Berkshire Hathaway 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

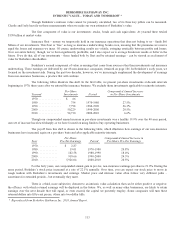

Management’s Discussion and Analysis (Continued)

Equity Price Risk (Continued)

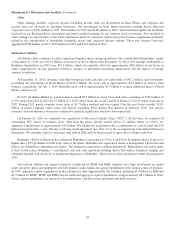

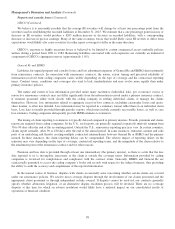

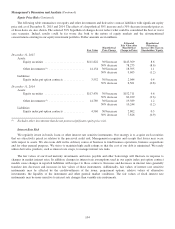

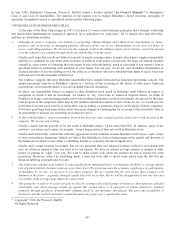

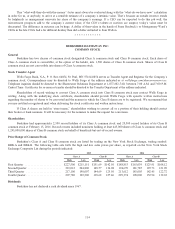

The following table summarizes our equity and other investments and derivative contract liabilities with significant equity

price risk as of December 31, 2015 and 2014. The effects of a hypothetical 30% increase and a 30% decrease in market prices as

of those dates are also shown. The selected 30% hypothetical changes do not reflect what could be considered the best or worst

case scenarios. Indeed, results could be far worse due both to the nature of equity markets and the aforementioned

concentrations existing in our equity investment portfolio. Dollar amounts are in millions.

Fair Value

Hypothetical

Price Change

Estimated

Fair Value after

Hypothetical

Change in Prices

Hypothetical

Percentage

Increase (Decrease) in

Shareholders’ Equity

December 31, 2015

Assets:

Equity securities ........................... $111,822 30%increase $145,369 8.6

30% decrease 78,275 (8.6)

Other investments (1) ........................ 14,154 30%increase 18,395 1.1

30% decrease 9,605 (1.2)

Liabilities:

Equity index put option contracts .............. 3,552 30%increase 2,044 0.4

30% decrease 6,561 (0.8)

December 31, 2014

Assets:

Equity securities ........................... $117,470 30%increase $152,711 9.6

30% decrease 82,229 (9.6)

Other investments (1) ........................ 14,789 30%increase 19,389 1.2

30% decrease 10,244 (1.2)

Liabilities:

Equity index put option contracts .............. 4,560 30%increase 2,802 0.5

30% decrease 7,826 (0.9)

(1) Excludes other investments that do not possess significant equity price risk.

Interest Rate Risk

We regularly invest in bonds, loans or other interest rate sensitive instruments. Our strategy is to acquire such securities

that are attractively priced in relation to the perceived credit risk. Management recognizes and accepts that losses may occur

with respect to assets. We also issue debt in the ordinary course of business to fund business operations, business acquisitions

and for other general purposes. We strive to maintain high credit ratings so that the cost of our debt is minimized. We rarely

utilize derivative products, such as interest rate swaps, to manage interest rate risks.

The fair values of our fixed maturity investments and notes payable and other borrowings will fluctuate in response to

changes in market interest rates. In addition, changes in interest rate assumptions used in our equity index put option contract

models cause changes in reported liabilities with respect to those contracts. Increases and decreases in interest rates generally

translate into decreases and increases in fair values of those instruments. Additionally, fair values of interest rate sensitive

instruments may be affected by the creditworthiness of the issuer, prepayment options, relative values of alternative

investments, the liquidity of the instrument and other general market conditions. The fair values of fixed interest rate

instruments may be more sensitive to interest rate changes than variable rate instruments.

104