Berkshire Hathaway 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

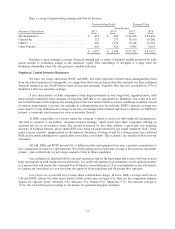

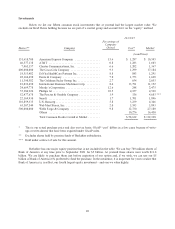

Manufacturing, Service and Retailing Operations

Our activities in this part of Berkshire cover the waterfront. Let’s look, though, at a summary balance sheet

and earnings statement for the entire group.

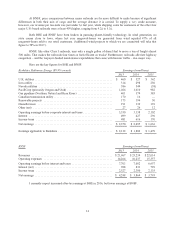

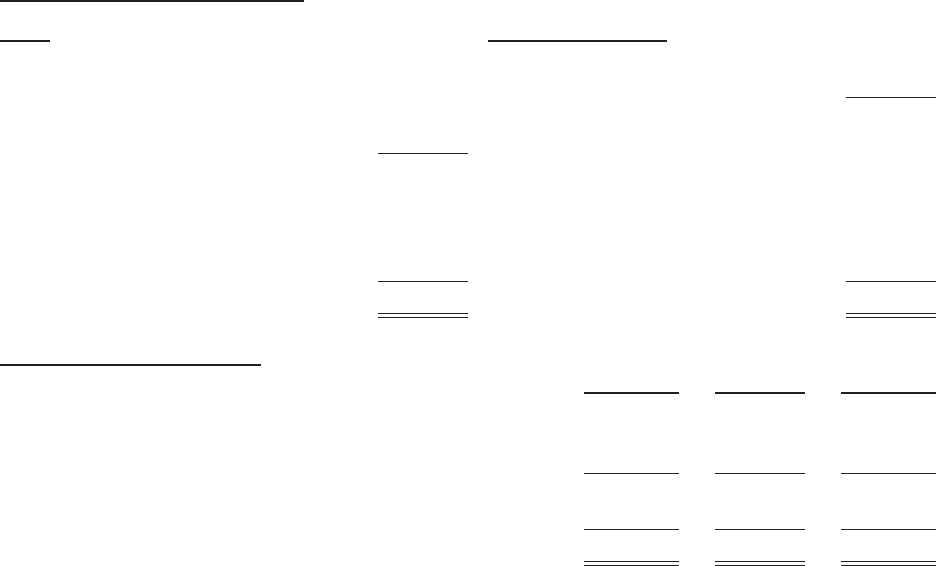

Balance Sheet 12/31/15 (in millions)

Assets Liabilities and Equity

Cash and equivalents .................. $ 6,807 Notes payable ...................... $ 2,135

Accounts and notes receivable ........... 8,886 Other current liabilities ............... 10,565

Inventory ............................ 11,916 Total current liabilities ............... 12,700

Other current assets ................... 970

Total current assets .................... 28,579

Deferred taxes ...................... 3,649

Goodwill and other intangibles .......... 30,289 Term debt and other liabilities ......... 4,767

Fixed assets .......................... 15,161 Non-controlling interests ............. 521

Other assets .......................... 4,445 Berkshire equity .................... 56,837

$ 78,474 $ 78,474

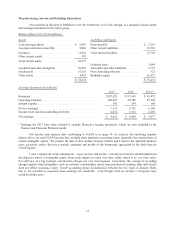

Earnings Statement (in millions)

2015 2014 2013*

Revenues ............................................... $107,825 $ 97,689 $ 93,472

Operating expenses ....................................... 100,607 90,788 87,208

Interest expense ......................................... 103 109 104

Pre-tax earnings ......................................... 7,115 6,792 6,160

Income taxes and non-controlling interests .................... 2,432 2,324 2,283

Net earnings ............................................ $ 4,683 $ 4,468 $ 3,877

* Earnings for 2013 have been restated to exclude Marmon’s leasing operations, which are now included in the

Finance and Financial Products results.

Our income and expense data conforming to GAAP is on page 38. In contrast, the operating expense

figures above are non-GAAP because they exclude some purchase-accounting items (primarily the amortization of

certain intangible assets). We present the data in this manner because Charlie and I believe the adjusted numbers

more accurately reflect the true economic expenses and profits of the businesses aggregated in the table than do

GAAP figures.

I won’t explain all of the adjustments – some are tiny and arcane – but serious investors should understand

the disparate nature of intangible assets. Some truly deplete in value over time, while others in no way lose value.

For software, as a big example, amortization charges are very real expenses. Conversely, the concept of recording

charges against other intangibles, such as customer relationships, arises from purchase-accounting rules and clearly

does not reflect economic reality. GAAP accounting draws no distinction between the two types of charges. Both,

that is, are recorded as expenses when earnings are calculated – even though, from an investor’s viewpoint, they

could not differ more.

15