Berkshire Hathaway 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

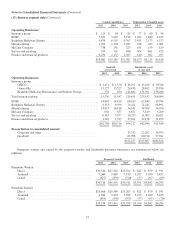

Notes to Consolidated Financial Statements (Continued)

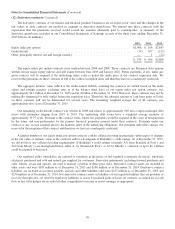

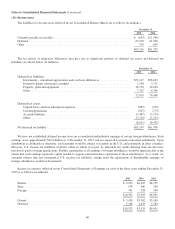

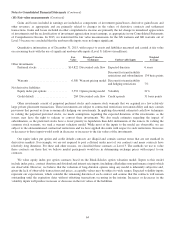

(20) Accumulated other comprehensive income

A summary of the net changes in after-tax accumulated other comprehensive income attributable to Berkshire Hathaway

shareholders and significant amounts reclassified out of accumulated other comprehensive income for each of the three years

ending December 31, 2015 follows (in millions).

Unrealized

appreciation of

investments, net

Foreign

currency

translation

Prior service

and actuarial

gains/losses of

defined benefit

pension plans Other

Accumulated

other

comprehensive

income

Balance at December 31, 2012 ......................... $29,254 $ (120) $(1,601) $ (33) $27,500

Other comprehensive income, net before reclassifications .... 16,379 25 1,534 106 18,044

Reclassifications from accumulated other comprehensive

income .......................................... (1,591) (31) 114 10 (1,498)

Transactions with noncontrolling interests ................ — (20) (1) — (21)

Balance at December 31, 2013 ......................... 44,042 (146) 46 83 44,025

Other comprehensive income, net before reclassifications .... 3,778 (1,877) (1,130) 31 802

Reclassifications from accumulated other comprehensive

income .......................................... (2,184) 66 45 (22) (2,095)

Balance at December 31, 2014 ......................... 45,636 (1,957) (1,039) 92 42,732

Other comprehensive income, net before reclassifications .... (5,522) (2,027) 191 (112) (7,470)

Reclassifications from accumulated other comprehensive

income .......................................... (1,516) 128 86 22 (1,280)

Balance at December 31, 2015 ......................... $38,598 $(3,856) $ (762) $ 2 $33,982

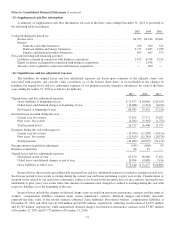

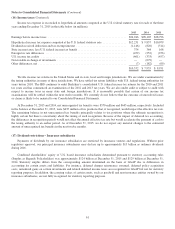

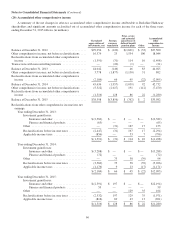

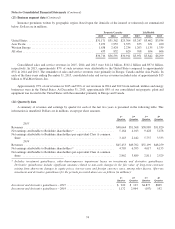

Reclassifications from other comprehensive income into net

earnings:

Year ending December 31, 2013:

Investment gains/losses:

Insurance and other ...................... $(2,382) $ — $ — $ — $ (2,382)

Finance and financial products ............. (65) — — — (65)

Other ..................................... — (31) 167 17 153

Reclassifications before income taxes ............ (2,447) (31) 167 17 (2,294)

Applicable income taxes ...................... (856) — 53 7 (796)

$ (1,591) $ (31) $ 114 $ 10 $ (1,498)

Year ending December 31, 2014:

Investment gains/losses:

Insurance and other ...................... $(3,288) $ — $ — $ — $ (3,288)

Finance and financial products ............. (72) — — — (72)

Other ..................................... — 75 58 (39) 94

Reclassifications before income taxes ............ (3,360) 75 58 (39) (3,266)

Applicable income taxes ...................... (1,176) 9 13 (17) (1,171)

$ (2,184) $ 66 $ 45 $ (22) $ (2,095)

Year ending December 31, 2015:

Investment gains/losses:

Insurance and other ...................... $(2,391) $ 197 $ — $ — $ (2,194)

Finance and financial products ............. 59 — — — 59

Other ..................................... — — 129 35 164

Reclassifications before income taxes ............ (2,332) 197 129 35 (1,971)

Applicable income taxes ...................... (816) 69 43 13 (691)

$ (1,516) $ 128 $ 86 $ 22 $ (1,280)

66