Berkshire Hathaway 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(2) Significant business acquisitions (Continued)

On December 19, 2013, we acquired NV Energy, Inc. (“NV Energy”) for cash consideration of approximately $5.6 billion.

NV Energy is an energy holding company serving approximately 1.2 million electric and 0.2 million retail natural gas customers

in Nevada. NV Energy’s principal operating subsidiaries, Nevada Power Company and Sierra Pacific Power Company, are

regulated utilities.

During the last three years, we also completed several smaller-sized business acquisitions, many of which were considered

as “bolt-on” acquisitions to several of our existing business operations. Aggregate consideration paid for these other business

acquisitions was approximately $1.1 billion in 2015, $1.8 billion in 2014 and $1.1 billion in 2013. We do not believe that these

acquisitions were material, individually or in the aggregate, to our Consolidated Financial Statements.

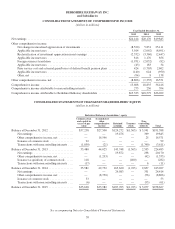

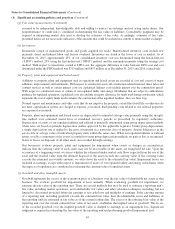

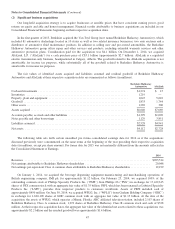

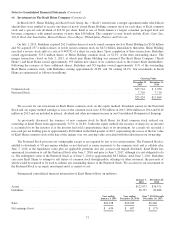

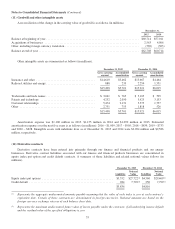

(3) Investments in fixed maturity securities

Investments in securities with fixed maturities as of December 31, 2015 and 2014 are summarized by type below (in

millions).

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

December 31, 2015

U.S. Treasury, U.S. government corporations and agencies ............... $ 3,425 $ 10 $ (8) $ 3,427

States, municipalities and political subdivisions ........................ 1,695 71 (2) 1,764

Foreign governments ............................................. 11,327 226 (85) 11,468

Corporate bonds ................................................. 7,323 632 (29) 7,926

Mortgage-backed securities ........................................ 1,279 168 (5) 1,442

$25,049 $1,107 $(129) $26,027

December 31, 2014

U.S. Treasury, U.S. government corporations and agencies ............... $ 2,921 $ 14 $ (5) $ 2,930

States, municipalities and political subdivisions ........................ 1,820 93 (1) 1,912

Foreign governments ............................................. 12,023 373 (126) 12,270

Corporate bonds ................................................. 7,704 1,072 (5) 8,771

Mortgage-backed securities ........................................ 1,555 202 (4) 1,753

$26,023 $1,754 $(141) $27,636

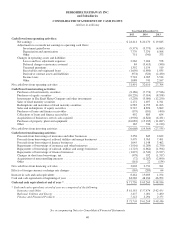

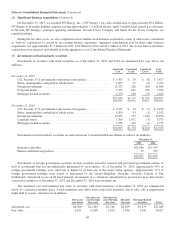

Investments in fixed maturity securities are reflected in our Consolidated Balance Sheets as follows (in millions).

December 31,

2015 2014

Insurance and other ............................................................ $25,988 $27,397

Finance and financial products ................................................... 39 239

$26,027 $27,636

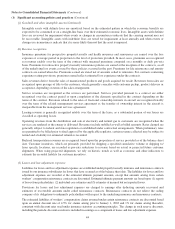

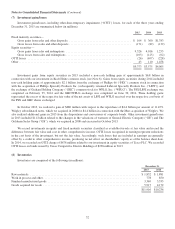

Investments in foreign government securities include securities issued by national and provincial government entities as

well as instruments that are unconditionally guaranteed by such entities. As of December 31, 2015, approximately 94% of

foreign government holdings were rated AA or higher by at least one of the major rating agencies. Approximately 77% of

foreign government holdings were issued or guaranteed by the United Kingdom, Germany, Australia, Canada or The

Netherlands. Unrealized losses on all fixed maturity investments in a continuous unrealized loss position for more than twelve

consecutive months as of December 31, 2015 and December 31, 2014 were insignificant.

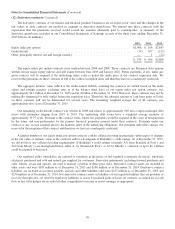

The amortized cost and estimated fair value of securities with fixed maturities at December 31, 2015 are summarized

below by contractual maturity dates. Actual maturities may differ from contractual maturities due to early call or prepayment

rights held by issuers. Amounts are in millions.

Due in one

year or less

Due after one

year through

five years

Due after five

years through

ten years

Due after

ten years

Mortgage-backed

securities Total

Amortized cost .......................... $6,900 $12,483 $1,748 $2,639 $1,279 $25,049

Fair value .............................. 6,921 12,889 1,829 2,946 1,442 26,027

48