Berkshire Hathaway 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Of course, a business with terrific economics can be a bad investment if it is bought at too high a price. We

have paid substantial premiums to net tangible assets for most of our businesses, a cost that is reflected in the large

figure we show for goodwill and other intangibles. Overall, however, we are getting a decent return on the capital

we have deployed in this sector. Earnings from the group should grow substantially in 2016 as Duracell and

Precision Castparts enter the fold.

************

We have far too many companies in this group to comment on them individually. Moreover, their

competitors – both current and potential – read this report. In a few of our businesses we might be disadvantaged if

others knew our numbers. In some of our operations that are not of a size material to an evaluation of Berkshire,

therefore, we only disclose what is required. You can nevertheless find a good bit of detail about many of our

operations on pages 88-91.

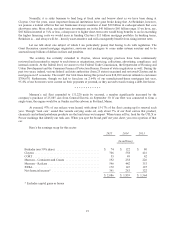

Finance and Financial Products

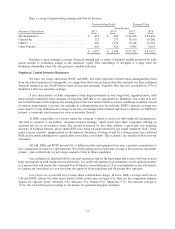

Our three leasing and rental operations are conducted by CORT (furniture), XTRA (semi-trailers), and

Marmon (primarily tank cars but also freight cars, intermodal tank containers and cranes). These companies are

industry leaders and have substantially increased their earnings as the American economy has gained strength. At

each of the three, we have invested more money in new equipment than have many of our competitors, and that’s

paid off. Dealing from strength is one of Berkshire’s enduring advantages.

Kevin Clayton has again delivered an industry-leading performance at Clayton Homes, the second-largest

home builder in America. Last year, the company sold 34,397 homes, about 45% of the manufactured homes bought

by Americans. In contrast, the company was number three in the field, with a 14% share, when Berkshire purchased

it in 2003.

Manufactured homes allow the American dream of home ownership to be achieved by lower-income

citizens: Around 70% of new homes costing $150,000 or less come from our industry. About 46% of Clayton’s

homes are sold through the 331 stores we ourselves own and operate. Most of Clayton’s remaining sales are made to

1,395 independent retailers.

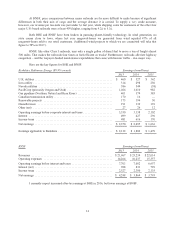

Key to Clayton’s operation is its $12.8 billion mortgage portfolio. We originate about 35% of all

mortgages on manufactured homes. About 37% of our mortgage portfolio emanates from our retail operation, with

the balance primarily originated by independent retailers, some of which sell our homes while others market only

the homes of our competitors.

Lenders other than Clayton have come and gone. With Berkshire’s backing, however, Clayton steadfastly

financed home buyers throughout the panic days of 2008-2009. Indeed, during that period, Clayton used precious

capital to finance dealers who did not sell our homes. The funds we supplied to Goldman Sachs and General Electric

at that time produced headlines; the funds Berkshire quietly delivered to Clayton both made home ownership

possible for thousands of families and kept many non-Clayton dealers alive.

Our retail outlets, employing simple language and large type, consistently inform home buyers of

alternative sources for financing – most of it coming from local banks – and always secure acknowledgments from

customers that this information has been received and read. (The form we use is reproduced in its actual size on

page 119.)

17