Berkshire Hathaway 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

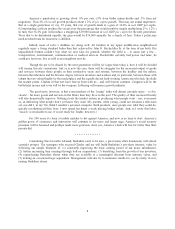

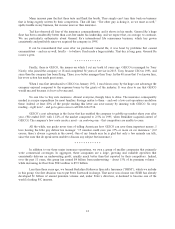

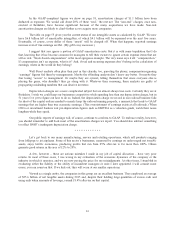

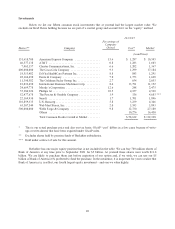

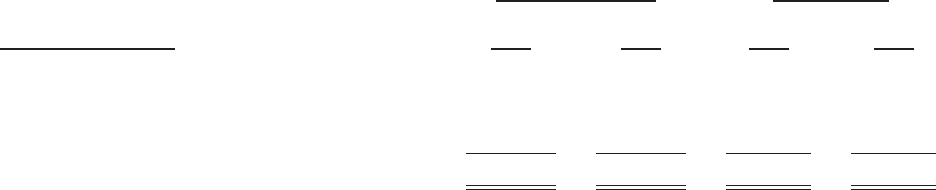

Here’s a recap of underwriting earnings and float by division:

Underwriting Profit Yearend Float

(in millions)

Insurance Operations 2015 2014 2015 2014

BH Reinsurance ............................... $ 421 $ 606 $44,108 $ 42,454

General Re ................................... 132 277 18,560 19,280

GEICO ...................................... 460 1,159 15,148 13,569

Other Primary ................................. 824 626 9,906 8,618

$ 1,837 $ 2,668 $ 87,722 $ 83,921

Berkshire’s great managers, premier financial strength and a variety of business models protected by wide

moats amount to something unique in the insurance world. This assemblage of strengths is a huge asset for

Berkshire shareholders that will only get more valuable with time.

Regulated, Capital-Intensive Businesses

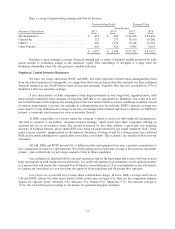

We have two major operations, BNSF and BHE, that share important characteristics distinguishing them

from our other businesses. Consequently, we assign them their own section in this letter and split out their combined

financial statistics in our GAAP balance sheet and income statement. Together, they last year accounted for 37% of

Berkshire’s after-tax operating earnings.

A key characteristic of both companies is their huge investment in very long-lived, regulated assets, with

these partially funded by large amounts of long-term debt that is not guaranteed by Berkshire. Our credit is in fact

not needed because each company has earning power that even under terrible economic conditions would far exceed

its interest requirements. Last year, for example, in a disappointing year for railroads, BNSF’s interest coverage was

more than 8:1. (Our definition of coverage is the ratio of earnings before interest and taxes to interest, not EBITDA/

interest, a commonly used measure we view as seriously flawed.)

At BHE, meanwhile, two factors ensure the company’s ability to service its debt under all circumstances.

The first is common to all utilities: recession-resistant earnings, which result from these companies offering an

essential service on an exclusive basis. The second is enjoyed by few other utilities: a great and ever-widening

diversity of earnings streams, which shield BHE from being seriously harmed by any single regulatory body. These

many sources of profit, supplemented by the inherent advantage of being owned by a strong parent, have allowed

BHE and its utility subsidiaries to significantly lower their cost of debt. This economic fact benefits both us and our

customers.

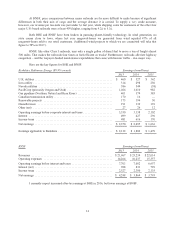

All told, BHE and BNSF invested $11.6 billion in plant and equipment last year, a massive commitment to

key components of America’s infrastructure. We relish making such investments as long as they promise reasonable

returns – and, on that front, we put a large amount of trust in future regulation.

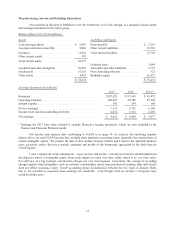

Our confidence is justified both by our past experience and by the knowledge that society will forever need

huge investments in both transportation and energy. It is in the self-interest of governments to treat capital providers

in a manner that will ensure the continued flow of funds to essential projects. It is concomitantly in our self-interest

to conduct our operations in a way that earns the approval of our regulators and the people they represent.

Low prices are a powerful way to keep these constituencies happy. In Iowa, BHE’s average retail rate is

6.8¢ per KWH. Alliant, the other major electric utility in the state, averages 9.5¢. Here are the comparable industry

figures for adjacent states: Nebraska 9.0¢, Missouri 9.3¢, Illinois 9.3¢, Minnesota 9.7¢. The national average is

10.4¢. Our rock-bottom prices add up to real money for paycheck-strapped customers.

13