non-

defendant programmers, which the Court held to be a necessary element of the alleged antitrust injury.

On April 19, 2010, plaintiffs filed an appeal to the United States Court of Appeals for the Ninth Circuit.

On March 30, 2012, the Ninth Circuit affirmed the District Court's dismissal of the case. On April 10,

2012, plaintiffs filed petitions for rehearing which the Ninth Circuit denied on May 4, 2012. On

August 2, 2012, plaintiffs filed a petition seeking leave to appeal to the U.S. Supreme Court. On

November 5, 2012, the U.S. Supreme Court denied the petition. The Company believes this matter is

now concluded.

Marchese, et al. v. Cablevision Systems Corporation and CSC Holdings, LLC: The Company is a

defendant in a lawsuit filed in the U.S. District Court for the District of New Jersey by several present and

former Cablevision subscribers, purportedly on behalf of a class of iO video subscribers in New Jersey,

Connecticut and New York. After three versions of the complaint were dismissed without prejudice by

the District Court, plaintiffs filed their third amended complaint on August 22, 2011, alleging that the

Company violated Section 1 of the Sherman Antitrust Act by allegedly tying the sale of interactive

services offered as part of iO television packages to the rental and use of set-top boxes distributed by

Cablevision, and violated Section 2 of the Sherman Antitrust Act by allegedly seeking to monopolize the

distribution of Cablevision compatible set-top boxes. Plaintiffs seek unspecified treble monetary

damages, attorney's fees, as well as injunctive and declaratory relief. On September 23, 2011, the

Company filed a motion to dismiss the third amended complaint. On January 10, 2012, the District Court

issued a decision dismissing with prejudice the Section 2 monopolization claim, but allowing the