Cablevision 2012 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-54

significant judgments and therefore cannot be determined with precision. Changes in assumptions could

significantly affect the estimates.

NOTE 13. INCOME TAXES

Cablevision

Cablevision files a consolidated federal income tax return with its 80% or more owned subsidiaries.

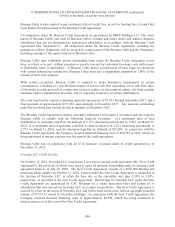

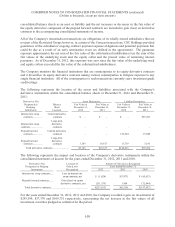

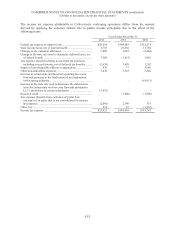

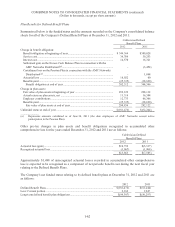

Income tax expense (benefit) attributable to Cablevision's continuing operations consists of the following

components:

Years Ended December 31,

2012 2011 2010

Current expense (benefit):

Federal ................................................................................. $(5,587) $ (1,616) $ (2,716)

State ..................................................................................... 13,772 22,295 17,134

8,185 20,679 14,418

Deferred expense (benefit):

Federal ................................................................................. 28,642 138,804 120,234

State ..................................................................................... (6,363) 18,415 (24,552)

22,279 157,219 95,682

Tax expense (benefit) relating to uncertain tax positions,

including accrued interest ....................................................

.

(6,643) 6,538 3,667

Income tax expense ................................................................. $23,821 $184,436 $113,767

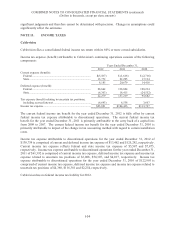

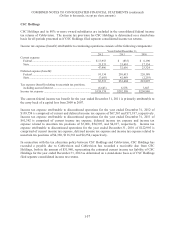

The current federal income tax benefit for the year ended December 31, 2012 is fully offset by current

federal income tax expense attributable to discontinued operations. The current federal income tax

benefit for the year ended December 31, 2011 is primarily attributable to the carry back of a capital loss

from 2009 to 2007. The current federal income tax benefit for the year ended December 31, 2010 is

primarily attributable to impact of the change in tax accounting method with regard to certain installation

costs.

Income tax expense attributable to discontinued operations for the year ended December 31, 2012 of

$138,754 is comprised of current and deferred income tax expense of $13,462 and $125,292, respectively.

Current income tax expense reflects federal and state income tax expense of $5,587 and $7,875,

respectively. Income tax expense attributable to discontinued operations for the year ended December 31,

2011 of $61,392 is comprised of current income tax expense, deferred income tax expense and income tax

expense related to uncertain tax positions of $3,068, $54,307, and $4,017, respectively. Income tax

expense attributable to discontinued operations for the year ended December 31, 2010 of $122,995 is

comprised of current income tax expense, deferred income tax expense and income tax expense related to

uncertain tax positions of $4,360, $116,381 and $2,254, respectively.

Cablevision has no federal income tax liability for 2012.