Berkshire Hathaway 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

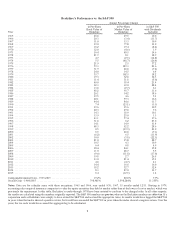

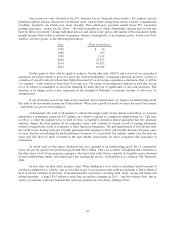

Berkshire’s Performance vs. the S&P 500

Annual Percentage Change

Year

in Per-Share

Book Value of

Berkshire

in Per-Share

Market Value of

Berkshire

in S&P 500

with Dividends

Included

1965 .................................................. 23.8 49.5 10.0

1966 .................................................. 20.3 (3.4) (11.7)

1967 .................................................. 11.0 13.3 30.9

1968 .................................................. 19.0 77.8 11.0

1969 .................................................. 16.2 19.4 (8.4)

1970 .................................................. 12.0 (4.6) 3.9

1971 .................................................. 16.4 80.5 14.6

1972 .................................................. 21.7 8.1 18.9

1973 .................................................. 4.7 (2.5) (14.8)

1974 .................................................. 5.5 (48.7) (26.4)

1975 .................................................. 21.9 2.5 37.2

1976 .................................................. 59.3 129.3 23.6

1977 .................................................. 31.9 46.8 (7.4)

1978 .................................................. 24.0 14.5 6.4

1979 .................................................. 35.7 102.5 18.2

1980 .................................................. 19.3 32.8 32.3

1981 .................................................. 31.4 31.8 (5.0)

1982 .................................................. 40.0 38.4 21.4

1983 .................................................. 32.3 69.0 22.4

1984 .................................................. 13.6 (2.7) 6.1

1985 .................................................. 48.2 93.7 31.6

1986 .................................................. 26.1 14.2 18.6

1987 .................................................. 19.5 4.6 5.1

1988 .................................................. 20.1 59.3 16.6

1989 .................................................. 44.4 84.6 31.7

1990 .................................................. 7.4 (23.1) (3.1)

1991 .................................................. 39.6 35.6 30.5

1992 .................................................. 20.3 29.8 7.6

1993 .................................................. 14.3 38.9 10.1

1994 .................................................. 13.9 25.0 1.3

1995 .................................................. 43.1 57.4 37.6

1996 .................................................. 31.8 6.2 23.0

1997 .................................................. 34.1 34.9 33.4

1998 .................................................. 48.3 52.2 28.6

1999 .................................................. 0.5 (19.9) 21.0

2000 .................................................. 6.5 26.6 (9.1)

2001 .................................................. (6.2) 6.5 (11.9)

2002 .................................................. 10.0 (3.8) (22.1)

2003 .................................................. 21.0 15.8 28.7

2004 .................................................. 10.5 4.3 10.9

2005 .................................................. 6.4 0.8 4.9

2006 .................................................. 18.4 24.1 15.8

2007 .................................................. 11.0 28.7 5.5

2008 .................................................. (9.6) (31.8) (37.0)

2009 .................................................. 19.8 2.7 26.5

2010 .................................................. 13.0 21.4 15.1

2011 .................................................. 4.6 (4.7) 2.1

2012 .................................................. 14.4 16.8 16.0

2013 .................................................. 18.2 32.7 32.4

2014 .................................................. 8.3 27.0 13.7

2015 .................................................. 6.4 (12.5) 1.4

Compounded Annual Gain – 1965-2015 ...................... 19.2% 20.8% 9.7%

Overall Gain – 1964-2015 ................................. 798,981% 1,598,284% 11,355%

Notes: Data are for calendar years with these exceptions: 1965 and 1966, year ended 9/30; 1967, 15 months ended 12/31. Starting in 1979,

accounting rules required insurance companies to value the equity securities they hold at market rather than at the lower of cost or market, which was

previously the requirement. In this table, Berkshire’s results through 1978 have been restated to conform to the changed rules. In all other respects,

the results are calculated using the numbers originally reported. The S&P 500 numbers are pre-tax whereas the Berkshire numbers are after-tax.Ifa

corporation such as Berkshire were simply to have owned the S&P 500 and accrued the appropriate taxes, its results would have lagged the S&P 500

in years when that index showed a positive return, but would have exceeded the S&P 500 in years when the index showed a negative return. Over the

years, the tax costs would have caused the aggregate lag to be substantial.

2