Berkshire Hathaway 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

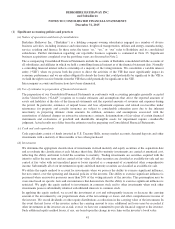

(1) Significant accounting policies and practices (Continued)

(s) Income taxes (Continued)

Assets and liabilities are established for uncertain tax positions taken or positions expected to be taken in income tax

returns when such positions, in our judgment, do not meet a “more-likely-than-not” threshold based on the technical

merits of the positions. Estimated interest and penalties related to uncertain tax positions are generally included as a

component of income tax expense.

(t) New accounting pronouncements adopted in 2015

In April 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”)

2014-08 “Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity.” ASU 2014-

08 requires that a disposal of components of an entity (or groups of components) be reported as discontinued

operations if the disposal represents a strategic shift that will have a major effect on the reporting entity’s operations

and financial results. ASU 2014-08 is effective for disposals of components occurring after December 15, 2014 and its

adoption did not have a material effect on our Consolidated Financial Statements.

In April 2015, the FASB issued ASU 2015-03 “Interest – Imputation of Interest,” which requires that debt issuance

costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying

amount of the debt liability, instead of as an asset. The recognition and measurement guidance for debt issuance costs

under current GAAP is not affected by this pronouncement. We adopted ASU 2015-03 as of December 31, 2015 and

the impact was not material to our Consolidated Financial Statements.

(u) New accounting pronouncements to be adopted subsequent to December 31, 2015

In May 2014, the FASB issued ASU 2014-09 “Revenue from Contracts with Customers.” ASU 2014-09 applies to

contracts with customers, excluding, most notably, insurance and leasing contracts. ASU 2014-09 prescribes a

framework in accounting for revenues from contracts within its scope, including (a) identifying the contract,

(b) identifying the performance obligations under the contract, (c) determining the transaction price, (d) allocating the

transaction price to the identified performance obligations and (e) recognizing revenues as the identified performance

obligations are satisfied. ASU 2014-09 also prescribes additional disclosures and financial statement presentations.

ASU 2014-09 is currently effective for reporting periods beginning after December 15, 2017, with early adoption

permitted for reporting periods beginning after December 15, 2016. ASU 2014-09 may be adopted retrospectively or

under a modified retrospective method where the cumulative effect is recognized at the date of initial application. Our

evaluation of ASU 2014-09 is ongoing and not complete. Further, the FASB may issue interpretative guidance in the

future, which may cause our evaluation to change. While we currently anticipate some relatively minor changes to

revenue recognition for certain aspects of customer contracts, we currently do not anticipate ASU 2014-09 will have a

material effect on our Consolidated Financial Statements.

In May 2015, the FASB issued ASU 2015-09 “Financial Services – Insurance – Disclosures about Short-Duration

Contracts,” which requires additional disclosures in annual and interim reporting periods by insurance entities

regarding liabilities for unpaid claims and claim adjustment expenses, and changes in assumptions or methodologies

for calculating such liabilities. ASU 2015-09 is effective for annual periods beginning after December 15, 2015 and

interim periods beginning after December 15, 2016. We are currently evaluating the effect adopting this standard will

have on our Consolidated Financial Statements.

In January 2016, the FASB issued ASU 2016-01 “Financial Instruments – Recognition and Measurement of Financial

Assets and Financial Liabilities.” Among its provisions, ASU 2016-01 generally requires that equity investments

(excluding equity method investments) be measured at fair value with changes in fair value recognized in net income.

ASU 2016-01 also modifies certain disclosure requirements related to financial assets and liabilities. Under existing

GAAP, changes in fair value of available-for-sale equity investments are recorded in other comprehensive income.

Given the magnitude of equity investments that we currently own, the adoption of ASU 2016-01 will likely have a

significant impact on Berkshire’s periodic net earnings reported in the Consolidated Statement of Earnings. However,

the adoption of ASU 2016-01 will not produce a significant impact on our comprehensive income or shareholders’

equity. ASU 2016-01 is effective for annual and interim periods beginning after December 15, 2017 with the

cumulative effect of the adoption made to the balance sheet as of the date of adoption. Thus, the initial adoption will

result in a reclassification of the related accumulated unrealized appreciation, net of applicable deferred income taxes,

currently included in accumulated other comprehensive income to retained earnings, resulting in no impact on our

comprehensive income or Berkshire shareholders’ equity.

46