Cablevision 2012 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-68

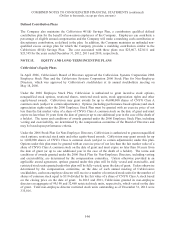

Valuation Assumptions - Stock Options and Stock Appreciation Rights

Cablevision calculates the fair value of each option award on the date of grant and for each stock

appreciation right on the date of grant and at the end of each reporting period using the Black-Scholes

option pricing model. Cablevision's computation of expected life was determined based on historical

experience of similar awards, giving consideration to the contractual terms of the share-based awards and

vesting schedules, or by using the simplified method (the average of the vesting period and option term),

if applicable. The interest rate for periods within the contractual life of the stock option is based on

interest yields for U.S. Treasury instruments in effect at the time of grant. For stock appreciation rights,

the interest rate is based on interest yields for U.S. Treasury instruments in effect at the time of grant and

at the end of each reporting period. Cablevision's computation of expected volatility is based on historical

volatility of its common stock.

In the first quarter of 2012, Cablevision granted options that are scheduled to vest over a two year period

in 50% annual increments and expire 10 years from the date of grant. These options are performance

based and will vest based on the achievement of certain performance criteria. Cablevision calculated the

fair value of each option award on the date of grant using the Black-Scholes option pricing model.

Cablevision's computation of expected life was determined based on the simplified method (the average

of the vesting period and option term) due to the Company's lack of recent historical data for similar

awards. Cablevision has not, in its recent history, granted options with performance criteria or with

similar terms. Additionally, these options were issued subsequent to a change in Cablevision's structure

in connection with the AMC Networks Distribution and the MSG Distribution.

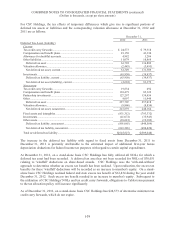

The following assumptions were used to calculate the fair value of stock option awards granted in 2012:

Risk-free interest rate ......................................................................................................................

.

1.14%

Expected life (in years) ...................................................................................................................

.

5.75

Dividend yield .................................................................................................................................

.

3.52%

Volatility ..........................................................................................................................................

.

43.20%

Grant date fair value ........................................................................................................................

.

$4.06

There were no stock options granted during 2011 and 2010.

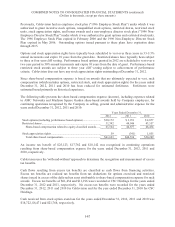

Treatment of Share-Based Payment Awards After the AMC Networks Distribution and MSG Distribution

In connection with the AMC Networks Distribution and MSG Distribution, and as provided for in the

Company's equity plans, each stock option and stock appreciation right ("SAR") outstanding at the

effective date of the AMC Networks Distribution and MSG Distribution became: (i) one option and one

SAR with respect to CNYG Class A Common Stock, (ii) one option and one SAR with respect to AMC

Networks Class A common stock, and (iii) one option and one SAR with respect to Madison Square

Garden Class A common stock. The existing exercise price of each option/SAR was allocated between

the existing Cablevision option/SAR, AMC Networks option/SAR and Madison Square Garden

option/SAR based on the average of the volume weighted average prices of AMC Network's, Madison

Square Garden's and Cablevision's common shares for the ten trading days immediately following the

AMC Networks Distribution and MSG Distribution. The underlying share amount took into account the

1:4 distribution ratio for both the AMC Networks Distribution and MSG Distribution. As a result of these

adjustments, 82.63% of the pre-MSG Distribution exercise price of options/rights was allocated to the

Cablevision options/rights and 17.37% was allocated to the new Madison Square Garden options/rights

and approximately 73.59% of the pre-AMC Networks Distribution exercise price of options/SARs was

allocated to the Cablevision options/SARs and approximately 26.41% was allocated to the new AMC