Berkshire Hathaway 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis (Continued)

Property and casualty losses (Continued)

GEICO (Continued)

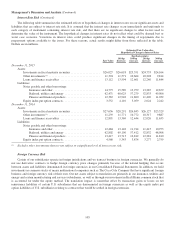

We believe it is reasonably possible that the average BI severities will change by at least one percentage point from the

severities used in establishing the recorded liabilities at December 31, 2015. We estimate that a one percentage point increase or

decrease in BI severities would produce a $205 million increase or decrease in recorded liabilities, with a corresponding

decrease or increase in pre-tax earnings. Many of the same economic forces that would likely cause BI severity to differ from

expectations would likely also cause severities for other injury coverages to differ in the same direction.

GEICO’s exposure to highly uncertain losses is believed to be limited to certain commercial excess umbrella policies

written during a period from 1981 to 1984. Remaining liabilities associated with such exposures are currently an immaterial

component of GEICO’s aggregate reserves (approximately 1.0%).

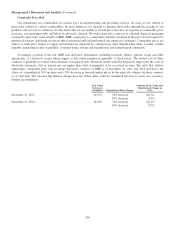

General Re and BHRG

Liabilities for unpaid property and casualty losses and loss adjustment expenses of General Re and BHRG derive primarily

from reinsurance contracts. In connection with reinsurance contracts, the nature, extent, timing and perceived reliability of

information received from ceding companies varies widely depending on the type of coverage and the contractual reporting

terms. Contract terms, conditions and coverages also tend to lack standardization and may evolve more rapidly than under

primary insurance policies.

The nature and extent of loss information provided under many facultative (individual risk), per occurrence excess or

retroactive reinsurance contracts may not differ significantly from the information received under a primary insurance contract,

if reinsurer personnel either work closely with the ceding company in settling individual claims or manage the claims

themselves. However, loss information related to aggregate excess-of-loss contracts, including catastrophe losses and quota-

share treaties, is often less detailed. Loss information may be reported in a summary format rather than on an individual claim

basis. Loss data is usually provided through periodic reports, which may include currently recoverable losses, as well as case

loss estimates. Ceding companies infrequently provide IBNR estimates to reinsurers.

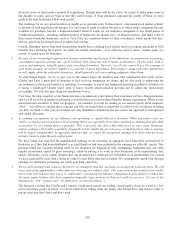

The timing of claim reporting to reinsurers is typically delayed compared to primary insurers. Periodic premium and claims

reports are required from ceding companies. In the U.S., such reports are generally required at quarterly intervals ranging from

30 to 90 days after the end of the accounting period. Outside the U.S., reinsurance reporting practices vary. In certain countries,

clients report annually, often 90 to 180 days after the end of the annual period. In some instances, reinsurers assume and cede

parts of an underlying risk thereby creating multiple contractual intermediaries between General Re or BHRG and the primary

insured. In these instances, the claim reporting delays can be compounded. The relative impact of reporting delays on the

reinsurer may vary depending on the type of coverage, contractual reporting terms, and the magnitude of the claim relative to

the attachment point of the reinsurance contract and for other reasons.

Premium and loss data is provided through at least one intermediary (the primary insurer), so there is a risk that the loss

data reported to us is incomplete, inaccurate or the claim is outside the coverage terms. Information provided by ceding

companies is reviewed for completeness and compliance with the contract terms. Generally, BHRG and General Re are

contractually permitted to access the ceding company’s books and records with respect to the subject business, thus providing

the ability to audit the accuracy and completeness of the reported information.

In the normal course of business, disputes with clients occasionally arise concerning whether certain claims are covered

under our reinsurance policies. We resolve most coverage disputes through the involvement of our claims personnel and the

appropriate client personnel or through independent outside counsel. If disputes cannot be resolved, our contracts generally

specify whether arbitration, litigation, or an alternative dispute resolution process will be invoked. There are no coverage

disputes at this time for which an adverse resolution would likely have a material impact on our consolidated results of

operations or financial condition.

98