Berkshire Hathaway 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (Continued)

(14) Unpaid losses and loss adjustment expenses (Continued)

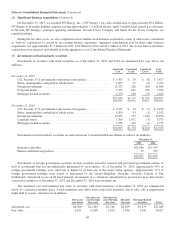

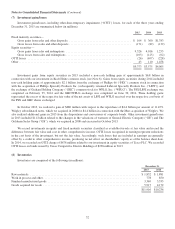

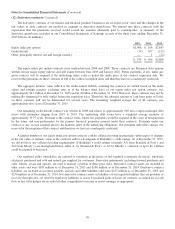

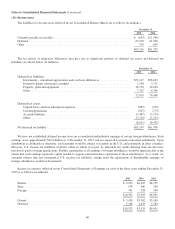

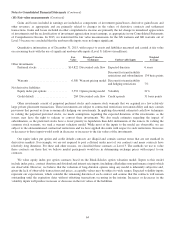

A summary of the impact of deferred charges and liability discounts on incurred losses recorded during the year with

respect to prior years’ loss events follows (in millions):

2015 2014 2013

Incurred losses before the effects of deferred charges and liability discounts .................. $(1,545) $(1,493) $(1,938)

Incurred losses from changes in deferred charges and liability discounts ..................... 243 128 186

Incurred losses prior years ......................................................... $(1,302) $(1,365) $(1,752)

Before the effects of changes in deferred charges and liability discounts, incurred losses included reductions for prior

years’ events of approximately $1.5 billion in 2015 and 2014 and $1.9 billion in 2013. In each year, these reductions derived

from our direct insurance business (including private passenger automobile, medical malpractice and other commercial

coverages), as well as from reinsurance business, partially offset by increases related to retroactive reinsurance. The reductions

for reinsurance business were primarily attributable to lower than expected reported losses from ceding companies with respect

to both property and casualty coverages. Underlying claim counts and average amounts per claim are not consistently utilized

by our reinsurance businesses, as clients do not consistently provide reliable data in sufficient detail. We increased liabilities

related to prior years’ retroactive reinsurance contracts by approximately $550 million in 2015 and $825 million in 2014,

primarily due to net increases in estimated asbestos and environmental liabilities. Loss estimates are regularly adjusted to

consider updated loss development patterns and emergence of prior years’ losses, whether favorable or unfavorable.

We are exposed to environmental, asbestos and other latent injury claims arising from insurance and reinsurance contracts.

Liability estimates for these exposures include case basis reserves and also reflect reserves for legal and other loss adjustment

expenses and IBNR reserves. IBNR reserves are based upon our historic general liability exposure base and policy language,

previous environmental loss experience and the assessment of current trends of environmental law, environmental cleanup

costs, asbestos liability law and judgmental settlements of asbestos liabilities.

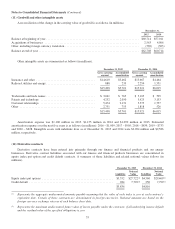

The liabilities for environmental, asbestos and other latent injury claims and claims expenses, net of reinsurance

recoverables, were approximately $14.0 billion at December 31, 2015 and $14.4 billion at December 31, 2014. These liabilities

included approximately $12.4 billion at December 31, 2015 and $12.7 billion at December 31, 2014 assumed under retroactive

reinsurance contracts. Liabilities arising from retroactive contracts with exposure to claims of this nature are generally subject to

aggregate policy limits. Thus, our exposure to environmental and other latent injury claims under these contracts is likewise

limited. We monitor evolving case law and its effect on environmental and other latent injury claims. Changing government

regulations, newly identified toxins, newly reported claims, new theories of liability, new contract interpretations and other

factors could result in increases in these liabilities. Such development could be material to our results of operations. We are

unable to reliably estimate the amount of additional net loss or the range of net loss that is reasonably possible.

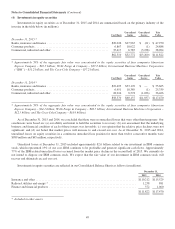

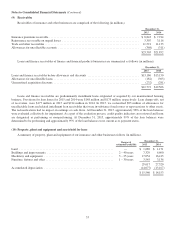

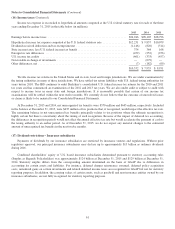

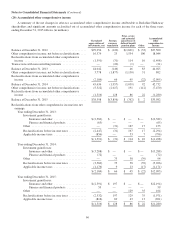

(15) Notes payable and other borrowings

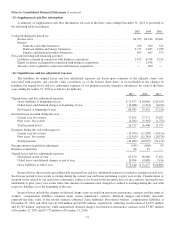

Notes payable and other borrowings are summarized below (in millions). The weighted average interest rates and maturity

date ranges shown in the following tables are based on borrowings as of December 31, 2015.

Weighted

Average

Interest Rate

December 31,

2015 2014

Insurance and other:

Issued by Berkshire due 2016-2047 .......................................... 2.2% $ 9,799 $ 8,314

Short-term subsidiary borrowings ........................................... 2.2% 1,989 839

Other subsidiary borrowings due 2016-2044 ................................... 6.0% 2,811 2,701

$14,599 $11,854

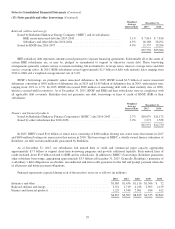

In March 2015, Berkshire issued €3.0 billion in senior unsecured notes consisting of €750 million of 0.75% senior notes

due in 2023, €1.25 billion of 1.125% senior notes due in 2027 and €1.0 billion of 1.625% senior notes due in 2035. In February

2015, $1.7 billion of Berkshire senior notes matured.

58