Berkshire Hathaway 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis (Continued)

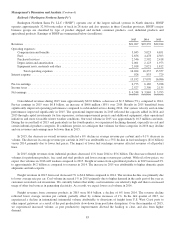

Investment and Derivative Gains/Losses (Continued)

Investment gains/losses (Continued)

Pre-tax investment gains/losses in 2013 were $4.3 billion and included approximately $2.1 billion related to our

investments in General Electric and Goldman Sachs common stock warrants and Wrigley subordinated notes. Beginning in

2013, the unrealized gains or losses associated with the warrants were included in earnings. These warrants were exercised in

October 2013 on a cashless basis in exchange for shares of General Electric and Goldman Sachs common stock with an

aggregate value of approximately $2.4 billion. The Wrigley subordinated notes were repurchased for cash of $5.08 billion,

resulting in a pre-tax investment gain of $680 million.

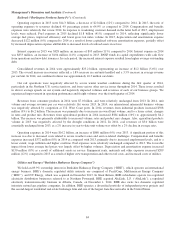

Other-than-temporary impairments (“OTTI”)

OTTI charges in 2015 were not significant and in 2014 were $697 million, which predominantly related to our investments

in equity securities of Tesco PLC. OTTI charges in 2013 related to our investments in Texas Competitive Electric Holdings

bonds. Although we have periodically recorded OTTI charges in earnings in past years, we continue to hold some of those

securities. If the market values of those investments increase following the date OTTI charges are recorded in earnings, the

increases are not reflected in earnings but are instead included in shareholders’ equity as a component of accumulated other

comprehensive income. When recorded, OTTI charges have no impact whatsoever on the asset values otherwise recorded in our

Consolidated Balance Sheets or on our consolidated shareholders’ equity. In addition, the recognition of such losses in earnings

rather than in accumulated other comprehensive income does not necessarily indicate that sales are planned and sales ultimately

may not occur for a number of years. Furthermore, the recognition of OTTI charges does not necessarily indicate that the loss in

value of the security is permanent or that the market price of the security will not subsequently increase to and ultimately exceed

our original cost.

As of December 31, 2015 and 2014, consolidated gross unrealized losses on our investments in equity and fixed maturity

securities determined on an individual purchase lot basis were approximately $3.4 billion and $1.2 billion, respectively. We

have concluded that as of December 31, 2015, these unrealized losses were not other than temporary. We consider several

factors in determining whether or not impairments are deemed to be other than temporary, including the current and expected

long-term business prospects and if applicable, the creditworthiness of the issuer, our ability and intent to hold the investment

until the price recovers and the length of time and relative magnitude of the price decline.

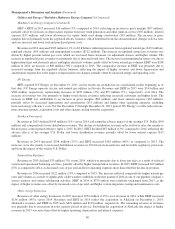

Derivative gains/losses

Derivative gains/losses primarily represent the changes in fair value of our credit default and equity index put option

contracts. Periodic changes in the fair values of these contracts are reflected in earnings and can be significant, reflecting the

volatility of underlying credit and equity markets.

In 2015, equity index put option contracts produced pre-tax gains of approximately $1.0 billion, which were primarily

attributable to the impact of a stronger U.S. Dollar and shorter remaining durations. As of December 31, 2015, the intrinsic

value of these contracts was approximately $1.1 billion and the fair value of our recorded liabilities was approximately $3.55

billion. Our ultimate payment obligations, if any, under our equity index put option contracts will be determined as of the

contract expiration dates, which begin in 2018, and will be based on the intrinsic value, as defined under the contracts. We have

made no loss payments to date.

Our remaining credit default contract produced a pre-tax loss in 2015 of $34 million. The loss represents an increase in the

estimated fair value of our recorded liabilities during the period, reflecting changes in credit spreads, interest rates and

remaining durations of the underlying exposures. There were no loss payments over the three years ending December 31, 2015.

In 2014, derivative contracts produced pre-tax gains of $506 million. The change in the fair value of our credit default

contract during 2014 produced a pre-tax gain of $397 million, and was attributable to lower credit spreads. Equity index put

option contracts produced pre-tax gains of $108 million in 2014. Such gains reflected the favorable impact of foreign currency

exchange rate changes and generally higher index values, partially offset by the negative impact of lower interest rate

assumptions.

In 2013, derivative contracts generated pre-tax gains of $2.6 billion, including gains of $2.8 billion from equity index put

option contracts and a loss of $213 million from our credit default contract. The gains from equity index put option contracts

were due to changes in fair values of the contracts as a result of overall higher equity index values, favorable currency

movements and modestly higher interest rate assumptions. The credit default contract loss was primarily attributable to wider

credit spreads.

93