Cablevision 2012 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-40

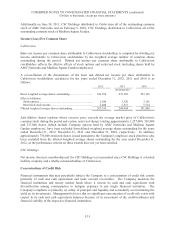

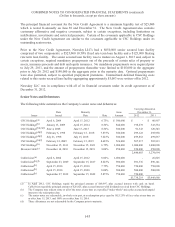

NOTE 10. DEBT

Credit Facility Debt

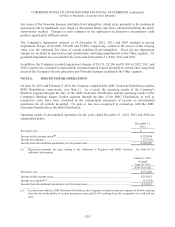

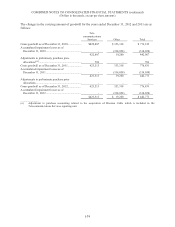

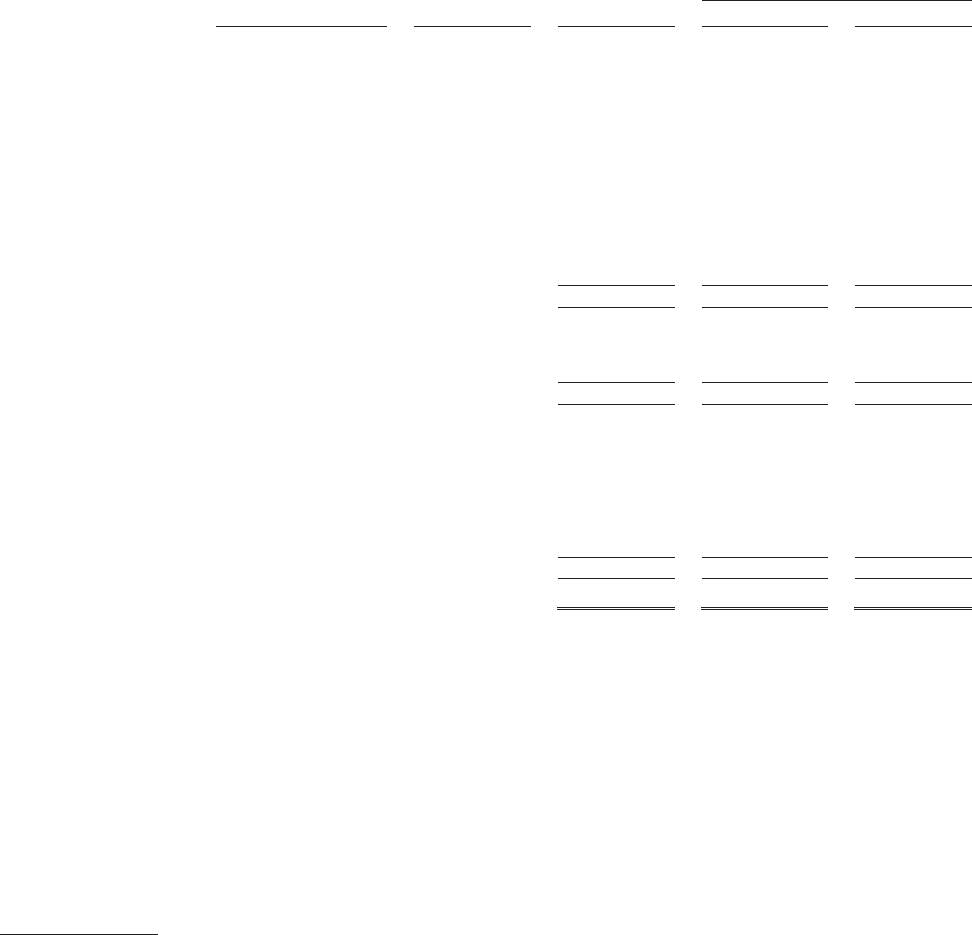

The following table provides details of the Company's outstanding credit facility debt:

Maturity

Interest

Rate at

December 31,

Amounts

Payable on

or prior to

December 31,

Carrying

Value at

December 31,

Date

2012(d) 2013 2012 2011

Restricted Group:

Revolving loan facility(a) .... February 24, 2012 -$ - $ - $ -

Extended revolving loan

facility(b) ......................... March 31, 2015 - - - -

Term A-3 extended loan

facility .............................. March 31, 2015 2.46% 91,067 333,908 400,690

Term A-4 extended loan

facility .............................. December 31, 2016 2.46% 30,000 600,000 600,000

Term B-2 extended loan

facility .............................. March 29, 2016 3.46% 7,483 697,807 1,133,699

Term B-3 extended loan

facility .............................. March 29, 2016 3.21% 16,784 1,632,286 1,649,071

Restricted Group credit facility debt ..................................................... 145,334 3,264,001 3,783,460

Bresnan Cable:

Term loan facility ................ December 14, 2017 4.50% 7,650 744,105 750,734

Revolving loan facility(c) .... December 14, 2015 - - - -

Bresnan Cable credit facility debt ......................................................... 7,650 744,105 750,734

Newsday:

Fixed rate term loan

facility .............................. August 1, 2013 - - - 525,000

Floating rate term loan

facility .............................. August 1, 2013 - - - 125,000

Floating rate term loan

facility .............................. October 12, 2016 3.71% 20,000 650,000 -

Newsday credit facility debt ................................................................. 20,000 650,000 650,000

Total credit facility debt ........................................................................... $172,984 $4,658,106 $5,184,194

________________

(a) On February 24, 2012, this $158,500 undrawn revolving loan facility matured.

(b) At December 31, 2012, $68,025 of the extended revolving loan facility was restricted for certain letters of credit issued on behalf

of CSC Holdings and $1,185,928 of the extended revolving loan facility was undrawn and available, subject to covenant

limitations, to be drawn to meet the net funding and investment requirements of the Restricted Group.

(c) At December 31, 2012, $300 of the revolving loan facility was restricted for certain letters of credit issued on behalf of Bresnan

Cable and $74,700 of the revolving loan facility was undrawn and available, subject to covenant limitations, to be drawn to meet

the net funding and investment requirements of Bresnan Cable.

(d) Includes extension fees, where applicable.

See Note 11 for details relating to interest rate swap contracts outstanding at December 31, 2011.

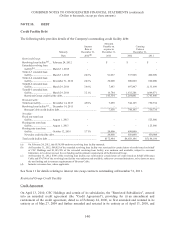

Restricted Group Credit Facility

Credit Agreement

On April 13, 2010, CSC Holdings and certain of its subsidiaries, the "Restricted Subsidiaries", entered

into an amended credit agreement (the "Credit Agreement"), providing for (i) an amendment and

restatement of the credit agreement, dated as of February 24, 2006, as first amended and restated in its

entirety as of May 27, 2009 and further amended and restated in its entirety as of April 13, 2010, and