Cablevision 2012 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-37

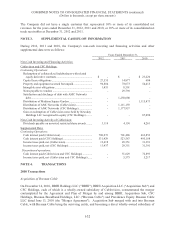

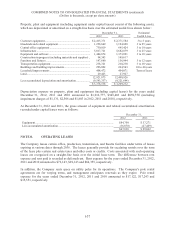

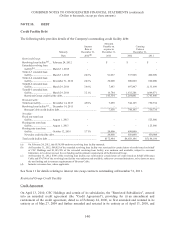

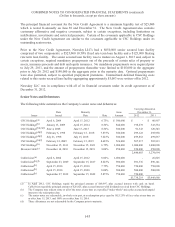

Property, plant and equipment (including equipment under capital leases) consist of the following assets,

which are depreciated or amortized on a straight-line basis over the estimated useful lives shown below:

December 31, Estimated

2012 2011 Useful Lives

Customer equipment ..............................................................

.

$ 2,415,371 $ 2,371,584 3 to 5 years

Headends and related equipment ...........................................

.

1,258,649 1,194,608 3 to 25 years

Central office equipment .......................................................

.

730,019 695,424 3 to 10 years

Infrastructure .........................................................................

.

5,817,721 5,682,079 3 to 25 years

Equipment and software ........................................................

.

1,484,874 1,373,891 3 to 10 years

Construction in progress (including materials and supplies) .

.

94,343 109,617

Furniture and fixtures ............................................................

.

147,880 156,944 3 to 12 years

Transportation equipment ......................................................

.

238,321 210,238 3 to 18 years

Buildings and building improvements ...................................

.

296,802 264,543 10 to 40 years

Leasehold improvements .......................................................

.

408,472 404,071 Term of lease

Land .......................................................................................

.

29,423 27,927

12,921,875 12,490,926

Less accumulated depreciation and amortization ..................

.

(9,543,337) (9,221,694)

$ 3,378,538 $ 3,269,232

Depreciation expense on property, plant and equipment (including capital leases) for the years ended

December 31, 2012, 2011 and 2010 amounted to $1,012,777, $945,403 and $859,750 (including

impairment charges of $1,131, $2,506 and $1,803 in 2012, 2011 and 2010), respectively.

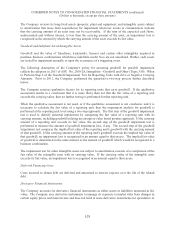

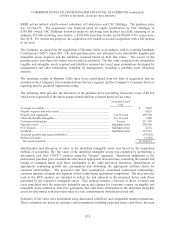

At December 31, 2012 and 2011, the gross amount of equipment and related accumulated amortization

recorded under capital leases were as follows:

December 31,

2012 2011

Equipment ............................................................................................................. $84,700 $ 57,271

Less accumulated amortization ............................................................................. (36,870) (27,409)

$47,830 $ 29,862

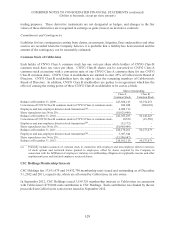

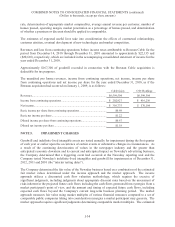

NOTE 8. OPERATING LEASES

The Company leases certain office, production, transmission, and theatre facilities under terms of leases

expiring at various dates through 2036. The leases generally provide for escalating rentals over the term

of the lease plus certain real estate taxes and other costs or credits. Costs associated with such operating

leases are recognized on a straight-line basis over the initial lease term. The difference between rent

expense and rent paid is recorded as deferred rent. Rent expense for the years ended December 31, 2012,

2011 and 2010 amounted to $72,143, $69,143 and $64,355, respectively.

In addition, the Company rents space on utility poles for its operations. The Company's pole rental

agreements are for varying terms, and management anticipates renewals as they expire. Pole rental

expense for the years ended December 31, 2012, 2011 and 2010 amounted to $17,122, $17,243 and

$15,551, respectively.