Cablevision 2012 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-53

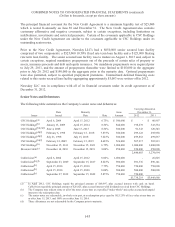

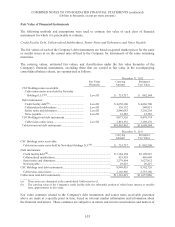

Fair Value of Financial Instruments

The following methods and assumptions were used to estimate fair value of each class of financial

instruments for which it is practicable to estimate:

Credit Facility Debt, Collateralized Indebtedness, Senior Notes and Debentures and Notes Payable

The fair values of each of the Company's debt instruments are based on quoted market prices for the same

or similar issues or on the current rates offered to the Company for instruments of the same remaining

maturities.

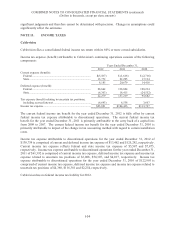

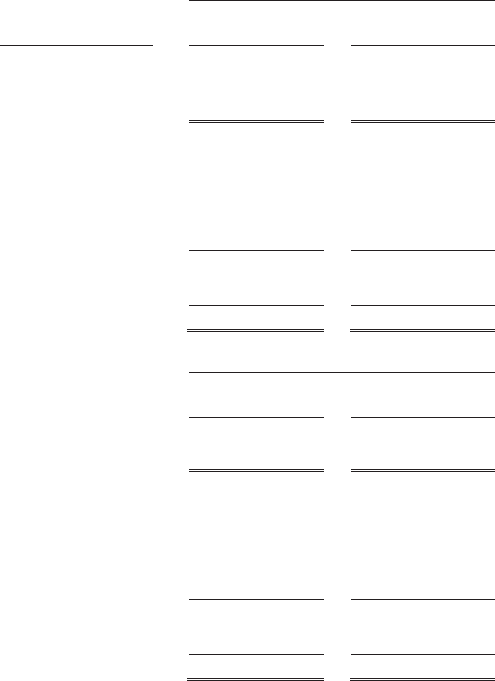

The carrying values, estimated fair values, and classification under the fair value hierarchy of the

Company's financial instruments, excluding those that are carried at fair value in the accompanying

consolidated balance sheets, are summarized as follows:

December 31, 2012

Fair Value

Hierarchy

Carrying

Amount

Estimated

Fair Value

CSC Holdings notes receivable:

Cablevision senior notes held by Newsday

Holdings LLC(a) ................................................... Level II $ 753,717 $ 842,184

Debt instruments:

Credit facility debt(b) ............................................... Level II $ 4,658,106 $ 4,666,700

Collateralized indebtedness ..................................... Level II 556,152 540,831

Senior notes and debentures ..................................... Level II 2,846,683 3,250,258

Notes payable ........................................................... Level II 12,585 12,585

CSC Holdings total debt instruments .......................... 8,073,526 8,470,374

Cablevision senior notes .......................................... Level II 2,891,536 3,198,170

Cablevision total debt instruments .............................. $10,965,062 $11,668,544

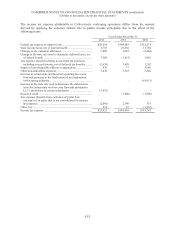

December 31, 2011

Carrying

Amount

Estimated

Fair Value

CSC Holdings notes receivable:

Cablevision senior notes held by Newsday Holdings LLC(a) .........................

.

$ 753,717 $ 802,268

Debt instruments:

Credit facility debt(b) ......................................................................................

.

$ 5,184,194 $5,198,987

Collateralized indebtedness .............................................................................

.

455,938 446,660

Senior notes and debentures ............................................................................

.

3,279,694 3,627,852

Notes payable ..................................................................................................

.

29,227 29,227

CSC Holdings total debt instruments ..................................................................

.

8,949,053 9,302,726

Cablevision senior notes .................................................................................

.

2,166,966 2,355,160

Cablevision total debt instruments ......................................................................

.

$11,116,019 $11,657,886

________________

(a) These notes are eliminated at the consolidated Cablevision level.

(b) The carrying value of the Company's credit facility debt, the substantial portion of which bears interest at variable

rates, approximates its fair value.

Fair value estimates related to the Company's debt instruments and senior notes receivable presented

above are made at a specific point in time, based on relevant market information and information about

the financial instrument. These estimates are subjective in nature and involve uncertainties and matters of