Berkshire Hathaway 2015 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

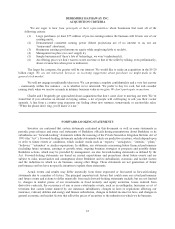

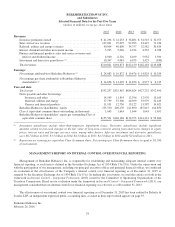

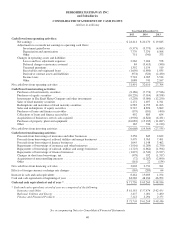

BERKSHIRE HATHAWAY INC.

and Subsidiaries

Selected Financial Data for the Past Five Years

(dollars in millions except per-share data)

2015 2014 2013 2012 2011

Revenues:

Insurance premiums earned ................................. $ 41,294 $ 41,253 $ 36,684 $ 34,545 $ 32,075

Sales and service revenues .................................. 107,001 97,097 92,993 81,447 71,226

Railroad, utilities and energy revenues ........................ 40,004 40,690 34,757 32,582 30,839

Interest, dividend and other investment income ................. 5,235 5,026 4,934 4,532 4,788

Finance and financial products sales and service revenues and

interest and dividend income .............................. 6,940 6,526 6,109 5,932 5,590

Investment and derivative gains/losses (1) ...................... 10,347 4,081 6,673 3,425 (830)

Total revenues ........................................... $210,821 $194,673 $182,150 $162,463 $143,688

Earnings:

Net earnings attributable to Berkshire Hathaway (1) .............. $ 24,083 $ 19,872 $ 19,476 $ 14,824 $ 10,254

Net earnings per share attributable to Berkshire Hathaway

shareholders (2) ......................................... $ 14,656 $ 12,092 $ 11,850 $ 8,977 $ 6,215

Year-end data:

Total assets .............................................. $552,257 $525,867 $484,624 $427,252 $392,490

Notes payable and other borrowings:

Insurance and other ................................... 14,599 11,854 12,396 12,970 13,163

Railroad, utilities and energy ............................ 57,739 55,306 46,399 35,979 32,443

Finance and financial products ........................... 11,951 12,730 13,122 13,587 14,621

Berkshire Hathaway shareholders’ equity ...................... 255,550 240,170 221,890 187,647 164,850

Class A equivalent common shares outstanding, in thousands ...... 1,643 1,643 1,644 1,643 1,651

Berkshire Hathaway shareholders’ equity per outstanding Class A

equivalent common share ................................. $155,501 $146,186 $134,973 $114,214 $ 99,860

(1) Investment gains/losses include other-than-temporary impairment losses. Derivative gains/losses include significant

amounts related to non-cash changes in the fair value of long-term contracts arising from short-term changes in equity

prices, interest rates and foreign currency rates, among other factors. After-tax investment and derivative gains/losses

were $6.7 billion in 2015, $3.3 billion in 2014, $4.3 billion in 2013, $2.2 billion in 2012 and $(521) million in 2011.

(2) Represents net earnings per equivalent Class A common share. Net earnings per Class B common share is equal to 1/1,500

of such amount.

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Management of Berkshire Hathaway Inc. is responsible for establishing and maintaining adequate internal control over

financial reporting, as such term is defined in the Securities Exchange Act of 1934 Rule 13a-15(f). Under the supervision and

with the participation of our management, including our principal executive officer and principal financial officer, we conducted

an evaluation of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2015 as

required by the Securities Exchange Act of 1934 Rule 13a-15(c). In making this assessment, we used the criteria set forth in the

framework in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the

Treadway Commission. Based on our evaluation under the framework in Internal Control – Integrated Framework (2013), our

management concluded that our internal control over financial reporting was effective as of December 31, 2015.

The effectiveness of our internal control over financial reporting as of December 31, 2015 has been audited by Deloitte &

Touche LLP, an independent registered public accounting firm, as stated in their report which appears on page 35.

Berkshire Hathaway Inc.

February 26, 2016

34