Berkshire Hathaway 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

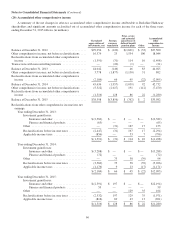

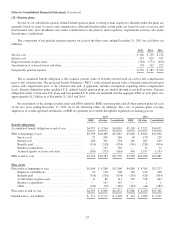

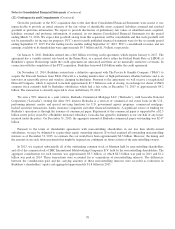

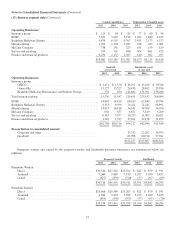

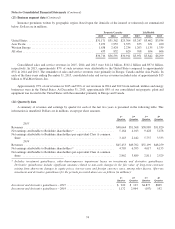

Notes to Consolidated Financial Statements (Continued)

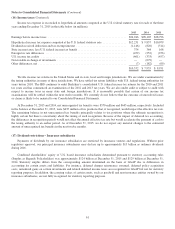

(23) Business segment data

Our operating businesses include a large and diverse group of insurance, finance, manufacturing, service and retailing

businesses. Our reportable business segments are organized in a manner that reflects how management views those business

activities. Certain businesses have been grouped together for segment reporting based upon similar products or product lines,

marketing, selling and distribution characteristics, even though those business units are operated under separate local

management.

The tabular information that follows shows data of reportable segments reconciled to amounts reflected in our

Consolidated Financial Statements. Intersegment transactions are not eliminated from segment results when management

considers those transactions in assessing the results of the respective segments. Furthermore, our management does not consider

investment and derivative gains/losses or amortization of purchase accounting adjustments related to Berkshire’s acquisitions in

assessing the performance of reporting units. Collectively, these items are included in reconciliations of segment amounts to

consolidated amounts.

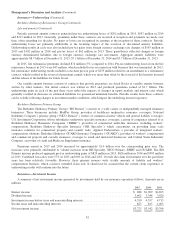

Business Identity Business Activity

GEICO Underwriting private passenger automobile insurance mainly

by direct response methods

General Re Underwriting excess-of-loss, quota-share and facultative

reinsurance worldwide

Berkshire Hathaway Reinsurance Group Underwriting excess-of-loss and quota-share reinsurance for

insurers and reinsurers worldwide

Berkshire Hathaway Primary Group Underwriting multiple lines of property and casualty

insurance policies for primarily commercial accounts

BNSF Operates one of the largest railroad systems in North

America

Berkshire Hathaway Energy Regulated electric and gas utility, including power

generation and distribution activities and real estate

brokerage activities

Manufacturing Manufacturers of numerous products including industrial,

consumer and building products

McLane Company Wholesale distribution of groceries and non-food items

Service and retailing Providers of numerous services including fractional aircraft

ownership programs, aviation pilot training, electronic

components distribution and various retailing businesses,

including automotive dealerships

Finance and financial products Manufactured housing and related consumer financing;

transportation equipment, manufacturing and leasing; and

furniture leasing

71