Berkshire Hathaway 2015 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BERKSHIRE HATHAWAY INC.

ACQUISITION CRITERIA

We are eager to hear from principals or their representatives about businesses that meet all of the

following criteria:

(1) Large purchases (at least $75 million of pre-tax earnings unless the business will fit into one of our

existing units),

(2) Demonstrated consistent earning power (future projections are of no interest to us, nor are

“turnaround” situations),

(3) Businesses earning good returns on equity while employing little or no debt,

(4) Management in place (we can’t supply it),

(5) Simple businesses (if there’s lots of technology, we won’t understand it),

(6) An offering price (we don’t want to waste our time or that of the seller by talking, even preliminarily,

about a transaction when price is unknown).

The larger the company, the greater will be our interest: We would like to make an acquisition in the $5-20

billion range. We are not interested, however, in receiving suggestions about purchases we might make in the

general stock market.

We will not engage in unfriendly takeovers. We can promise complete confidentiality and a very fast answer

– customarily within five minutes – as to whether we’re interested. We prefer to buy for cash, but will consider

issuing stock when we receive as much in intrinsic business value as we give. We don’t participate in auctions.

Charlie and I frequently get approached about acquisitions that don’t come close to meeting our tests: We’ve

found that if you advertise an interest in buying collies, a lot of people will call hoping to sell you their cocker

spaniels. A line from a country song expresses our feeling about new ventures, turnarounds, or auction-like sales:

“When the phone don’t ring, you’ll know it’s me.”

FORWARD-LOOKING STATEMENTS

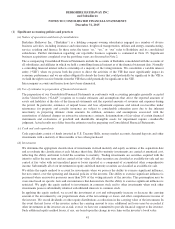

Investors are cautioned that certain statements contained in this document as well as some statements in

periodic press releases and some oral statements of Berkshire officials during presentations about Berkshire or its

subsidiaries are “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of

1995 (the “Act”). Forward-looking statements include statements which are predictive in nature, which depend upon

or refer to future events or conditions, which include words such as “expects,” “anticipates,” “intends,” “plans,”

“believes,” “estimates” or similar expressions. In addition, any statements concerning future financial performance

(including future revenues, earnings or growth rates), ongoing business strategies or prospects and possible future

Berkshire actions, which may be provided by management, are also forward-looking statements as defined by the

Act. Forward-looking statements are based on current expectations and projections about future events and are

subject to risks, uncertainties and assumptions about Berkshire and its subsidiaries, economic and market factors

and the industries in which we do business, among other things. These statements are not guarantees of future

performance and we have no specific intention to update these statements.

Actual events and results may differ materially from those expressed or forecasted in forward-looking

statements due to a number of factors. The principal important risk factors that could cause our actual performance

and future events and actions to differ materially from such forward-looking statements include, but are not limited

to, changes in market prices of our investments in fixed maturity and equity securities, losses realized from

derivative contracts, the occurrence of one or more catastrophic events, such as an earthquake, hurricane or act of

terrorism that causes losses insured by our insurance subsidiaries, changes in laws or regulations affecting our

insurance, railroad, utilities and energy and finance subsidiaries, changes in federal income tax laws, and changes in

general economic and market factors that affect the prices of securities or the industries in which we do business.

32