Cablevision 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(48)

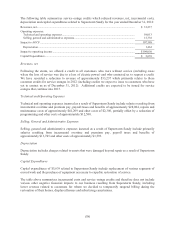

The Company's identifiable indefinite-lived intangible assets that represent over 99% of the total

indefinite-lived intangibles recorded on the consolidated balance sheet at December 31, 2012 are the

Company's cable television franchises and various reporting unit trademarks, which are valued using an

income approach or market approach. The Company's cable television franchises are the largest of the

Company's identifiable indefinite-lived intangible assets and reflect agreements we have with state and

local governments that allow us to construct and operate a cable business within a specified geographic

area. Our cable television franchises are valued using a discounted cash flows ("DCF") methodology.

The DCF methodology used to value cable television franchises entails identifying the projected discrete

cash flows related to such cable television franchises and discounting them back to the valuation date.

The projected discrete cash flows related to such cable television franchises represent the rights to solicit

and the right to service potential customers in the service areas defined by franchise rights currently held

by the Company. Significant judgments inherent in a valuation include the selection of appropriate

discount rates, estimating the amount and timing of estimated future cash flows attributable to the cable

television franchises and identification of appropriate continuing growth rate assumptions. The discount

rates used in the DCF analysis are intended to reflect the risk inherent in the projected future cash flows

generated by the respective intangible assets.

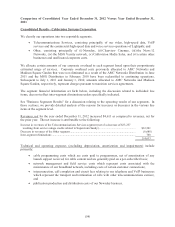

Based on the Company's annual impairment test during the first quarter of 2012, the Company's units of

accounting that represent approximately 57% of the Company's identifiable indefinite-lived intangible

assets have significant safety margins, representing the excess of the identifiable indefinite-lived

intangible assets estimated fair value unit of accounting over their respective carrying values. In order to

evaluate the sensitivity of the fair value calculations of all the Company's identifiable indefinite-lived

intangibles, the Company applied hypothetical 10%, 20% and 30% decreases to the estimated fair value

of each of the Company's identifiable indefinite-lived intangibles. These hypothetical 10%, 20% and

30% decreases in estimated fair value would have resulted in an impairment to the Company's Bresnan

related franchise rights, and the Newsday related trademarks, which had a carrying value of $554,000

(approximately $508,000 related to Bresnan) at the annual impairment test date. The hypothetical fair

value decreases would have resulted in impairment charges of approximately $4,000 at 10%,

approximately $33,000 at 20%, and approximately $98,000 at 30% related to these identifiable indefinite-

lived intangibles.

During the fourth quarter of 2012, 2011 and 2010, the Company recorded an impairment charge of

$13,000, $11,000 and $7,800, respectively, relating to the excess of the carrying value over the estimated

fair value of Newsday's indefinite-lived intangible trademarks.

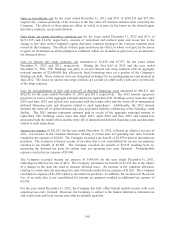

The Company determined the fair value of our Newsday reporting unit based on a weighting of the

estimated fair values determined under the income approach and the market approach. The income

approach utilizes a DCF valuation methodology, which requires the exercise of significant judgments,

including judgments about appropriate discount rates based on the assessment of risks inherent in the

projected future cash flows including the cash flows generated from potential synergies a market

participant may generate, the amount and timing of expected future cash flows, including expected cash

flows beyond the Company's current long-term business planning period, and certain tax benefits the

Company would recognize. The discount rate utilized for the interim impairment assessment was a

consolidated weighted average discount rate of 11.5% at December 31, 2012, 12.5% at December 31,

2011, and 12% at December 31, 2010. The market approach measures fair value using market multiples

of various financial measures compared to a set of comparable publicly traded newspaper publishing

companies and comparable transactions taking into consideration potential synergies a market participant

may generate and requires significant judgments in determining comparable market multiples. The

weighting between the income approach and market approach was weighted more towards the income

approach based on our belief that the income approach was more reliable in the midst of the steep

economic decline impacting the publishing industry, and in view of the fact that there were no recent

observable sales transactions involving the newspaper business. The estimated fair values of Newsday's

indefinite-lived intangibles, which relate primarily to the trademarks associated with its newspaper

mastheads, were based on discounted future cash flows calculated based on the relief-from-royalty