Berkshire Hathaway 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis (Continued)

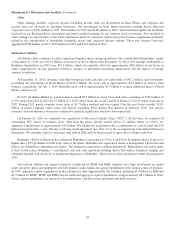

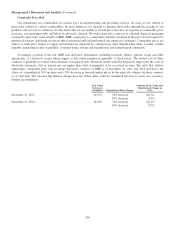

Contractual Obligations (Continued)

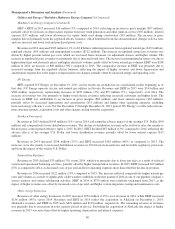

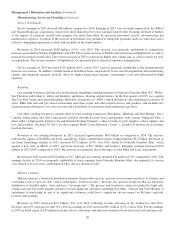

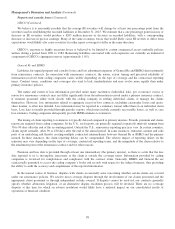

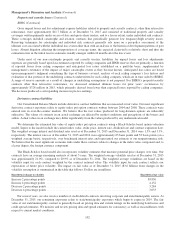

A summary of contractual obligations as of December 31, 2015 follows. Amounts are in millions.

Estimated payments due by period

Total 2016 2017-2018 2019-2020 After 2020

Notes payable and other borrowings, including interest ............. $133,247 $10,197 $21,009 $12,471 $ 89,570

Operating leases ............................................ 8,738 1,347 2,199 1,680 3,512

Purchase obligations (1) ....................................... 39,582 12,152 8,583 5,386 13,461

Losses and loss adjustment expenses (2) .......................... 74,723 15,229 16,448 9,472 33,574

Life, annuity and health insurance benefits (3) ..................... 27,128 1,287 184 357 25,300

Other (4) ................................................... 43,604 32,258 470 1,758 9,118

Total ..................................................... $327,022 $72,470 $48,893 $31,124 $174,535

(1) Primarily obligations of BHE, BNSF and NetJets.

(2) Before reserve discounts of $1,579 million.

(3) Amounts represent estimated undiscounted benefits, net of estimated future premiums, as applicable.

(4) Includes consideration payable in 2016 related to the PCC acquisition.

Critical Accounting Policies

Certain accounting policies require us to make estimates and judgments that affect the amounts reflected in the

Consolidated Financial Statements. Such estimates and judgments necessarily involve varying, and possibly significant, degrees

of uncertainty. Accordingly, certain amounts currently recorded in the financial statements will likely be adjusted in the future

based on new available information and changes in other facts and circumstances.

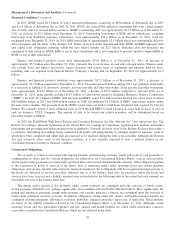

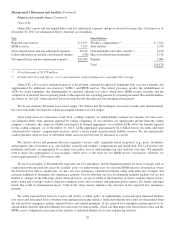

Property and casualty losses

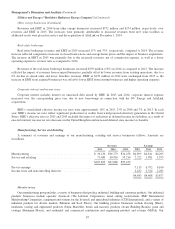

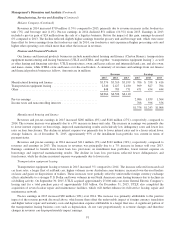

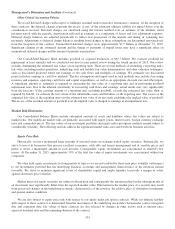

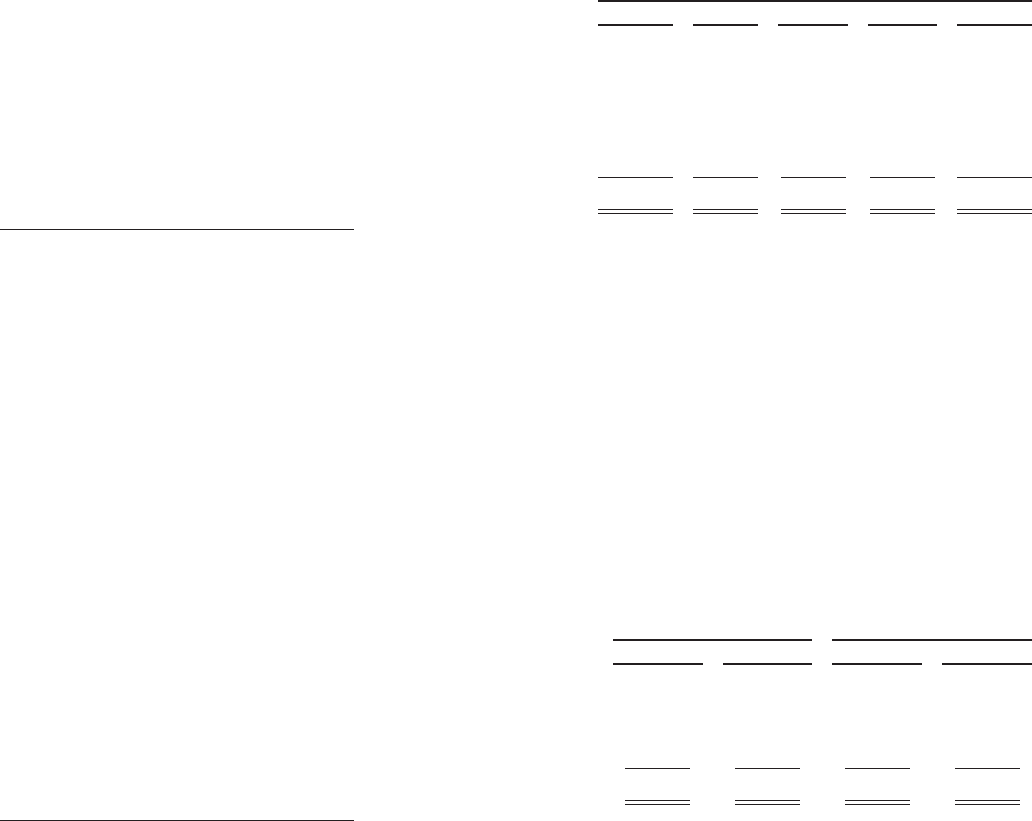

A summary of our consolidated liabilities for unpaid property and casualty losses is presented in the table below. Amounts

are in millions.

Gross unpaid losses Net unpaid losses *

Dec. 31, 2015 Dec. 31, 2014 Dec. 31, 2015 Dec. 31, 2014

GEICO ..................................................... $13,743 $12,207 $12,752 $11,402

General Re .................................................. 14,124 14,790 13,384 14,006

BHRG ..................................................... 35,413 35,916 27,064 27,420

Berkshire Hathaway Primary Group .............................. 9,864 8,564 8,950 7,761

Total ....................................................... $73,144 $71,477 $62,150 $60,589

* Net of reinsurance recoverable and deferred charges on reinsurance assumed.

We record liabilities for unpaid losses and loss adjustment expenses under property and casualty insurance and reinsurance

contracts based upon estimates of the ultimate amounts payable for losses occurring on or before the balance sheet date. Except

for certain workers’ compensation claims, all liabilities for unpaid property and casualty losses (referred to in this section as

“gross unpaid losses”) are reflected in the Consolidated Balance Sheets without discounting for time value. The timing and

amount of ultimate loss payments are contingent upon, among other things, the timing of claim reporting from insureds and

cedants and the final determination of the loss amount through the loss adjustment process. A variety of techniques are used in

establishing these liabilities and all techniques require significant judgments and assumptions. We utilize processes and

techniques that are believed to best suit the underlying claims and available data.

As of any balance sheet date, recorded liabilities include provisions for reported claims (referred to as “case reserves”) and

claims that have not been reported (referred to as incurred but not yet reported (“IBNR”) reserves). The time period between the

loss occurrence date and settlement or payment date is referred to as the “claim-tail.” Property claims usually have fairly short

claim-tails and, absent litigation, are reported and settled within a few years of occurrence. Casualty losses usually have longer

claim-tails, occasionally extending for decades. Casualty claims are more susceptible to litigation and can be significantly

affected by changing contract interpretations. The legal environment and judicial process further contributes to extending claim-

tails.

96