Berkshire Hathaway 2015 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A personal thank-you: The PCC acquisition would not have happened without the input and assistance of

our own Todd Combs, who brought the company to my attention a few years ago and went on to educate

me about both the business and Mark. Though Todd and Ted Weschler are primarily investment managers

– they each handle about $9 billion for us – both of them cheerfully and ably add major value to Berkshire

in other ways as well. Hiring these two was one of my best moves.

‹With the PCC acquisition, Berkshire will own 10

1

⁄

4

companies that would populate the Fortune 500 if they

were stand-alone businesses. (Our 27% holding of Kraft Heinz is the

1

⁄

4

.) That leaves just under 98% of

America’s business giants that have yet to call us. Operators are standing by.

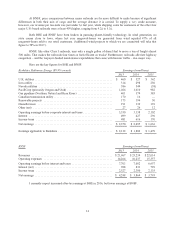

‹Our many dozens of smaller non-insurance businesses earned $5.7 billion last year, up from $5.1 billion in

2014. Within this group, we have one company that last year earned more than $700 million, two that

earned between $400 million and $700 million, seven that earned between $250 million and $400 million,

six that earned between $100 million and $250 million, and eleven that earned between $50 million and

$100 million. We love them all: This collection of businesses will expand both in number and earnings as

the years go by.

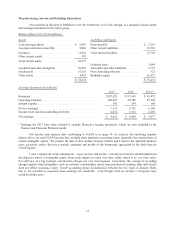

‹When you hear talk about America’s crumbling infrastructure, rest assured that they’re not talking about

Berkshire. We invested $16 billion in property, plant and equipment last year, a full 86% of it deployed in

the United States.

I told you earlier about BNSF’s record capital expenditures in 2015. At the end of every year, our railroad’s

physical facilities will be improved from those existing twelve months earlier.

Berkshire Hathaway Energy (“BHE”) is a similar story. That company has invested $16 billion in

renewables and now owns 7% of the country’s wind generation and 6% of its solar generation. Indeed, the

4,423 megawatts of wind generation owned and operated by our regulated utilities is six times the

generation of the runner-up utility.

We’re not done. Last year, BHE made major commitments to the future development of renewables in

support of the Paris Climate Change Conference. Our fulfilling those promises will make great sense, both

for the environment and for Berkshire’s economics.

‹Berkshire’s huge and growing insurance operation again operated at an underwriting profit in 2015 – that

makes 13 years in a row – and increased its float. During those years, our float – money that doesn’t belong

to us but that we can invest for Berkshire’s benefit – grew from $41 billion to $88 billion. Though neither

that gain nor the size of our float is reflected in Berkshire’s earnings, float generates significant investment

income because of the assets it allows us to hold.

Meanwhile, our underwriting profit totaled $26 billion during the 13-year period, including $1.8 billion

earned in 2015. Without a doubt, Berkshire’s largest unrecorded wealth lies in its insurance business.

We’ve spent 48 years building this multi-faceted operation, and it can’t be replicated.

‹While Charlie and I search for new businesses to buy, our many subsidiaries are regularly making bolt-on

acquisitions. Last year we contracted for 29 bolt-ons, scheduled to cost $634 million in aggregate. The cost

of these purchases ranged from $300,000 to $143 million.

Charlie and I encourage bolt-ons, if they are sensibly-priced. (Most deals offered us most definitely aren’t.)

These purchases deploy capital in operations that fit with our existing businesses and that will be managed

by our corps of expert managers. That means no additional work for us, yet more earnings for Berkshire, a

combination we find highly appealing. We will make many dozens of bolt-on deals in future years.

5