Berkshire Hathaway 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

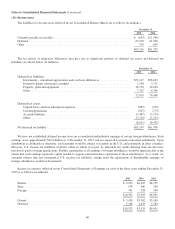

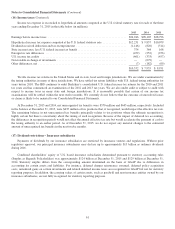

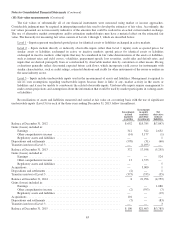

Notes to Consolidated Financial Statements (Continued)

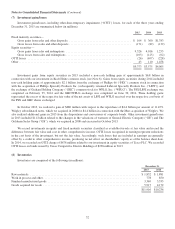

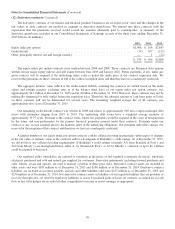

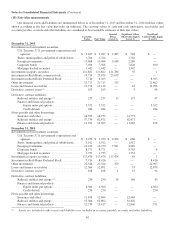

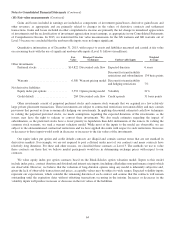

(18) Fair value measurements

Our financial assets and liabilities are summarized below as of December 31, 2015 and December 31, 2014 with fair values

shown according to the fair value hierarchy (in millions). The carrying values of cash and cash equivalents, receivables and

accounts payable, accruals and other liabilities are considered to be reasonable estimates of their fair values.

Carrying

Value Fair Value

Quoted

Prices

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable Inputs

(Level 3)

December 31, 2015

Investments in fixed maturity securities:

U.S. Treasury, U.S. government corporations and

agencies ................................. $ 3,427 $ 3,427 $ 2,485 $ 942 $ —

States, municipalities and political subdivisions . . . 1,764 1,764 — 1,764 —

Foreign governments ........................ 11,468 11,468 9,188 2,280 —

Corporate bonds ............................ 7,926 7,926 — 7,826 100

Mortgage-backed securities ................... 1,442 1,442 — 1,442 —

Investments in equity securities .................... 111,822 111,822 111,786 35 1

Investment in Kraft Heinz common stock ............ 15,714 23,679 23,679 — —

Investment in Kraft Heinz Preferred Stock ........... 7,710 8,363 — — 8,363

Other investments ............................... 21,717 21,717 315 — 21,402

Loans and finance receivables ..................... 12,772 13,112 — 16 13,096

Derivative contract assets (1) ....................... 103 103 — 5 98

Derivative contract liabilities:

Railroad, utilities and energy (1) ................ 237 237 13 177 47

Finance and financial products:

Equity index put options .................. 3,552 3,552 — — 3,552

Credit default .......................... 284 284 — — 284

Notes payable and other borrowings:

Insurance and other .......................... 14,599 14,773 — 14,773 —

Railroad, utilities and energy .................. 57,739 62,471 — 62,471 —

Finance and financial products ................. 11,951 12,363 — 11,887 476

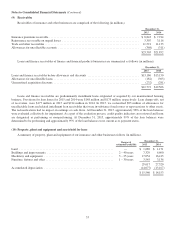

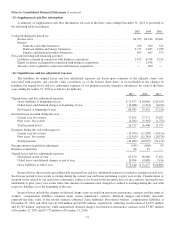

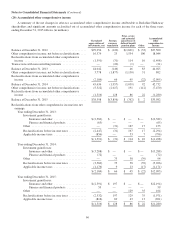

December 31, 2014

Investments in fixed maturity securities:

U.S. Treasury, U.S. government corporations and

agencies ................................. $ 2,930 $ 2,930 $ 2,264 $ 666 $ —

States, municipalities and political subdivisions . . . 1,912 1,912 — 1,912 —

Foreign governments ........................ 12,270 12,270 7,981 4,289 —

Corporate bonds ............................ 8,771 8,771 — 8,763 8

Mortgage-backed securities ................... 1,753 1,753 — 1,753 —

Investments in equity securities .................... 117,470 117,470 117,424 45 1

Investment in Kraft Heinz Preferred Stock ........... 7,710 8,416 — — 8,416

Other investments ............................... 22,324 22,324 329 — 21,995

Loans and finance receivables ..................... 12,566 12,891 — 33 12,858

Derivative contract assets (1) ....................... 108 108 1 13 94

Derivative contract liabilities:

Railroad, utilities and energy (1) ................ 230 230 18 169 43

Finance and financial products:

Equity index put options .................. 4,560 4,560 — — 4,560

Credit default .......................... 250 250 — — 250

Notes payable and other borrowings:

Insurance and other .......................... 11,854 12,484 — 12,484 —

Railroad, utilities and energy .................. 55,306 62,802 — 62,802 —

Finance and financial products ................. 12,730 13,417 — 12,846 571

(1) Assets are included in other assets and liabilities are included in accounts payable, accruals and other liabilities.

62