Cablevision 2012 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

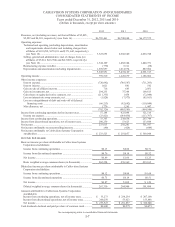

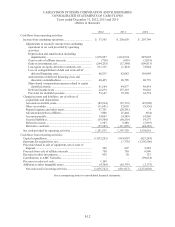

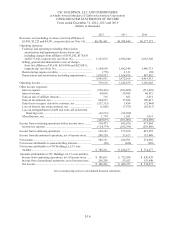

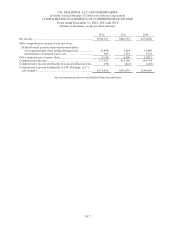

CABLEVISION SYSTEMS CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

Years ended December 31, 2012, 2011 and 2010

(Dollars in thousands, except per share amounts)

I-7

2012 2011 2010

Revenues, net (including revenues, net from affiliates of $5,805,

$5,222 and $4,381, respectively) (see Note 16) ..............................

.

$6,705,461 $6,700,848 $6,177,575

Operating expenses:

Technical and operating (excluding depreciation, amortization

and impairments shown below and including charges from

affiliates of $183,292, $178,831 and $171,642, respectively)

(see Note 16) ...............................................................................

.

3,323,655 2,968,540 2,663,748

Selling, general and administrative (net of charges from (to)

affiliates of $3,614, $(16,994) and $(23,083), respectively)

(see Note 16) ...............................................................................

.

1,544,109 1,482,344 1,440,731

Restructuring expense (credits) .......................................................

.

(770) 6,311 (58)

Depreciation and amortization (including impairments) .................

.

1,078,957 1,014,974 887,092

5,945,951 5,472,169 4,991,513

Operating income ................................................................................

.

759,510 1,228,679 1,186,062

Other income (expense):

Interest expense ...............................................................................

.

(720,692) (746,587) (711,293)

Interest income ................................................................................

.

1,021 881 542

Gain on sale of affiliate interests .....................................................

.

716 683 2,051

Gain on investments, net .................................................................

.

294,235 37,384 109,813

Gain (loss) on equity derivative contracts, net ................................

.

(211,335) 1,454 (72,044)

Loss on interest rate swap contracts, net .........................................

.

(1,828) (7,973) (85,013)

Loss on extinguishment of debt and write-off of deferred

financing costs ...........................................................................

.

(66,213) (92,692) (110,049)

Miscellaneous, net ...........................................................................

.

1,770 1,265 1,447

(702,326) (805,585) (864,546)

Income from continuing operations before income taxes ....................

.

57,184 423,094 321,516

Income tax expense .........................................................................

.

(23,821) (184,436) (113,767)

Income from continuing operations .....................................................

.

33,363 238,658 207,749

Income from discontinued operations, net of income taxes .................

.

200,250 53,623 153,848

Net income ..........................................................................................

.

233,613 292,281 361,597

Net income attributable to noncontrolling interests .............................

.

(90) (424) (649)

Net income attributable to Cablevision Systems Corporation

stockholders ....................................................................................

.

$ 233,523 $ 291,857 $ 360,948

INCOME PER SHARE:

Basic net income per share attributable to Cablevision Systems

Corporation stockholders:

Income from continuing operations .................................................

.

$0.13 $0.86 $0.71

Income from discontinued operations .............................................

.

$0.76 $0.19 $0.52

Net income ......................................................................................

.

$0.89 $1.06 $1.23

Basic weighted average common shares (in thousands) ..................

.

262,258 276,369 293,165

Diluted net income per share attributable to Cablevision Systems

Corporation stockholders:

Income from continuing operations .................................................

.

$0.12 $0.84 $ 0.69

Income from discontinued operations .............................................

.

$0.75 $0.19 $0.51

Net income ......................................................................................

.

$0.87 $1.02 $ 1.20

Diluted weighted average common shares (in thousands) ...............

.

267,330 284,904 301,880

Amounts attributable to Cablevision Systems Corporation

stockholders:

Income from continuing operations, net of income taxes ................

.

$ 33,273 $ 238,234 $ 207,100

Income from discontinued operations, net of income taxes .............

.

200,250 53,623 153,848

Net income ......................................................................................

.

$ 233,523 $ 291,857 $ 360,948

Cash dividends declared and paid per share of common stock ............

.

$0.600 $0.575 $0.475

See accompanying notes to consolidated financial statements.