Cablevision 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(50)

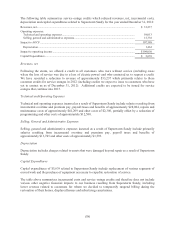

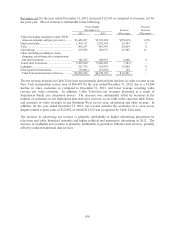

the provisioning process for new digital product offerings are capitalized. The departmental activities

supporting the connection process are tracked through specific metrics, and the portion of departmental

costs that is capitalized is determined through a time weighted activity allocation of costs incurred based

on time studies used to estimate the average time spent on each activity. New connections are amortized

over the estimated useful lives of 5 years or 12 years for residence wiring and feeder cable to the home,

respectively. The portion of departmental costs related to reconnection, programming service up- and

down- grade, repair and maintenance, and disconnection activities are expensed as incurred.

The estimated useful lives assigned to our property, plant and equipment are reviewed on an annual basis

or more frequently if circumstances warrant and such lives are revised to the extent necessary due to

changing facts and circumstances. Any changes in estimated useful lives are reflected prospectively.

Refer to Note 2 to our consolidated financial statements included in this Annual Report on Form 10-K for

a discussion of our accounting policies with respect to the policies discussed above and other items.

Legal Contingencies

The Company is party to various lawsuits and proceedings and is subject to other claims that arise in the

ordinary course of business, some involving claims for substantial damages. The Company records an

estimated liability for these claims when management believes the loss from such matters is probable and

reasonably estimable. The Company reassesses the risk of loss as new information becomes available and

adjusts liabilities as necessary. The actual cost of resolving a claim may be substantially different from

the amount of the liability recorded. Refer to Note 17 to our consolidated financial statements included in

this Annual Report on Form 10-K for a discussion of our legal contingencies.

Certain Transactions

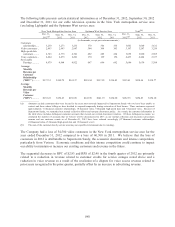

The following transactions occurred during the periods covered by this Management's Discussion and

Analysis of Financial Condition and Results of Operations:

2011 Transactions

On June 30, 2011, we completed the AMC Networks Distribution. As a result of the AMC Networks

Distribution, we no longer consolidate the financial results of AMC Networks for the purpose of our own

financial reporting and the historical financial results of AMC Networks have been reflected in the

Company's consolidated financial statements as discontinued operations for all periods presented through

the AMC Networks Distribution date.

2010 Transactions

On February 9, 2010, we completed the MSG Distribution. As a result of the MSG Distribution, we no

longer consolidate the financial results of Madison Square Garden for the purpose of our own financial

reporting and the historical financial results of Madison Square Garden have been reflected in the

Company's consolidated financial statements as discontinued operations for all periods presented through

the MSG Distribution date.

On December 14, 2010, we completed the acquisition of Bresnan Cable for a purchase price of

$1,364,276. The acquisition was financed using an equity contribution by CSC Holdings of $395,000

(which CSC Holdings borrowed under its revolving loan facility) and debt consisting of an undrawn

$75,000 revolving loan facility, a $765,000 term loan facility and $250,000 8.0% senior notes due 2018.