Berkshire Hathaway 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements (Continued)

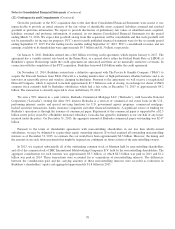

(22) Contingencies and Commitments (Continued)

Given the proximity of the PCC acquisition date to the date these Consolidated Financial Statements were issued, it was

impracticable to provide an initial estimate of the fair values of identifiable assets acquired, liabilities assumed and residual

goodwill or proforma information. We expect to provide disclosures of preliminary fair values of identified assets acquired,

liabilities assumed and proforma information, if material, in our interim Consolidated Financial Statements for the period

ending March 31, 2016. We expect that goodwill arising from this acquisition will be considerable and that such goodwill will

not be amortizable for income tax purposes. PCC’s most recently published financial statements were for the six month period

ending September 27, 2015. For the trailing twelve months ending September 27, 2015, PCC’s consolidated revenues and net

earnings available to its shareholders were approximately $9.7 billion and $1.3 billion, respectively.

On January 8, 2016, Berkshire entered into a $10 billion revolving credit agreement, which expires January 6, 2017. The

agreement has a variable interest rate based on the Prime Rate, or a spread above either the Federal Funds Rate or LIBOR, at

Berkshire’s option. Borrowings under the credit agreement are unsecured and there are no materially restrictive covenants. In

connection with the completion of the PCC acquisition, Berkshire borrowed $10 billion under the credit agreement.

On November 13, 2014, Berkshire entered into a definitive agreement with The Procter & Gamble Company (“P&G”) to

acquire the Duracell business from P&G. Duracell is a leading manufacturer of high-performance alkaline batteries and is an

innovator in renewable power and wireless charging technologies. Pursuant to the agreement, we will receive a recapitalized

Duracell Company, which is expected to include approximately $1.7 billion in cash at closing, in exchange for shares of P&G

common stock currently held by Berkshire subsidiaries which had a fair value at December 31, 2015 of approximately $4.2

billion. The transaction is currently expected to close on February 29, 2016.

We own a 50% interest in a joint venture, Berkadia Commercial Mortgage LLC (“Berkadia”), with Leucadia National

Corporation (“Leucadia”) owning the other 50% interest. Berkadia is a servicer of commercial real estate loans in the U.S.,

performing primary, master and special servicing functions for U.S. government agency programs, commercial mortgage-

backed securities transactions, banks, insurance companies and other financial institutions. A significant source of funding for

Berkadia’s operations is through the issuance of commercial paper. Repayment of the commercial paper is supported by a $2.5

billion surety policy issued by a Berkshire insurance subsidiary. Leucadia has agreed to indemnify us for one-half of any losses

incurred under the policy. On December 31, 2015, the aggregate amount of Berkadia commercial paper outstanding was $2.47

billion.

Pursuant to the terms of shareholder agreements with noncontrolling shareholders in our less than wholly-owned

subsidiaries, we may be obligated to acquire their equity ownership interests. If we had acquired all outstanding noncontrolling

interests as of December 31, 2015, we estimate the cost would have been approximately $4.3 billion. However, the timing and

the amount of any such future payments that might be required are contingent on future actions of the noncontrolling owners.

In 2013, we acquired substantially all of the outstanding common stock of Marmon held by noncontrolling shareholders

and all of the common stock of IMC International Metalworking Companies B.V. held by the noncontrolling shareholders. The

aggregate consideration for such interests was approximately $3.5 billion, of which $2.3 billion was paid in 2013 and $1.2

billion was paid in 2014. These transactions were accounted for as acquisitions of noncontrolling interests. The differences

between the consideration paid and the carrying amounts of these noncontrolling interests were recorded as reductions in

Berkshire’s shareholders’ equity and aggregated approximately $1.8 billion in 2013.

70