Berkshire Hathaway 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis (Continued)

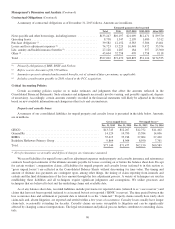

Other

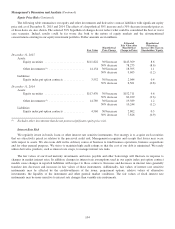

Other earnings includes corporate income (including income from our investments in Kraft Heinz) and expenses and

income taxes not allocated to operating businesses. Our investments in Kraft Heinz generated earnings before allocated

corporate taxes of $730 million in 2015, $694 million in 2014 and $146 million in 2013, which included significant dividends

received on our Preferred Stock investment and equity method earnings on our common stock investment. Also included in

other earnings are amortization of fair value adjustments made in connection with several prior business acquisitions (primarily

related to the amortization of identifiable intangible assets) and corporate interest expense. These two charges (after-tax)

aggregated $708 million in 2015, $682 million in 2014 and $514 million in 2013.

Financial Condition

Our balance sheet continues to reflect significant liquidity and a strong capital base. Our consolidated shareholders’ equity

at December 31, 2015 was $255.6 billion, an increase of $15.4 billion since December 31, 2014. Net earnings attributable to

Berkshire shareholders in 2015 were $24.1 billion, which was partially offset by approximately $8.8 billion of net losses in

other comprehensive income primarily related to changes in unrealized investment appreciation and the impact of foreign

currency translation.

At December 31, 2015, insurance and other businesses held cash and cash equivalents of $61.2 billion, and investments

(excluding our investments in Kraft Heinz) of $152.2 billion. We used cash of approximately $4.9 billion in 2015 to fund

business acquisitions. On July 1, 2015, Berkshire used cash of approximately $5.3 billion to acquire additional shares of Kraft

Heinz common stock.

In 2015, Berkshire Hathaway parent company issued €3.0 billion in senior unsecured notes consisting of €750 million of

0.75% senior notes due in 2023, €1.25 billion of 1.125% senior notes due in 2027 and €1.0 billion of 1.625% senior notes due in

2035. During 2015, parent company senior notes of $1.7 billion matured and were repaid. Over the next twelve months, $1.05

billion of parent company senior notes will mature, including $300 million that matured in February 2016. Our various

insurance and non-insurance businesses continued to generate significant cash flows from operations.

On January 29, 2016 we completed our acquisition of Precision Castparts Corp. (“PCC”). At that time, we acquired all

outstanding PCC shares of common stock, other than the shares already owned (about 2.7 million shares or 1.96%), for

aggregate consideration of approximately $32 billion. We funded the acquisition with a combination of cash on hand and $10

billion borrowed under a new 364-day revolving credit agreement. See Note 22 to the accompanying Consolidated Financial

Statements. We currently expect to issue new term debt in 2016 and use the proceeds to repay the revolving credit loan.

Berkshire’s Board of Directors has authorized Berkshire to repurchase its Class A and Class B common shares at prices no

higher than a 20% premium over the book value of the shares. Berkshire may repurchase shares at management’s discretion and

there is no obligation to repurchase any shares. The program is expected to continue indefinitely. Repurchases will not be made

if they would reduce Berkshire’s consolidated cash and cash equivalent holdings below $20 billion. Financial strength and

redundant liquidity will always be of paramount importance at Berkshire. There were no share repurchases under the program in

2015.

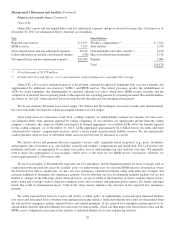

Our railroad, utilities and energy businesses (conducted by BNSF and BHE) maintain very large investments in capital

assets (property, plant and equipment) and will regularly make significant capital expenditures in the normal course of business.

In 2015, aggregate capital expenditures of these businesses were approximately $11.6 billion, including $5.9 billion by BHE and

$5.7 billion by BNSF. BNSF and BHE forecast additional aggregate capital expenditures of approximately $8.7 billion in 2016.

Future capital expenditures are expected to be funded from cash flows from operations and debt issuances.

94