Berkshire Hathaway 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Year at Berkshire

Charlie Munger, Berkshire Vice Chairman and my partner, and I expect Berkshire’s normalized earning

power to increase every year. (Actual year-to-year earnings, of course, will sometimes decline because of weakness

in the U.S. economy or, possibly, because of insurance mega-catastrophes.) In some years the normalized gains will

be small; at other times they will be material. Last year was a good one. Here are the highlights:

‹The most important development at Berkshire during 2015 was not financial, though it led to better

earnings. After a poor performance in 2014, our BNSF railroad dramatically improved its service to

customers last year. To attain that result, we invested about $5.8 billion during the year in capital

expenditures, a sum far and away the record for any American railroad and nearly three times our annual

depreciation charge. It was money well spent.

BNSF moves about 17% of America’s intercity freight (measured by revenue ton-miles), whether

transported by rail, truck, air, water or pipeline. In that respect, we are a strong number one among the

seven large American railroads (two of which are Canadian-based), carrying 45% more ton-miles of freight

than our closest competitor. Consequently, our maintaining first-class service is not only vital to our

shippers’ welfare but also important to the smooth functioning of the U.S. economy.

For most American railroads, 2015 was a disappointing year. Aggregate ton-miles fell, and earnings

weakened as well. BNSF, however, maintained volume, and pre-tax income rose to a record $6.8 billion*

(a gain of $606 million from 2014). Matt Rose and Carl Ice, the managers of BNSF, have my thanks and

deserve yours.

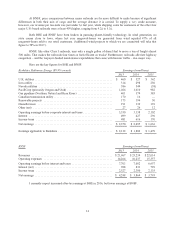

‹BNSF is the largest of our “Powerhouse Five,” a group that also includes Berkshire Hathaway Energy,

Marmon, Lubrizol and IMC. Combined, these companies – our five most profitable non-insurance

businesses – earned $13.1 billion in 2015, an increase of $650 million over 2014.

Of the five, only Berkshire Hathaway Energy, then earning $393 million, was owned by us in 2003.

Subsequently, we purchased three of the other four on an all-cash basis. In acquiring BNSF, however, we

paid about 70% of the cost in cash and, for the remainder, issued Berkshire shares that increased the

number outstanding by 6.1%. In other words, the $12.7 billion gain in annual earnings delivered Berkshire

by the five companies over the twelve-year span has been accompanied by only minor dilution. That

satisfies our goal of not simply increasing earnings, but making sure we also increase per-share results.

‹Next year, I will be discussing the “Powerhouse Six.” The newcomer will be Precision Castparts Corp.

(“PCC”), a business that we purchased a month ago for more than $32 billion of cash. PCC fits perfectly

into the Berkshire model and will substantially increase our normalized per-share earning power.

Under CEO Mark Donegan, PCC has become the world’s premier supplier of aerospace components (most

of them destined to be original equipment, though spares are important to the company as well). Mark’s

accomplishments remind me of the magic regularly performed by Jacob Harpaz at IMC, our remarkable

Israeli manufacturer of cutting tools. The two men transform very ordinary raw materials into extraordinary

products that are used by major manufacturers worldwide. Each is the da Vinci of his craft.

PCC’s products, often delivered under multi-year contracts, are key components in most large aircraft.

Other industries are served as well by the company’s 30,466 employees, who work out of 162 plants in 13

countries. In building his business, Mark has made many acquisitions and will make more. We look

forward to having him deploy Berkshire’s capital.

* Throughout this letter, all earnings are stated on a pre-tax basis unless otherwise designated.

4