Berkshire Hathaway 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

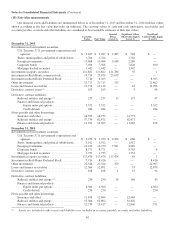

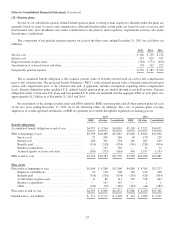

(21) Pension plans

Several of our subsidiaries sponsor defined benefit pension plans covering certain employees. Benefits under the plans are

generally based on years of service and compensation, although benefits under certain plans are based on years of service and

fixed benefit rates. Our subsidiaries may make contributions to the plans to meet regulatory requirements and may also make

discretionary contributions.

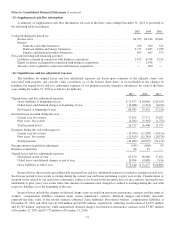

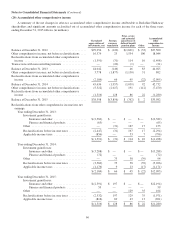

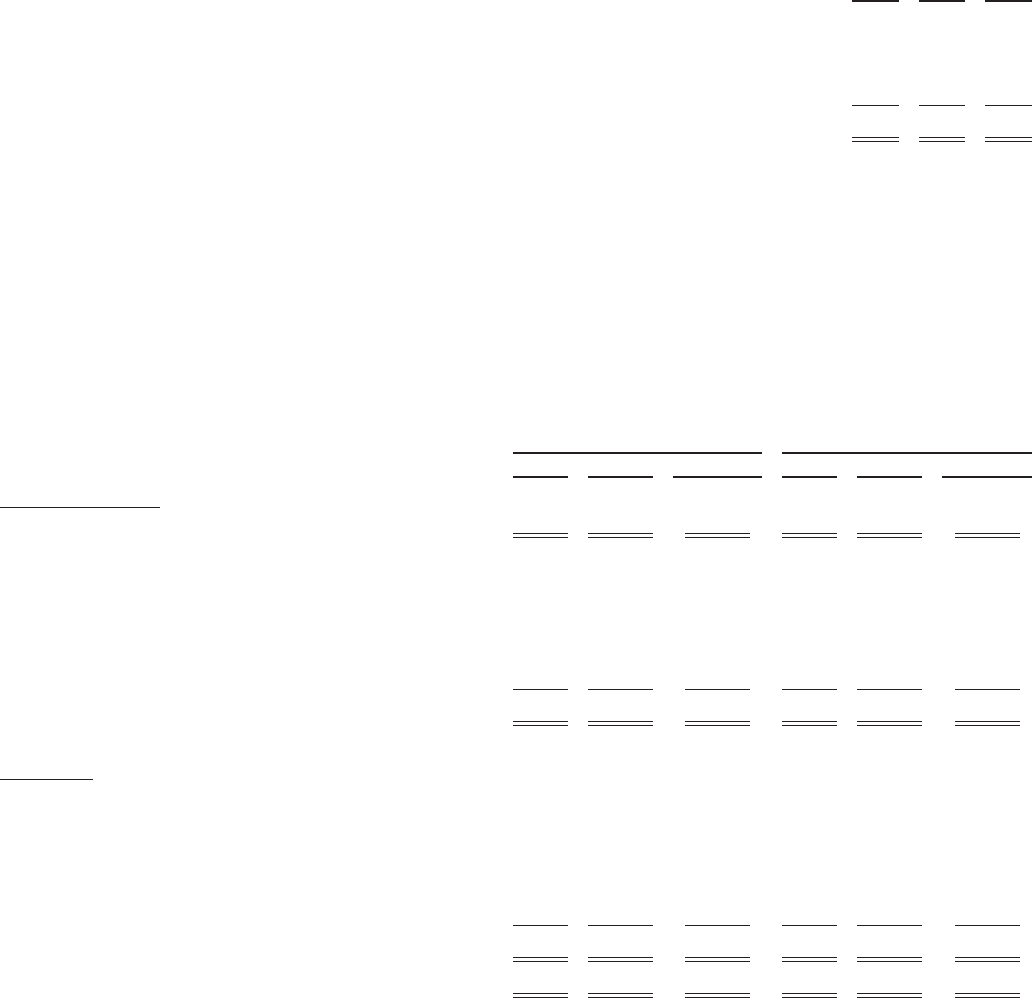

The components of net periodic pension expense for each of the three years ending December 31, 2015 are as follows (in

millions).

2015 2014 2013

Service cost ......................................................................... $266 $230 $254

Interest cost ......................................................................... 591 629 547

Expected return on plan assets .......................................................... (782) (772) (634)

Amortization of actuarial losses and other ................................................. 179 102 225

Net periodic pension expense ........................................................... $254 $189 $392

The accumulated benefit obligation is the actuarial present value of benefits earned based on service and compensation

prior to the valuation date. The projected benefit obligation (“PBO”) is the actuarial present value of benefits earned based upon

service and compensation prior to the valuation date and, if applicable, includes assumptions regarding future compensation

levels. Benefit obligations under qualified U.S. defined benefit pension plans are funded through assets held in trusts. Pension

obligations under certain non-U.S. plans and non-qualified U.S. plans are unfunded and the aggregate PBO of such plans was

approximately $1.2 billion as of December 31, 2015 and 2014.

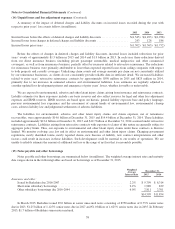

Reconciliations of the changes in plan assets and PBOs related to BHE’s pension plans and all other pension plans for each

of the two years ending December 31, 2015 are in the following tables (in millions). The costs of pension plans covering

employees of certain regulated subsidiaries of BHE are generally recoverable through the regulated rate making process.

2015 2014

BHE All other Consolidated BHE All other Consolidated

Benefit obligations

Accumulated benefit obligation at end of year ............ $4,797 $ 9,264 $14,061 $5,105 $ 9,522 $14,627

PBO at beginning of year ............................ $5,398 $10,489 $15,887 $5,006 $ 8,892 $13,898

Service cost ................................... 57 209 266 60 170 230

Interest cost ................................... 200 391 591 226 403 629

Benefits paid .................................. (316) (518) (834) (310) (524) (834)

Business acquisitions ............................ — 165 165 — 11 11

Actuarial (gains) or losses and other ................ (263) (553) (816) 416 1,537 1,953

PBO at end of year ................................. $5,076 $10,183 $15,259 $5,398 $10,489 $15,887

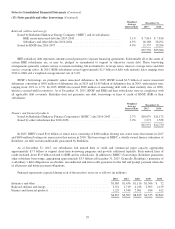

Plan assets

Plan assets at beginning of year ....................... $5,086 $ 8,280 $13,366 $4,888 $ 8,389 $13,277

Employer contributions .......................... 90 116 206 126 122 248

Benefits paid .................................. (316) (518) (834) (310) (524) (834)

Actual return on plan assets ....................... 31 80 111 525 338 863

Business acquisitions ............................ — 167 167 — 1 1

Other ........................................ (126) (59) (185) (143) (46) (189)

Plan assets at end of year ............................. $4,765 $ 8,066 $12,831 $5,086 $ 8,280 $13,366

Funded status – net liability .......................... $ 311 $ 2,117 $ 2,428 $ 312 $ 2,209 $ 2,521

67