Cablevision 2012 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

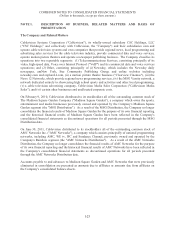

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-25

services is recognized as installations are completed, as direct selling costs have exceeded this revenue in

all periods reported. Advertising revenues are recognized when commercials are aired.

The Company's Newsday business recognizes publication advertising revenue when advertisements are

published. Newsday recognizes circulation revenue for single copy sales as newspapers are distributed,

net of returns. Proceeds from advance billings for home-delivery subscriptions are recorded as deferred

revenue and are recognized as revenue on a pro-rata basis over the term of the subscriptions.

Revenues derived from other sources are recognized when services are provided or events occur.

Multiple-Element Transactions

On January 1, 2011, the Company adopted Accounting Standard Update ("ASU") No. 2009-13, Multiple-

Deliverable Revenue Arrangements, which was applicable on a prospective basis to revenue

arrangements entered into or materially modified on or after January 1, 2011. ASU No. 2009-13

eliminates the residual method of allocating arrangement consideration to deliverables, requires the use of

the relative selling price method and requires that the Company determine its best estimate of selling price

in a manner consistent with that used to determine the price to sell the deliverable on a standalone basis.

For revenue arrangements entered into prior to January 1, 2011, the Company allocated the arrangement

consideration to the separate elements of accounting based on relative fair values, if there was objective

and reliable evidence of fair value for all elements of accounting in a multiple-element arrangement.

There may be cases in which there was objective and reliable evidence of the fair value of undelivered

items in an arrangement but no such evidence for the delivered items. In those cases, the Company

utilized the residual method to allocate the arrangement consideration. Under the residual method, the

amount of consideration allocated to the delivered items equaled the total arrangement consideration less

the aggregate fair value of the undelivered items. In determining fair value, the Company referred to

historical transactions or comparable cash transactions.

Gross Versus Net Revenue Recognition

In the normal course of business, the Company is assessed non-income related taxes by governmental

authorities, including franchising authorities, and collects such taxes from its customers. The Company's

policy is that, in instances where the tax is being assessed directly on the Company, amounts paid to the

governmental authorities and amounts received from the customers are recorded on a gross basis. That is,

amounts paid to the governmental authorities are recorded as technical and operating expenses and

amounts received from the customer are recorded as revenues. For the years ended December 31, 2012,

2011 and 2010, the amount of franchise fees included as a component of net revenue aggregated

$146,060, $147,498, and $134,730, respectively.

Technical and Operating Expenses

Costs of revenue related to sales of services are classified as "technical and operating" expenses in the

accompanying statements of income.

Programming Costs

Programming expenses for the Company's cable television business included in the Telecommunications

Services segment relate to fees paid to programming distributors to license the programming distributed

to subscribers. This programming is acquired generally under multi-year distribution agreements, with