Cablevision 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

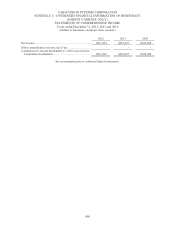

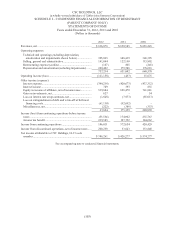

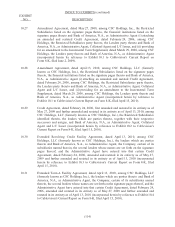

CSC HOLDINGS, LLC

(a wholly-owned subsidiary of Cablevision Systems Corporation)

SCHEDULE I – CONDENSED FINANCIAL INFORMATION OF REGISTRANT

(PARENT COMPANY ONLY)

STATEMENTS OF CASH FLOWS

Years ended December 31, 2012, 2011 and 2010

(Dollars in thousands)

(105)

2012 2011 2010

Cash flows from operating activities:

Income from continuing operations ...........................................

.

$ 186,011 $ 372,654 $ 420,429

Adjustments to reconcile income from continuing operations

to net cash used in operating activities:

Depreciation and amortization (including impairments) ........

.

220,492 179,588 178,618

Equity in income of affiliates, net of income taxes ................

.

(519,644) (696,470) (741,881)

Loss (gain) on investments, net..............................................

.

(627) - (54)

Loss on extinguishment of debt and write-off of deferred

financing costs ...................................................................

.

61,130 92,692 -

Amortization of deferred financing costs, discounts on

indebtedness and other costs ..............................................

.

24,824 31,637 30,308

Share-based compensation expense related to equity

classified awards ................................................................

.

3,259 2,207 2,262

Deferred income taxes ...........................................................

.

(232,902) (203,880) (188,329)

Provision for doubtful accounts .............................................

.

3,497 3,770 4,555

Amounts due to/from Cablevision .........................................

.

34,558 (6,742) 5,332

Amounts due to/from other affiliates .....................................

.

(4,050) (55,072) 15,585

Change in assets and liabilities ..................................................

.

(57,499) (161,893) (32,302)

Net cash used in operating activities ..........................................

.

(280,951) (441,509) (305,477)

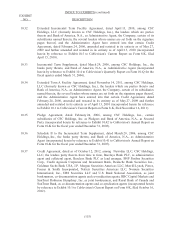

Cash flows from investing activities:

Capital expenditures ..................................................................

.

(311,838) (196,447) (157,728)

Proceeds from sale of equipment, net of costs of disposal ........

.

(1,311) 703 648

Distributions from affiliates .......................................................

.

923,327 1,478,061 787,689

Decrease in other investments ...................................................

.

955 50 133

Additions to other intangible assets ...........................................

.

(1,140) (914) (257)

Net cash provided by investing activities ...............................

.

609,993 1,281,453 630,485

Cash flows from financing activities:

Proceeds from credit facility debt ..............................................

.

- 1,265,000 795,000

Repayment of credit facility debt ...............................................

.

(519,458) (580,651) (514,638)

Proceeds from issuance of senior notes .....................................

.

- 1,000,000 -

Repayment and repurchase of senior notes and debentures,

including tender premiums and fees ......................................

.

(504,501) (1,227,307) -

Principal payments on capital lease obligations ........................

.

(1,608) - -

Capital contributions from Cablevision .....................................

.

735,000 - 5,259

Distributions to Cablevision ......................................................

.

(671,809) (929,947) (556,272)

Additions to deferred financing costs ........................................

.

(738) (25,186) (13,036)

Net cash used in financing activities ......................................

.

(963,114) (498,091) (283,687)

Net increase (decrease) in cash and cash equivalents from

continuing operations ................................................................

.

(634,072) 341,853 41,321

Cash flows of discontinued operations:

Net cash provided by operating activities ..................................

.

346,955 - -

Net increase in cash and cash equivalents from discontinued

operations ..................................................................................

.

346,955 - -

Cash and cash equivalents at beginning of year ............................

.

459,574 117,721 76,400

Cash and cash equivalents at end of year ......................................

.

$ 172,457 $ 459,574 $ 117,721

See accompanying note to condensed financial statements.