Cablevision 2012 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-50

consolidated balance sheets as an asset or liability and the net increases or decreases in the fair value of

the equity derivative component of the prepaid forward contracts are included in gain (loss) on derivative

contracts in the accompanying consolidated statements of income.

All of the Company's monetization transactions are obligations of its wholly-owned subsidiaries that are

not part of the Restricted Group; however, in certain of the Comcast transactions, CSC Holdings provided

guarantees of the subsidiaries' ongoing contract payment expense obligations and potential payments that

could be due as a result of an early termination event (as defined in the agreements). The guarantee

exposure approximates the net sum of the fair value of the collateralized indebtedness less the sum of the

fair values of the underlying stock and the equity collar and the present value of remaining interest

payments. As of December 31, 2012, this exposure was zero since the fair value of the underlying stock

and equity collars exceeded the fair value of the collateralized indebtedness.

The Company monitors the financial institutions that are counterparties to its equity derivative contracts

and it diversifies its equity derivative contracts among various counterparties to mitigate exposure to any

single financial institution. All of the counterparties to such transactions currently carry investment grade

credit ratings.

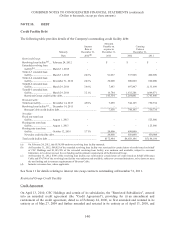

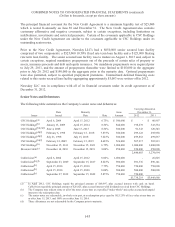

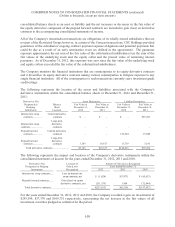

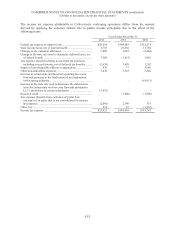

The following represents the location of the assets and liabilities associated with the Company's

derivative instruments within the consolidated balance sheets at December 31, 2012 and December 31,

2011:

Derivatives Not Asset Derivatives Liability Derivatives

Designated as

Hedging

Instruments

Balance

Sheet

Location

Fair Value at

December 31,

2012

Fair Value at

December 31,

2011

Fair Value at

December 31,

2012

Fair Value at

December 31,

2011

Interest rate swap

contracts .............

.

Current derivative

contracts $ - $ - $ - $55,383

Interest rate swap

contracts .................

.

Long-term

derivative

contracts - - - -

Prepaid forward

contracts .............

.

Current derivative

contracts - - 134,524 19,840

Prepaid forward

contracts .............

.

Long-term

derivative

contracts 3,143 18,617 13,739 3,141

Total derivative contracts ........................

.

$3,143 $18,617 $148,263 $78,364

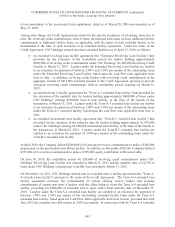

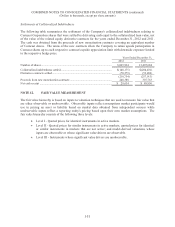

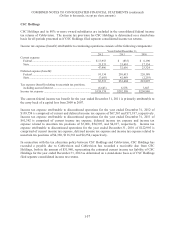

The following represents the impact and location of the Company's derivative instruments within the

consolidated statements of income for the years ended December 31, 2012, 2011 and 2010:

Derivatives Not Location of Amount of Gain (Loss) Recognized

Designated as Hedging Gain (Loss) Years Ended December 31,

Instruments Recognized 2012 2011 2010

Interest rate swap contracts ....

.

Loss on interest rate

swap contracts, net $ (1,828) $(7,973) $ (85,013)

Prepaid forward contracts ......

.

Gain (loss) on equity

derivative contracts, net (211,335) 1,454 (72,044)

Total derivative contracts ........................................................ $(213,163) $(6,519) $(157,057)

For the years ended December 31, 2012, 2011 and 2010, the Company recorded a gain on investments of

$293,599, $37,370 and $109,751 respectively, representing the net increase in the fair values of all

investment securities pledged as collateral for the period.