Berkshire Hathaway 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis (Continued)

Commodity Price Risk

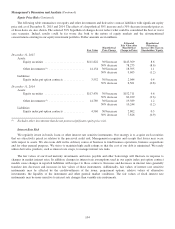

Our subsidiaries use commodities in various ways in manufacturing and providing services. As such, we are subject to

price risks related to various commodities. In most instances, we attempt to manage these risks through the pricing of our

products and services to customers. To the extent that we are unable to sustain price increases in response to commodity price

increases, our operating results will likely be adversely affected. We utilize derivative contracts to a limited degree in managing

commodity price risks, most notably at BHE. BHE’s exposures to commodities include variations in the price of fuel required to

generate electricity, wholesale electricity that is purchased and sold and natural gas supply for customers. Commodity prices are

subject to wide price swings as supply and demand are impacted by, among many other unpredictable items, weather, market

liquidity, generating facility availability, customer usage, storage and transmission and transportation constraints.

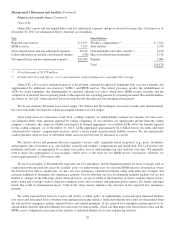

To mitigate a portion of the risk, BHE uses derivative instruments, including forwards, futures, options, swaps and other

agreements, to effectively secure future supply or sell future production generally at fixed prices. The settled cost of these

contracts is generally recovered from customers in regulated rates. Financial results would be negatively impacted if the costs of

wholesale electricity, fuel or natural gas are higher than what is permitted to be recovered in rates. The table that follows

summarizes commodity price risk on energy derivative contracts of BHE as of December 31, 2015 and 2014 and shows the

effects of a hypothetical 10% increase and a 10% decrease in forward market prices by the expected volumes for these contracts

as of each date. The selected hypothetical change does not reflect what could be considered the best or worst case scenarios.

Dollars are in millions.

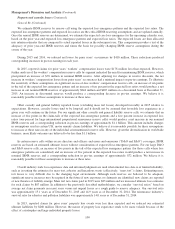

Fair Value

Net Assets

(Liabilities) Hypothetical Price Change

Estimated Fair Value after

Hypothetical Change in

Price

December 31, 2015 .................................... $(233) 10% increase $(152)

10% decrease (313)

December 31, 2014 .................................... $(192) 10% increase $(111)

10% decrease (272)

106