Cablevision 2012 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-57

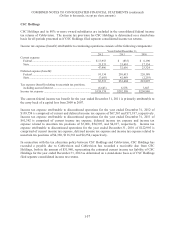

CSC Holdings

CSC Holdings and its 80% or more owned subsidiaries are included in the consolidated federal income

tax returns of Cablevision. The income tax provision for CSC Holdings is determined on a stand-alone

basis for all periods presented as if CSC Holdings filed separate consolidated income tax returns.

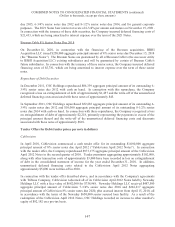

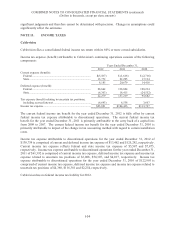

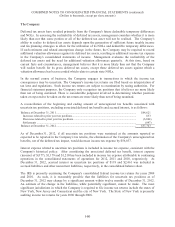

Income tax expense (benefit) attributable to continuing operations consists of the following components:

Years Ended December 31,

2012 2011 2010

Current expense:

Federal ................................................................................. $ 13,953 $ (835) $ 6,190

State ..................................................................................... 33,533 33,491 17,134

47,486 32,656 23,324

Deferred expense (benefit):

Federal ................................................................................. 91,134 210,415 226,188

State ..................................................................................... (7,603) 42,989 (2,293)

83,531 253,404 223,895

Tax expense (benefit) relating to uncertain tax positions,

including accrued interest .................................................... (6,643) 6,538 3,667

Income tax expense ................................................................. $124,374 $292,598 $250,886

The current federal income tax benefit for the year ended December 31, 2011 is primarily attributable to

the carry back of a capital loss from 2009 to 2007.

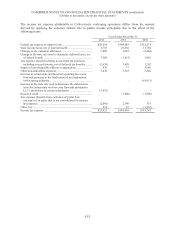

Income tax expense attributable to discontinued operations for the year ended December 31, 2012 of

$138,754 is comprised of current and deferred income tax expense of $67,567 and $71,187, respectively.

Income tax expense attributable to discontinued operations for the year ended December 31, 2011 of

$61,392 is comprised of current income tax expense, deferred income tax expense and income tax

expense related to uncertain tax positions of $3,068, $54,307, and $4,017, respectively. Income tax

expense attributable to discontinued operations for the year ended December 31, 2010 of $122,995 is

comprised of current income tax expense, deferred income tax expense and income tax expense related to

uncertain tax positions of $4,360, $116,381 and $2,254, respectively.

In connection with the tax allocation policy between CSC Holdings and Cablevision, CSC Holdings has

recorded a payable due to Cablevision and Cablevision has recorded a receivable due from CSC

Holdings, both in the amount of $31,960, representing the estimated current income tax liability of CSC

Holdings for the year ended December 31, 2012 as determined on a stand-alone basis as if CSC Holdings

filed separate consolidated income tax returns.